Zywave is a prominent software company that has earned a reputation for providing cutting-edge insurance technology solutions. In this article, we will explore the top features of Zywave, discuss why it is a preferred choice for insurance professionals, examine its target audience, pricing structure, and alternatives, compare it with other insurance software solutions, delve into user reviews, and conclude with an assessment of its overall impact on the industry.

- Comprehensive Core Systems: eBaoTech offers a suite of comprehensive core insurance systems that cater to various insurance sectors, including life, property and casualty, health, and general insurance. These systems are designed to streamline the entire insurance process, from policy administration to claims management.

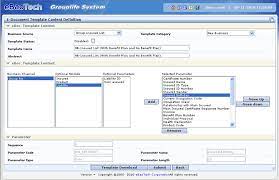

- Seamless Integration: One of eBaoTech's most distinguished features is its ability to seamlessly integrate with existing systems and third-party applications. This enables insurance companies to upgrade their operations without undergoing a complete overhaul of their current infrastructure.

- Digital Insurance Ecosystem: eBaoTech provides a robust digital insurance ecosystem that empowers insurers to offer innovative insurance products and services to their customers. The ecosystem enables easy integration with InsurTech companies and other partners, fostering collaboration and opening doors to new revenue streams.

- Customer-Centric Solutions: Understanding the importance of customer-centricity in the insurance domain, eBaoTech's solutions are geared towards enhancing customer experiences. From personalized policy offerings to efficient claims processing, the focus remains on ensuring customer satisfaction.

- Data Analytics and AI: Leveraging the power of data analytics and artificial intelligence, eBaoTech's software equips insurers with valuable insights, enabling data-driven decision-making, risk assessment, and fraud detection.

- Guidewide:

Guidewide is a comprehensive insurance software provider that offers a wide range of solutions, including policy administration, claims management, billing, and customer management. Their platform is known for its user-friendly interface and easy integration capabilities. Guidewide focuses on enhancing customer experiences and streamlining operations to optimize efficiency.

- Insly:

Insly is a cloud-based insurance software designed specifically for insurance brokers and agencies. It provides tools for managing policies, claims, and accounting, making it a suitable choice for smaller businesses and startups. Insly’s intuitive platform facilitates the smooth handling of insurance operations, ensuring transparency and accuracy.

- Duck Creek Technologies:

Duck Creek Technologies is a well-established insurance software provider catering to both property and casualty insurers. Their platform offers comprehensive policy management, rating, and billing functionalities. Duck Creek is known for its scalability and flexibility, making it suitable for insurance companies of all sizes.

- Vertafore:

Vertafore is a leading provider of insurance agency management software. Their solutions cater to insurance agents and brokers, enabling them to efficiently manage client information, policies, and commissions. Vertafore’s platform aims to streamline agency workflows and boost productivity.

- Insurity:

Insurity offers an end-to-end policy administration and claims management platform, designed to cater to various lines of insurance, including property, casualty, and specialty lines. Their solutions focus on optimizing operational efficiency and enhancing customer engagement.

- Applied Systems:

Applied Systems provides insurance software solutions for both agencies and brokers. Their platform includes features like policy management, customer relationship management (CRM), and reporting tools. Applied Systems aims to improve collaboration and streamline insurance processes.

- Vlocity (A Salesforce Company):

Vlocity, now a part of Salesforce, offers industry-specific cloud-based solutions, including insurance. Their platform is designed to enable insurers to deliver personalized customer experiences through automation and data-driven insights.

- Majesco:

Majesco offers a suite of insurance software solutions, catering to life, annuity, property, and casualty insurance providers. Their platform focuses on digital transformation, helping insurers adapt to changing customer demands and market trends.

– Insurance Carriers: Insurance companies looking to modernize their operations, streamline processes, and offer advanced digital insurance products benefit from eBaoTech’s comprehensive solutions.

– Brokers and Agencies: Brokers and agencies seeking to enhance their service offerings, improve efficiency, and provide a seamless digital experience to their clients can leverage eBaoTech’s platform.

