Zywave is a prominent software company that has earned a reputation for providing cutting-edge insurance technology solutions. In this article, we will explore the top features of Zywave, discuss why it is a preferred choice for insurance professionals, examine its target audience, pricing structure, and alternatives, compare it with other insurance software solutions, delve into user reviews, and conclude with an assessment of its overall impact on the industry.

- General Liability Insurance: Protects businesses from claims of bodily injury, property damage, and advertising injury.

- Professional Liability Insurance: Provides coverage for errors, omissions, and negligence claims arising from professional services.

- Business Owner's Policy (BOP): Bundles multiple insurance coverages, such as general liability and commercial property insurance, into a cost-effective package.

- Cyber Liability Insurance: Safeguards businesses from data breaches and cyberattacks that may compromise sensitive customer information.

- Workers' Compensation Insurance: Covers medical expenses and lost wages for employees who suffer work-related injuries or illnesses.

By working with multiple insurance carriers, Insureon can present business owners with a range of coverage options, allowing them to choose the policies that best align with their risk profile and budget. This tailored approach ensures that small businesses don’t overpay for unnecessary coverage while still enjoying comprehensive protection.

Insureon specialises in small business insurance, offering a wide range of coverage options tailored to the unique needs of different industries. Some of the most common types of insurance offered by Insureon include:

General Liability Insurance: Protects businesses from claims of bodily injury, property damage, and advertising injury.

Professional Liability Insurance: Provides coverage for errors, omissions, and negligence claims arising from professional services.

Business Owner’s Policy (BOP): Bundles multiple insurance coverages, such as general liability and commercial property insurance, into a cost-effective package.

Cyber Liability Insurance: Safeguards businesses from data breaches and cyberattacks that may compromise sensitive customer information.

Workers’ Compensation Insurance: Covers medical expenses and lost wages for employees who suffer work-related injuries or illnesses.

To obtain insurance quotes from Insureon, small business owners can visit the Insureon website and fill out a simple online form. The form requires essential business information, such as the type of business, industry, number of employees, annual revenue, and desired coverage options. Based on this information, Insureon’s team of experienced agents works diligently to source quotes from top-rated insurance carriers that match the business’s requirements.

Small business owners can access educational resources, guides, and articles on Insureon’s website, providing valuable insights into insurance topics relevant to their industry. By demystifying insurance jargon and explaining policy features, Insureon helps business owners make informed decisions that protect their investments and foster growth.

- Risk Assessment and Analysis:

One of the primary commercial insurance services is risk assessment and analysis. Insurance professionals work closely with businesses to identify potential risks and vulnerabilities in their operations. Through a comprehensive analysis, they evaluate the specific risks faced by each business, including property damage, liability, cyber threats, and more. This process allows businesses to gain a deeper understanding of their unique risk exposures and the potential financial impact of these risks.

- Tailored Insurance Solutions:

Commercial insurance services offer customised insurance solutions that align with a business’s risk profile and needs. Insurance professionals work with businesses to design insurance packages that provide comprehensive coverage for their specific risks. This tailored approach ensures that businesses have the right level of protection without paying for unnecessary coverage.

- Policy Selection and Placement:

Commercial insurance services help businesses navigate the vast array of insurance policies available in the market. Insurance professionals have in-depth knowledge of different insurance carriers and their products. They assist businesses in selecting the most suitable policies from reputable insurers and negotiate competitive premiums on their behalf.

- Claims Management and Advocacy:

In the unfortunate event of a loss or claim, commercial insurance services provide vital support in managing the claims process. Insurance professionals act as advocates for businesses, guiding them through the claims procedure and ensuring that they receive fair and timely compensation. This service is invaluable in minimising disruptions to business operations and facilitating a smooth recovery process.

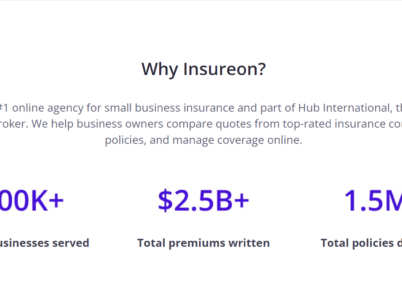

Insureon, a leading insurance agency specialising in small business insurance, stands as a reliable partner for entrepreneurs seeking to safeguard their ventures. In this article, we will delve into the world of Insureon, exploring its insurance quotes, coverage options, agent directory, customer reviews, policy customisation, and commercial insurance services. With a focus on empowering small businesses, Insureon continues to be a top choice for comprehensive and customised insurance solutions.

The comparison tool allows business owners to evaluate different coverage options, deductibles, limits, and premiums. Armed with this information, they can make well-informed choices that align with their unique risk profiles and budget constraints.

Business owners often praise Insureon for its professionalism, efficiency, and expertise in navigating the insurance landscape. The positive reviews stand as proof of Insureon’s commitment to empowering small businesses with the right insurance coverage.

With positive customer reviews and industry recognition as a top commercial insurance provider, Insureon continues to empower small businesses to thrive in an increasingly competitive market. Its policy customisation capabilities and commercial insurance services reflect a commitment to safeguarding businesses and ensuring they have the protection they need to succeed.

As a premier provider of small business insurance, Insureon stands ready to protect businesses from the unforeseen risks and challenges that may arise. With Insureon as a reliable partner, small business owners can focus on what they do best – building their ventures and achieving success.

ISCS SurePower Innovation is a leading insurance software provider, ISCS has developed SurePower Innovation, a comprehensive platform that empowers insurance companies with advanced features and functionalities. In this article, we will delve into ISCS SurePower Innovation, exploring its pricing, features, demo, reviews, training options, and its position among the best insurance software solutions available.

Xuber, a leading insurance software solution, has emerged as a powerful tool that empowers insurance businesses to streamline their processes, enhance customer experiences, and gain a competitive edge. In this article, we will explore the world of Xuber, delving into its pricing, features, demo, customer reviews, and training options. With a focus on providing comprehensive and efficient insurance software solutions, Xuber has earned its reputation as the best insurance software in the market.