In the contemporary digital landscape, technology has revolutionized the way individuals handle their finances and investments. Wealthfront, a notable entity in the fintech industry, offers a comprehensive software platform amalgamating the benefits of robo-advisory services, intelligent automation, and personalized wealth management strategies. Wealthfront has solidified its position as a leading wealth management solution.

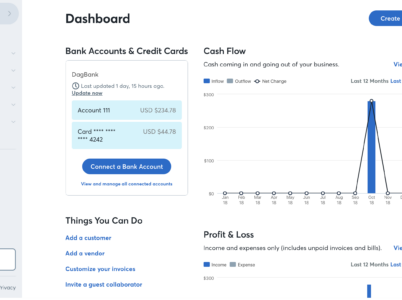

- Wave Financial Login: The platform offers a user-friendly login process, ensuring quick and secure access to your financial data from any device with an internet connection.

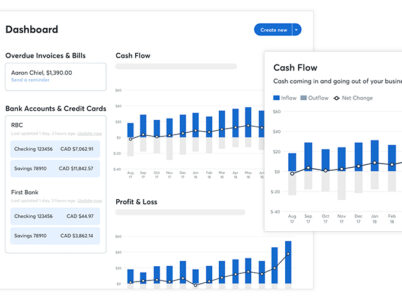

- Wave Financial Accounting: Wave Financial simplifies accounting by automating key processes such as expense tracking, bank reconciliation, and financial reporting. Users can easily create balance sheets, income statements, and cash flow statements.

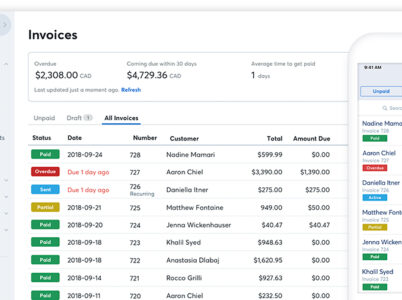

- Wave Financial Invoicing: The invoicing feature allows users to create professional invoices with customizable templates. It also enables easy tracking of sent invoices, monitoring payment status, and sending reminders to clients for outstanding payments.

- Wave Financial Payroll: Managing payroll becomes effortless with Wave Financial. The platform helps calculate employee salaries, deductions, and taxes. It also facilitates direct deposits to employees' bank accounts, handles payroll taxes, and generates necessary reports.

- Wave Financial Payments: Wave Financial supports seamless online payment processing, allowing businesses to accept credit card payments directly from invoices. It integrates with popular payment gateways, ensuring smooth and secure transactions.

- Wave Financial Integration: Wave Financial integrates with various third-party applications and services to enhance functionality. Integration with banking institutions, payment gateways, e-commerce platforms, and other business tools streamlines data flow and reduces manual entry.

- Wave Financial small business: Wave Financial offered a range of features designed to assist small businesses with their financial needs. This included tools for invoicing, expense tracking, accounting, payroll management, and receipt scanning. They also provided the option for businesses to accept credit card payments and connect their bank accounts for seamless financial data integration.

- Wave Financial Support: Wave Financial provides excellent customer support through various channels, including email, live chat, and an extensive knowledge base. The support team is responsive and knowledgeable, ensuring prompt assistance to users when needed.

- QuickBooks: QuickBooks is one of the most widely used accounting software solutions for small businesses. It offers a comprehensive range of features, including invoicing, expense tracking, payroll management, and financial reporting. QuickBooks has both online and desktop versions, allowing users to choose the option that suits their needs.

- Xero: Xero is a cloud-based accounting software designed for small and medium-sized businesses. It provides features such as bank reconciliation, invoicing, expense tracking, and inventory management. Xero offers integration with various third-party apps and has a user-friendly interface.

- FreshBooks: FreshBooks is an accounting software primarily aimed at freelancers, self-employed professionals, and small businesses. It offers features like time tracking, expense management, invoicing, and basic financial reporting. FreshBooks has a user-friendly interface and integrates with popular payment gateways.

- Zoho Books: Zoho Books is a cloud-based accounting solution that caters to small businesses. It provides features such as invoicing, expense tracking, bank reconciliation, and inventory management. Zoho Books integrates with other Zoho products and offers a mobile app for on-the-go access.

