Zywave is a prominent software company that has earned a reputation for providing cutting-edge insurance technology solutions. In this article, we will explore the top features of Zywave, discuss why it is a preferred choice for insurance professionals, examine its target audience, pricing structure, and alternatives, compare it with other insurance software solutions, delve into user reviews, and conclude with an assessment of its overall impact on the industry.

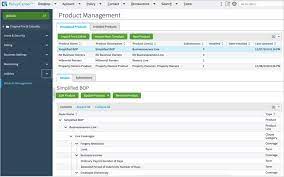

- Quote and Policy Issuance: PolicyCenter streamlines the process of generating quotes and issuing policies, facilitating quick and accurate policy issuance.

- Underwriting Rules: The application allows carriers to define underwriting rules and guidelines to ensure consistency and adherence to risk management practices.

- Product Configurability: PolicyCenter provides carriers with the flexibility to configure and modify insurance products to meet evolving market demands.

- Renewals and Endorsements: The platform automates policy renewals and endorsements, simplifying the process for both carriers and policyholders.

- Customer Portal: PolicyCenter offers a customer portal that allows policyholders to access policy information, make changes, and interact with carriers conveniently.

During the demo, users can typically interact with the user interface, perform tasks related to policy administration, claims management, and billing, and experience the platform’s ease of use and intuitive design. The demo serves as a valuable tool for insurance carriers to assess the platform’s capabilities and determine its suitability for their operations.

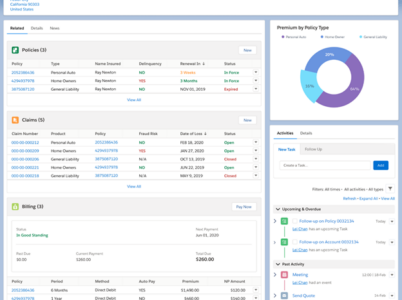

PolicyCenter: PolicyCenter is designed to handle policy administration processes efficiently. It allows insurance carriers to manage the entire policy lifecycle, from quote generation and underwriting to policy issuance and endorsements. PolicyCenter enables carriers to make data-driven decisions, improve underwriting accuracy, and enhance customer engagement.

ClaimCenter: ClaimCenter simplifies the claims management process, enabling carriers to handle claims seamlessly and deliver prompt and accurate settlements to policyholders. The application automates claims workflows, streamlines communication with customers and adjusters, and provides valuable insights through data analytics.

BillingCenter: BillingCenter streamlines the billing and payment processes for insurance companies. It enables carriers to manage billing plans, process premium payments, and handle invoicing and collections efficiently. BillingCenter empowers insurance carriers to provide flexible payment options to policyholders and reduce administrative overhead.

Discovery: In this initial phase, Guidewire consultants work with the carrier’s team to gain a comprehensive understanding of their existing processes, workflows, and requirements.

Configuration: Based on the gathered information, the platform is configured to align with the carrier’s specific business needs.

Testing: Rigorous testing is conducted to ensure that all functionalities are working as expected, and any issues are identified and addressed.

Training: Guidewire provides training sessions to key stakeholders to prepare them for using InsuranceSuite effectively.

Go-Live: The platform is deployed, and the carrier officially begins using Guidewire InsuranceSuite to manage their operations.

Throughout the implementation process, Guidewire maintains close communication with the carrier, providing regular updates and addressing any concerns promptly. The goal is to ensure a successful and seamless transition to the new platform.

Guidewire InsuranceSuite, a leading software platform designed specifically for the insurance industry, has emerged as a game-changer in this space. In this article, we will explore various aspects of Guidewire InsuranceSuite, including its pricing, demo, features, training, support, implementation, integration capabilities, documentation, and case studies showcasing its successful deployment in the insurance sector.

Through successful implementation and reliable support, Guidewire continues to demonstrate its commitment to delivering exceptional value to its customers. As the insurance industry continues to evolve, Guidewire InsuranceSuite remains at the forefront of technology innovation, empowering carriers to shape the future of insurance and deliver superior services to policyholders

ISCS SurePower Innovation is a leading insurance software provider, ISCS has developed SurePower Innovation, a comprehensive platform that empowers insurance companies with advanced features and functionalities. In this article, we will delve into ISCS SurePower Innovation, exploring its pricing, features, demo, reviews, training options, and its position among the best insurance software solutions available.

Xuber, a leading insurance software solution, has emerged as a powerful tool that empowers insurance businesses to streamline their processes, enhance customer experiences, and gain a competitive edge. In this article, we will explore the world of Xuber, delving into its pricing, features, demo, customer reviews, and training options. With a focus on providing comprehensive and efficient insurance software solutions, Xuber has earned its reputation as the best insurance software in the market.