Zywave is a prominent software company that has earned a reputation for providing cutting-edge insurance technology solutions. In this article, we will explore the top features of Zywave, discuss why it is a preferred choice for insurance professionals, examine its target audience, pricing structure, and alternatives, compare it with other insurance software solutions, delve into user reviews, and conclude with an assessment of its overall impact on the industry.

- Policy Management: The platform enables agencies to manage policies efficiently, from the initial quoting process to policy issuance, endorsements, and renewals.

- CRM Functionality: Vertafore Agency Platform includes a robust CRM system that allows agencies to manage client information, track interactions, and maintain a comprehensive view of client relationships.

- Document Storage: The platform provides secure cloud-based storage for agency documents, ensuring easy access and organisation of critical information.

- Commission Tracking: Vertafore Agency Platform offers commission tracking tools that help agencies manage and calculate agent commissions accurately.

- Reporting and Analytics: The platform provides advanced reporting and analytics capabilities, enabling agencies to gain insights into their performance, identify trends, and make data-driven decisions.

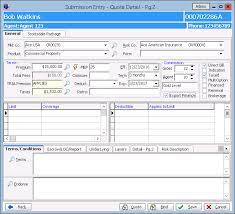

During the demo, agencies can typically navigate through different modules, perform tasks related to policy management, client data handling, and reporting. The demo serves as a valuable tool for agencies to assess the platform’s capabilities and determine its suitability for their operations.

Vertafore offers a flexible pricing model, ensuring that agencies can choose the package that best aligns with their budget and operational needs. To obtain accurate pricing information, insurance agencies are encouraged to reach out to Vertafore directly or visit their official website to request a personalised quote.

- Comprehensive Features: Vertafore Agency Platform offers a wide range of features that cover various aspects of agency operations, including policy management, customer relationship management (CRM), document storage, and commission tracking. The platform’s all-in-one nature eliminates the need for multiple systems, streamlining agency workflows and boosting efficiency.

- Industry Expertise: Vertafore has extensive experience in the insurance industry, and its solutions are built with a deep understanding of the unique challenges faced by agencies. The platform is designed to address these challenges and provide agencies with tools to succeed in a competitive market.

- Integration Capabilities: Vertafore Agency Platform seamlessly integrates with other systems, such as carrier platforms and accounting software, allowing agencies to access real-time data and streamline data sharing across various applications.

- Scalability: Vertafore Agency Platform is scalable, making it suitable for agencies of all size s, from small independent agencies to large national brokers. The platform can grow with the agency, accommodating its evolving needs and expanding operations.

Vertafore Agency Platform, a leading agency management software, has emerged as a game-changer in this space. In this article, we will explore various aspects of Vertafore Agency Platform, including its pricing, features, demo, reviews, training options, and how it compares to other agency management systems in the market.

Agencies may compare Vertafore Agency Platform with other solutions to understand how it aligns with their unique needs, workflow preferences, and budget constraints. The goal is to select a platform that will enhance agency efficiency, improve customer service, and drive business growth.

User-Friendly Interface: Users appreciate the platform’s user-friendly interface, which facilitates quick onboarding and easy navigation.

Comprehensive Features: Vertafore Agency Platform’s comprehensive features are commended by users for providing a complete solution to manage various agency operations.

Integration Capabilities: Users highlight the platform’s seamless integration with other systems, which simplifies data sharing and ensures smooth workflow integration.

Reliable Support: Vertafore’s customer support team is highly regarded for its responsiveness and expertise in addressing inquiries and technical issues.

With its flexible pricing options, comprehensive features, and reliable support, Vertafore Agency Platform is well-positioned to continue its leadership in the insurance software market. As the insurance industry evolves, Vertafore remains committed to delivering cutting-edge solutions that drive efficiency, improve customer experiences, and fuel the growth of insurance agencies across the globe

ISCS SurePower Innovation is a leading insurance software provider, ISCS has developed SurePower Innovation, a comprehensive platform that empowers insurance companies with advanced features and functionalities. In this article, we will delve into ISCS SurePower Innovation, exploring its pricing, features, demo, reviews, training options, and its position among the best insurance software solutions available.

Xuber, a leading insurance software solution, has emerged as a powerful tool that empowers insurance businesses to streamline their processes, enhance customer experiences, and gain a competitive edge. In this article, we will explore the world of Xuber, delving into its pricing, features, demo, customer reviews, and training options. With a focus on providing comprehensive and efficient insurance software solutions, Xuber has earned its reputation as the best insurance software in the market.