- Sage Intacct: Sage Intacct is a robust accounting software designed for mid-sized businesses and enterprises. It offers advanced features like multi-entity consolidation, revenue recognition, project accounting, and financial reporting. Sage Intacct provides scalability and customization options to meet specific business needs.

These are just a few alternatives to Wave Financial, and the best choice depends on your specific business requirements, budget, and preferences. It’s recommended to evaluate the features, pricing, and user reviews of each option to determine the most suitable alternative for your organization.

- Invoicing Plan

Invoicing Plan : Priced at $0

- Accounting Plan

Accounting Plan : Priced at $0

- Mobile Receipts Plan

Mobile receipts Plan : Priced at $8 billed monthly, USD ($96/year) or Save 25%, $72 billed annually USD ($6/month)

- Payroll Plan

Payroll Plan :<br />

Tax service states, $40 USD monthly fee + $6 USD per active employee + $6 USD per independent contractor paid<br />

Self service states, $20 USD monthly fees + $6 USD per active employee + $6 USD per independent contractor paid

- Advisors

Advisors: Wave Financial bookkeeping support $149 USD monthly fee Accounting & payroll coaching: $379 USD one time fee (other packages available)

- User-Friendly Interface: Wave Financial offers an intuitive and user-friendly interface, making it easy for even non-accountants to navigate and use the software efficiently.

- All-in-One Solution: With Wave Financial, small businesses can handle multiple financial tasks within a single platform. From accounting and invoicing to payroll and payments, everything is seamlessly integrated, eliminating the need for multiple software tools.

- Cost-Effective: The free features of Wave Financial make it an attractive option for small businesses with limited budgets. The advanced features are reasonably priced, providing excellent value for money.

- Automation and Efficiency: Wave Financial automates several financial tasks, saving time and reducing manual errors. This automation enables business owners to focus on core operations and growth.

- Accessibility: As a cloud-based solution, Wave Financial allows users to access their financial data anytime, anywhere, as long as there is an internet connection. This flexibility is essential for small businesses with remote teams or on-the-go entrepreneurs.

Wave Financial is a comprehensive software platform tailored to aid small businesses in efficiently managing their accounting and bookkeeping tasks. Offering an array of features and tools, it streamlines financial management, invoicing, payroll, and payments. With Wave Financial, business owners can direct their focus towards growing their ventures, confident in the knowledge that the software effectively handles the complexities of financial management.

- QuickBooks:

– Features: Invoicing, expense tracking, payroll management, financial reporting.

– Versions: Online and desktop options available.

– User base: Widely used by small businesses.

– Pricing: Offers different pricing plans based on features and scale.

- Xero:

– Features: Bank reconciliation, invoicing, expense tracking, inventory management.

– Deployment: Cloud-based accounting software.

– Integrations: Supports integration with various third-party apps.

– User interface: User-friendly and intuitive.

- FreshBooks:

– Target audience: Primarily for freelancers, self-employed professionals, and small businesses.

– Features: Time tracking, expense management, invoicing, basic financial reporting.

– Interface: User-friendly with a focus on simplicity.

– Integration: Integrates with popular payment gateways.

- Zoho Books:

– Features: Invoicing, expense tracking, bank reconciliation, inventory management.

– Integration: Integrates with other Zoho products.

– Mobile app: Offers a mobile app for easy access on the go.

– Deployment: Cloud-based accounting solution.

- Sage Intacct:

– Target audience: Mid-sized businesses and enterprises.

– Features: Advanced features like multi-entity consolidation, revenue recognition, project accounting, financial reporting.

– Scalability: Designed to handle the needs of growing businesses.

– Customization: Offers customization options to meet specific business requirements.

Zoho Invoice, developed by Zoho Corporation, an Indian software company, is an online invoicing software crafted to assist businesses in creating, sending, and managing invoices, while also tracking time and expenses and automating payment reminders. Tailored for small businesses, freelancers, and entrepreneurs, Zoho Invoice aims to simplify the invoicing process and streamline financial operations. This article will delve into how small businesses can leverage Zoho Invoices and explore the benefits it offers.

Zoho Books, created by Zoho Corporation, an Indian software company, is an online accounting software tailored to facilitate effective financial management for small and medium-sized businesses. With a diverse range of features, Zoho Books is a favored option for businesses seeking to streamline their accounting processes.