Wave Financial is a comprehensive software platform tailored to aid small businesses in efficiently managing their accounting and bookkeeping tasks. Offering an array of features and tools, it streamlines financial management, invoicing, payroll, and payments. With Wave Financial, business owners can direct their focus towards growing their ventures, confident in the knowledge that the software effectively handles the complexities of financial management.

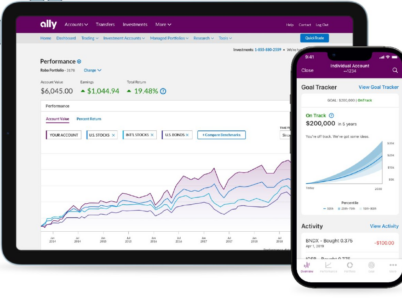

- Account Management: Users can view their account balances, positions, and transaction history. They can also deposit or withdraw funds from their investment accounts.

- Trading: The app allows users to place market orders, limit orders, and stop orders for buying or selling securities. Users can also access real-time quotes, charts, and market news to help them make informed investment decisions.

- Watchlists and Alerts: Users can create customised watchlists to monitor the performance of specific stocks or other securities. The app may also provide price and news alerts to keep users informed about important market developments.

- Research and Education: The app may offer research tools and educational resources such as market commentary, analyst ratings, and financial news to help users stay informed about the market and make informed investment decisions.

Ally Invest maintains a competitive commission structure for various types of trades. The platform offers commission-free trades for eligible stocks, ETFs, and options, making it an attractive choice for cost-conscious investors. For trades that do incur commissions, Ally Invest charges a competitive fee per trade, ensuring that investors can execute their investment strategies without excessive costs eating into their returns. By providing transparent and competitive pricing, Ally Invest enhances its appeal among investors looking for a cost-effective trading platform.

Ally Invest places great emphasis on providing exceptional customer support to its users. The platform understands the importance of timely assistance and aims to ensure that investors receive the support they need throughout their investment journey.

Ally Invest offers a dedicated customer support team that can be reached through multiple channels, including phone, email, and live chat. This accessibility allows users to choose the method that best suits their preferences and urgency of their inquiries. Whether investors have questions about their accounts, need assistance with the trading platform, or require clarification on fees and charges, Ally Invest’s knowledgeable and responsive customer support team is readily available to provide assistance and address concerns.

In addition to direct support channels, Ally Invest provides an extensive knowledge base and educational resources to empower investors with the information they need. The platform offers a comprehensive collection of articles, videos, tutorials, and frequently asked questions (FAQs) on its website. These resources cover a wide range of topics, including account setup, trading strategies, platform features, and retirement planning. By equipping investors with educational materials, Ally Invest aims to enhance their understanding of the platform and empower them to make informed investment decisions.

Ally Invest also understands the importance of community engagement and fosters a sense of community among its users. The platform provides forums and discussion boards where investors can connect with each other, share insights, and learn from experienced traders. This community-driven approach encourages collaboration and knowledge-sharing among users, further enhancing the overall trading experience.

In the rapidly evolving digital landscape, Ally Invest stands out as a leading online trading platform, known for its user-friendly interface, competitive pricing, and exceptional customer service.

In the contemporary digital landscape, technology has revolutionized the way individuals handle their finances and investments. Wealthfront, a notable entity in the fintech industry, offers a comprehensive software platform amalgamating the benefits of robo-advisory services, intelligent automation, and personalized wealth management strategies. Wealthfront has solidified its position as a leading wealth management solution.

Zoho Invoice, developed by Zoho Corporation, an Indian software company, is an online invoicing software crafted to assist businesses in creating, sending, and managing invoices, while also tracking time and expenses and automating payment reminders. Tailored for small businesses, freelancers, and entrepreneurs, Zoho Invoice aims to simplify the invoicing process and streamline financial operations. This article will delve into how small businesses can leverage Zoho Invoices and explore the benefits it offers.