Wave Financial is a comprehensive software platform tailored to aid small businesses in efficiently managing their accounting and bookkeeping tasks. Offering an array of features and tools, it streamlines financial management, invoicing, payroll, and payments. With Wave Financial, business owners can direct their focus towards growing their ventures, confident in the knowledge that the software effectively handles the complexities of financial management.

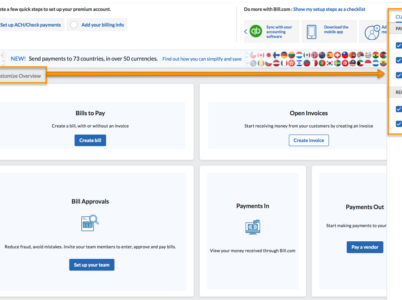

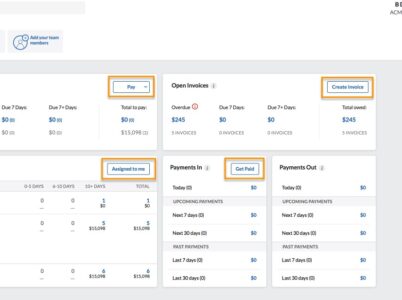

- Bill.com payment options: Bill.com provides payment automation tools that enable businesses to streamline the payment process. With this feature, businesses can automate the payment process, reducing the time and effort required to process payments.

- Bill.com integrations: Bill.com integrates seamlessly with popular accounting software like QuickBooks and Xero, making it easier to manage all financial processes in one place.

- Online Invoicing: Bill.com provides an online invoicing feature that makes it easier for businesses to create and send invoices to customers. The feature allows businesses to customize invoices and includes payment options that make it easier for customers to pay.

- Approval Workflow: Bill.com includes an approval workflow feature that enables businesses to set up a customized approval process for bills and invoices. This feature ensures that all bills and invoices are approved before payment is processed.

- Vendor Management: Bill.com provides a vendor management feature that enables businesses to manage all vendor information in one place. The feature includes tools for adding and editing vendor information, as well as tracking vendor payments.

- QuickBooks: QuickBooks is an accounting software that provides a range of features for managing bills, invoices, and payments. QuickBooks also integrates seamlessly with Bill.com, making it easy to manage all financial processes in one place.

- Xero: Xero is an accounting software that provides a range of features for managing bills, invoices, and payments. Xero also integrates seamlessly with Bill.com, making it easy to manage all financial processes in one place. Xero also provides a range of features for managing inventory and payroll.

- Wave: Wave is a free accounting software that provides a range of features for managing bills, invoices, and payments. Wave also provides features for managing payroll and inventory.

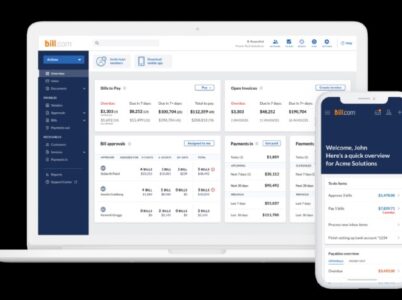

Bill.com is suitable for businesses that need to streamline their payment processes, automate manual tasks, and reduce paperwork. It can be used by businesses that have a high volume of invoices to process, as well as those that need to make payments to vendors, suppliers, and contractors regularly.

In addition to businesses, Bill.com can also be used by accountants and bookkeepers who manage finances for multiple clients. The platform offers features such as multi-entity management and client billing that make it easier for accounting professionals to manage their clients’ finances.

- Essential Plan

1) Essential Plan: The Essential Plan is priced at $39 per user per month and includes basic features like bill payment, invoicing, and vendor management.

- Team Plan

2) Team Plan: The Team Plan is priced at $49 per user per month and includes additional features like approval workflows, custom branding, and integrations with accounting software.

- Corporate Plan

3) Corporate Plan: The Corporate Plan is priced at $69 per user per month and includes all features of the Team Plan, plus advanced features like multiple entities, custom roles, and advanced approvals.

In addition to its core features, Bill.com provides excellent customer support. The company has a team of experts that are available to answer questions and provide assistance whenever needed. Bill.com also provides a range of resources, including tutorials, webinars, and articles, that help businesses get the most out of the software.

Bill.com is a trusted accounting software that streamlines financial management for businesses. With a robust suite of tools for bill, invoice, and payment management, it has established itself as a top choice for businesses of all sizes since its inception in 2006.

- Integration: QuickBooks and Bill.com both integrate seamlessly with each other, making it easy to manage all financial processes in one place. However, QuickBooks also integrates with a range of other software solutions, making it a more versatile option.

- Pricing: QuickBooks offers a range of pricing plans to suit businesses of all sizes, including a free plan for very small businesses. Bill.com, on the other hand, only offers paid plans, which may not be suitable for businesses with a limited budget.

- Bill.com automation: Both QuickBooks and Bill.com provide payment automation features that make it easier to manage payments. However, Bill.com’s payment automation features are more advanced and customizable, making it a better choice for businesses that need more control over their payment processes.

In the contemporary digital landscape, technology has revolutionized the way individuals handle their finances and investments. Wealthfront, a notable entity in the fintech industry, offers a comprehensive software platform amalgamating the benefits of robo-advisory services, intelligent automation, and personalized wealth management strategies. Wealthfront has solidified its position as a leading wealth management solution.

Zoho Invoice, developed by Zoho Corporation, an Indian software company, is an online invoicing software crafted to assist businesses in creating, sending, and managing invoices, while also tracking time and expenses and automating payment reminders. Tailored for small businesses, freelancers, and entrepreneurs, Zoho Invoice aims to simplify the invoicing process and streamline financial operations. This article will delve into how small businesses can leverage Zoho Invoices and explore the benefits it offers.