Zywave is a prominent software company that has earned a reputation for providing cutting-edge insurance technology solutions. In this article, we will explore the top features of Zywave, discuss why it is a preferred choice for insurance professionals, examine its target audience, pricing structure, and alternatives, compare it with other insurance software solutions, delve into user reviews, and conclude with an assessment of its overall impact on the industry.

- Intuitive User Interface: TechCanary's user interface is designed to be user-friendly, allowing insurance professionals to navigate the platform with ease. Its sleek and intuitive design contributes to a smooth user experience, simplifying even the most complex tasks.

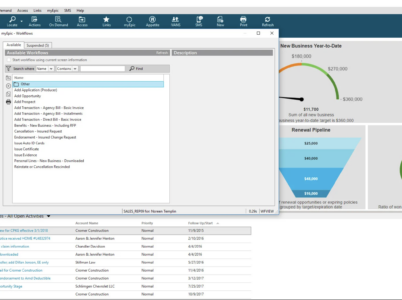

- Policy Management: The platform boasts advanced policy management capabilities, enabling users to create, edit, and manage policies efficiently. This feature ensures accuracy and reduces manual errors, saving valuable time for insurance professionals.

- Customer Relationship Management (CRM): TechCanary's integrated CRM empowers insurance agents to enhance customer engagement and foster lasting relationships. With comprehensive customer profiles and data analytics, agents can personalize their interactions for better customer experiences.

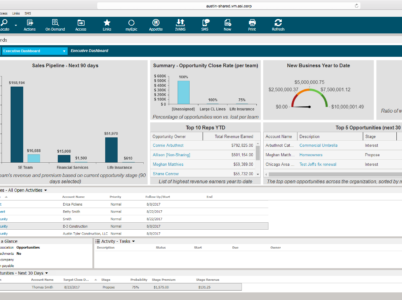

- Reporting and Analytics: The software equips users with powerful reporting and analytics tools. Access to real-time data and customizable reports empowers decision-makers to make informed choices, optimize processes, and identify growth opportunities.

- Mobile Accessibility: TechCanary recognizes the importance of mobility in today's business landscape. Its mobile app enables insurance professionals to access critical data, collaborate with colleagues, and serve clients on the go.

- Applied Epic: Known for its scalability and extensive range of features, Applied Epic caters to agencies of all sizes. It offers strong policy management, CRM capabilities, and reporting tools.

- Guidewires InsuranceSuite: Guidewire’s InsuranceSuite is a comprehensive platform that caters to the insurance industry’s various needs. It provides policy, billing, and claims management solutions, along with powerful data analytics capabilities.

- Insly: Insly is a cloud-based insurance software designed for managing insurance policies, commissions, and claims. It offers specialized features for brokers, agents, and underwriters, making it suitable for a diverse range of insurance professionals.

- Applied TAM: Targeted at small and medium-sized agencies, Applied TAM offers a user-friendly interface and essential features like policy management, accounting, and reporting.

- Vertafore Agency Platform: Vertafore’s Agency Platform provides tools to manage workflows, track commissions, and handle client communications. It caters to both large and small agencies, focusing on enhancing efficiency and productivity.

- AgencyBloc: Provides agency management and CRM software specifically for health and life insurance agencies.

- Newton by Agency Systems: Designed for insurance agencies of all sizes, offering policy management and accounting features.

- Insurance Agencies: Small, medium, and large insurance agencies can leverage TechCanary’s comprehensive suite of tools to manage policies, streamline operations, and enhance customer relationships.

- Insurance Brokers: TechCanary offers brokers the tools they need to track leads, manage policies, and improve overall productivity, enabling them to provide top-notch services to clients.

- Insurance Carriers: Insurance carriers can benefit from TechCanary’s advanced data analytics and reporting features, enabling them to make data-driven decisions and streamline their operations.

- Managing General Agents (MGAs): TechCanary’s tailored solutions cater to the specific needs of MGAs, helping them optimize their processes and drive growth.

- Small Team – for 3 users

$1,100/month

Additional user for $360/month

- Group Pack- for 7 users

$2,200/month

Additional user for $300/month

- Large Team- for 25 users

$7,150/month

Additional user for $300/month

- Corporate Plan – Customised solutions

- Tailored for the Insurance Industry: Unlike generic software solutions, TechCanary is built explicitly for the insurance sector. Its features cater to the unique requirements of insurance agencies, brokers, and carriers, enhancing their operational efficiency.

- Scalability and Flexibility: TechCanary’s software is scalable and can be customized to accommodate businesses of varying sizes. This flexibility ensures that the platform can adapt to evolving needs and grow with the business.