– InsurTech Startups: eBaoTech provides a launchpad for InsurTech startups, allowing them to quickly enter the market with agile and innovative insurance products.

– Reinsurers: Reinsurers can also harness eBaoTech’s capabilities to improve risk management and optimize their reinsurance strategies.

– Industry Expertise: eBaoTech has garnered extensive expertise in the insurance domain over the years, making it a trusted partner for many insurers worldwide.

– Scalability: eBaoTech’s solutions are highly scalable, catering to insurance companies of all sizes – from startups to well-established enterprises.

– Global Reach: With a strong global presence and a wide customer base spanning over many countries, eBaoTech demonstrates its reliability and adaptability across diverse markets.

– Innovation-driven: eBaoTech’s commitment to continuous innovation ensures that its clients are equipped with the latest technological advancements and stay ahead in the competitive insurance landscape.

– Customer Support: eBaoTech prioritizes customer satisfaction and provides exceptional support throughout the implementation process and beyond.

Among the frontrunners of cutting-edge insurance technology providers stands eBaoTech, a prominent software company catering to the needs of the insurance sector. This article delves into the world of eBaoTech, exploring its top features, benefits, target audience, pricing, alternatives, and reviews, ultimately highlighting why it is the preferred choice for insurance companies in today's market.

When comparing eBaoTech with its alternatives, it’s essential to consider various aspects to determine which insurance technology provider best suits the specific needs of your business. Here’s a comparison between eBaoTech and some of its prominent alternatives:

- eBaoTech:

– Comprehensive core insurance systems for life, property and casualty, health, and general insurance.

– Seamless integration with existing systems and third-party applications.

– Digital insurance ecosystem for collaboration with InsurTech partners.

– Customer-centric solutions and focus on enhancing customer experiences.

– Data analytics and AI capabilities for data-driven decision-making.

- Guidewide:

– Comprehensive insurance software with policy administration, claims management, billing, and customer management features.

– User-friendly interface and easy integration capabilities.

– Focus on enhancing customer experiences and optimizing efficiency.

– Suitable for various insurance companies looking for streamlined operations.

- Insly:

– Cloud-based insurance software for insurance brokers and agencies.

– Tools for managing policies, claims, and accounting.

– Intuitive platform for smooth handling of insurance operations.

– Suitable for smaller businesses and startups.

- Duck Creek Technologies:

– Comprehensive policy management, rating, and billing functionalities.

– Scalable and flexible solutions suitable for insurers of all sizes.

– Focus on property and casualty insurers.

- Vertafore:

– Insurance agency management software for agents and brokers.

– Efficient management of client information, policies, and commissions.

– Focus on improving agency workflows and productivity.

- Insurity:

– End-to-end policy administration and claims management platform.

– Catering to property, casualty, and specialty lines of insurance.

– Focus on optimizing operational efficiency and enhancing customer engagement.

- Applied Systems:

– Insurance software solutions for agencies and brokers.

– Features include policy management, CRM, and reporting tools.

– Focus on improving collaboration and streamlining insurance processes.

- Vlocity (A Salesforce Company):

– Cloud-based solutions for various industries, including insurance.

– Personalized customer experiences through automation and data-driven insights.

– Part of Salesforce’s suite of offerings.

- Majesco:

– Insurance software solutions for life, annuity, property, and casualty providers.

– Focus on digital transformation and adapting to changing customer demands.

ISCS SurePower Innovation is a leading insurance software provider, ISCS has developed SurePower Innovation, a comprehensive platform that empowers insurance companies with advanced features and functionalities. In this article, we will delve into ISCS SurePower Innovation, exploring its pricing, features, demo, reviews, training options, and its position among the best insurance software solutions available.

Xuber, a leading insurance software solution, has emerged as a powerful tool that empowers insurance businesses to streamline their processes, enhance customer experiences, and gain a competitive edge. In this article, we will explore the world of Xuber, delving into its pricing, features, demo, customer reviews, and training options. With a focus on providing comprehensive and efficient insurance software solutions, Xuber has earned its reputation as the best insurance software in the market.