Wave Financial is a comprehensive software platform tailored to aid small businesses in efficiently managing their accounting and bookkeeping tasks. Offering an array of features and tools, it streamlines financial management, invoicing, payroll, and payments. With Wave Financial, business owners can direct their focus towards growing their ventures, confident in the knowledge that the software effectively handles the complexities of financial management.

- Wealthfront Customer Service: Wealthfront places a strong emphasis on customer service, aiming to provide clients with prompt and reliable support. The platform offers several channels for clients to seek assistance, including phone support, email support, and a comprehensive knowledge base accessible through the website. Wealthfront's customer service representatives are known for their professionalism and responsiveness, striving to address client inquiries and concerns in a timely manner.

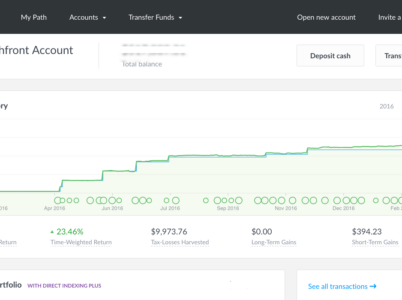

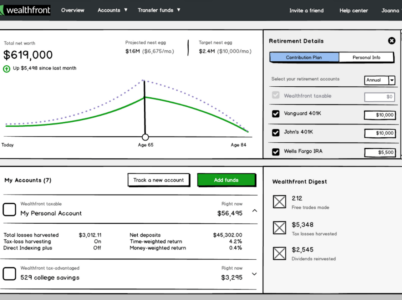

- Wealthfront Robo-Advisor: Wealthfront's software incorporates advanced robo-advisory services, leveraging technology and automation to deliver personalised investment advice. The platform's algorithms analyse client profiles, risk preferences, financial goals, and market conditions to provide customised investment recommendations.

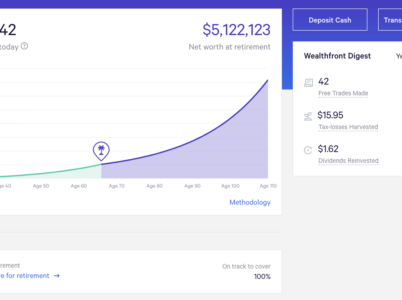

- Wealthfront Wealth Management In addition to its robo-advisory services, Wealthfront offers comprehensive wealth management features to help clients optimise their overall financial well-being. The platform provides tools and resources for financial planning, goal-based investing, tax-efficient strategies, college savings planning, and more. Wealthfront's goal-based investing feature enables clients to set specific financial goals, such as buying a home or funding a child's education, and provides personalised guidance and projections to track progress towards these goals.

Wealthfront employs a transparent and competitive fee structure, ensuring that clients have a clear understanding of the costs associated with using their services. The fee structure consists primarily of an annual advisory fee, which is based on a percentage of the assets under management (AUM). As of the time of writing, Wealthfront charges an annual advisory fee of 0.25% of the AUM. This fee is calculated and deducted on a monthly basis. It’s important to note that the advisory fee is subject to change, and investors should review the most up-to-date fee schedule provided by Wealthfront.

Management Fees

Wealthfront’s management fees are based on a percentage of the assets under management (AUM) in a client’s account. The annual advisory fee is currently set at 0.25% of the AUM. This fee is calculated on a prorated basis and charged on a monthly basis.

For example, if an investor has $10,000 invested with Wealthfront, the annual management fee would amount to $25 ($10,000 x 0.25%). This fee is then divided into monthly instalments, resulting in approximately $2.08 deducted from the account each month.

It’s worth noting that the management fee is subject to change, and investors should review the most up-to-date fee schedule provided by Wealthfront.

Account Fees

Wealthfront does not charge any account setup fees, inactivity fees, or trading fees. Additionally, there are no fees for deposits, withdrawals, or electronic fund transfers (EFTs) made to and from a Wealthfront account.

However, it’s important to be aware of potential fees associated with external factors such as wire transfers, returned ACH transfers, and account transfers. These fees are typically imposed by the financial institutions involved in the transaction rather than by Wealthfront itself.

Other Charges

While Wealthfront’s management fee covers the majority of costs, there are a few additional charges that investors should be aware of:

Expense Ratios: Wealthfront invests client funds in low-cost exchange-traded funds (ETFs) from reputable providers. These ETFs have their own expense ratios, which are charged by the fund providers to cover operating expenses. The expense ratios are built into the performance of the ETFs and indirectly affect the overall cost to the investor. However, Wealthfront focuses on utilising low-cost ETFs to minimise these expenses.

Fund-Specific Fees: Some ETFs may have transaction fees or other charges associated with buying or selling shares. These fees are specific to the individual funds and are not directly charged by Wealthfront. Before investing, it’s important for clients to review the prospectus and information provided by the ETF issuer to understand any fund-specific fees that may apply.

In the contemporary digital landscape, technology has revolutionized the way individuals handle their finances and investments. Wealthfront, a notable entity in the fintech industry, offers a comprehensive software platform amalgamating the benefits of robo-advisory services, intelligent automation, and personalized wealth management strategies. Wealthfront has solidified its position as a leading wealth management solution.

Zoho Invoice, developed by Zoho Corporation, an Indian software company, is an online invoicing software crafted to assist businesses in creating, sending, and managing invoices, while also tracking time and expenses and automating payment reminders. Tailored for small businesses, freelancers, and entrepreneurs, Zoho Invoice aims to simplify the invoicing process and streamline financial operations. This article will delve into how small businesses can leverage Zoho Invoices and explore the benefits it offers.

Zoho Books, created by Zoho Corporation, an Indian software company, is an online accounting software tailored to facilitate effective financial management for small and medium-sized businesses. With a diverse range of features, Zoho Books is a favored option for businesses seeking to streamline their accounting processes.