- Seamless Integration: Integration with other essential tools is crucial in streamlining workflows. TechCanary seamlessly integrates with various third-party applications, ensuring a seamless experience for users.

- Excellent Customer Support: TechCanary prides itself on delivering exceptional customer support. Their dedicated team is readily available to address queries, offer assistance, and provide timely TechCanary training to users.

TechCanary emerges as a leading player in the market, providing cutting-edge insurance software solutions tailored to meet the diverse needs of the industry. In this article, we will explore TechCanary and its top features, understand why it stands out, identify its target audience, delve into its pricing structure, present alternatives, conduct a comparative analysis, read reviews, and conclude with a comprehensive evaluation of the platform.

- TechCanary vs. Applied Epic:

Both TechCanary and Applied Epic are robust insurance software solutions, catering to various-sized agencies. While TechCanary emphasizes its user-friendly interface and seamless integrations, Applied Epic is known for its scalability and extensive feature set, including CRM, policy management, and reporting tools.

- TechCanary vs. Guidewires InsuranceSuite:

TechCanary and Guidewire’s InsuranceSuite offer unique strengths. TechCanary stands out with its specialized focus on the insurance sector, while Guidewire’s InsuranceSuite excels with its comprehensive suite of offerings, including policy, billing, and claims management.

- TechCanary vs. Insly:

TechCanary is a top choice for agencies seeking a tailored, cloud-based solution. On the other hand, Insly is an attractive option for brokers, agents, and underwriters with its specialized features in managing policies, commissions, and claims.

- TechCanary vs. Applied TAM:

TechCanary targets a broader spectrum of agencies, while Applied TAM is well-suited for smaller to medium-sized agencies. Applied TAM’s simplicity and essential features appeal to agencies with straightforward requirements.

- TechCanary vs. Vertafore Agency Platform:

TechCanary and Vertafore’s Agency Platform both offer workflow management tools and client communication features. TechCanary distinguishes itself with its emphasis on mobile accessibility and user-friendly design, while Vertafore’s Agency Platform is highly regarded for its efficiency-boosting capabilities.

Review 1 – John, Insurance Agent:

“I have been using TechCanary for over a year now, and I am thoroughly impressed. The platform’s CRM functionality has made it incredibly easy for me to stay on top of client interactions and follow-ups. The reporting tools have allowed me to analyze my performance and identify areas for improvement. The customer support team has been excellent, always prompt and helpful.”

Review 2 – Sarah, Insurance Agency Owner:

“As the owner of a growing insurance agency, I needed a software solution that could scale with my business. TechCanary has been the perfect fit. It has allowed us to efficiently manage policies, track leads, and provide top-notch customer service. The ability to access data on the go through the mobile app has been a game-changer. Highly recommended!”

Review 3 – Mark, Managing General Agent:

“TechCanary has been a game-changer for our MGA. The platform’s policy management features have significantly streamlined our processes, allowing us to handle a higher volume of business with ease. The seamless integration with other tools we use has also been a huge plus. The initial training provided by the TechCanary team was thorough and helpful, getting our team up to speed quickly.”

While TechCanary excels in various areas, it’s essential for businesses to carefully assess their unique requirements and compare the platform with other viable alternatives. The comparative analysis and user reviews can aid in making an informed decision that aligns with the organization’s goals and objectives.

As technology continues to shape the insurance agency software providers and industry, the demand for top-notch insurance software solutions is ever-increasing. By choosing a platform like TechCanary that combines advanced features with exceptional customer support, insurance professionals can position themselves for success in an increasingly competitive market.

In summary, TechCanary remains at the forefront of insurance technology solutions, offering an intuitive, scalable, and tailored platform that caters to diverse insurance professionals’ needs, ensuring a seamless and efficient experience for businesses and their clients alike.

ISCS SurePower Innovation is a leading insurance software provider, ISCS has developed SurePower Innovation, a comprehensive platform that empowers insurance companies with advanced features and functionalities. In this article, we will delve into ISCS SurePower Innovation, exploring its pricing, features, demo, reviews, training options, and its position among the best insurance software solutions available.

Xuber, a leading insurance software solution, has emerged as a powerful tool that empowers insurance businesses to streamline their processes, enhance customer experiences, and gain a competitive edge. In this article, we will explore the world of Xuber, delving into its pricing, features, demo, customer reviews, and training options. With a focus on providing comprehensive and efficient insurance software solutions, Xuber has earned its reputation as the best insurance software in the market.