Wave Financial is a comprehensive software platform tailored to aid small businesses in efficiently managing their accounting and bookkeeping tasks. Offering an array of features and tools, it streamlines financial management, invoicing, payroll, and payments. With Wave Financial, business owners can direct their focus towards growing their ventures, confident in the knowledge that the software effectively handles the complexities of financial management.

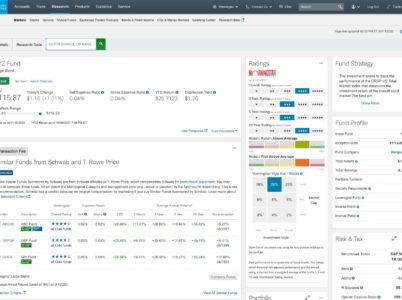

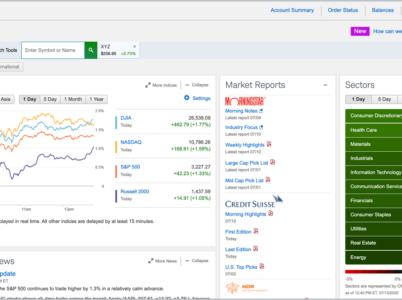

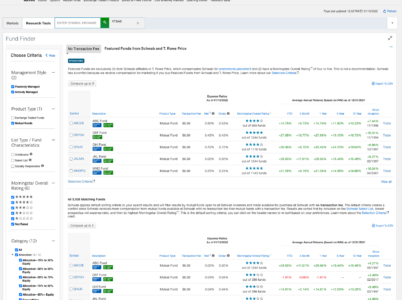

- Charles Schwab Investment: Charles Schwab's investment offerings are diverse, allowing investors to build well-rounded portfolios tailored to their individual goals and risk tolerance. Investors can access a wide range of investment options, including stocks, bonds, options, ETFs, mutual funds, and more.

- Charles Schwab Retirement: Planning for retirement is a crucial aspect of financial management, and Charles Schwab offers comprehensive retirement planning tools and resources to assist investors in achieving their retirement goals. The brokerage provides Individual Retirement Accounts (IRAs), including Traditional IRAs, Roth IRAs, and Rollover IRAs, allowing investors to take advantage of tax benefits while saving for retirement.

- Support Channels: Charles Schwab offers multiple support channels to ensure accessibility and convenience for clients. Investors can reach the customer service team via phone, email, and live chat. These channels enable clients to connect with a support representative and receive assistance with their queries, concerns, or technical issues. Charles Schwab's phone support is available 24/7, ensuring round-the-clock accessibility for clients in different time zones.

- Response Times: Charles Schwab is committed to providing efficient and timely customer service. The response times may vary depending on the complexity of the inquiry and the support channel used. Phone support typically offers immediate assistance, with clients able to connect with a representative promptly. Email responses are generally provided within 24 hours, allowing clients to receive comprehensive answers to their questions.

Charles Schwab’s commission structure is designed to be competitive and cost-effective for investors. The brokerage has made significant strides in recent years by eliminating trading commissions for U.S. stocks, ETFs, and options, making it highly attractive to investors. This move has democratised investing and reduced costs for both active traders and long-term investors. However, investors should be aware that there may still be other fees associated with certain transactions or account services. It is advisable to review the commission schedule and fee structure for a comprehensive understanding of the costs involved.

In the dynamic world of investment and trading, Charles Schwab stands as a leading brokerage firm, renowned for its cutting-edge software solutions. Explore Charles Schwab's user-friendly interface, comprehensive account tools, competitive fees, diverse investments, and exceptional customer service, as we delve into its software suite, covering login, account management, fees, trading platforms, and more.

In the contemporary digital landscape, technology has revolutionized the way individuals handle their finances and investments. Wealthfront, a notable entity in the fintech industry, offers a comprehensive software platform amalgamating the benefits of robo-advisory services, intelligent automation, and personalized wealth management strategies. Wealthfront has solidified its position as a leading wealth management solution.

Zoho Invoice, developed by Zoho Corporation, an Indian software company, is an online invoicing software crafted to assist businesses in creating, sending, and managing invoices, while also tracking time and expenses and automating payment reminders. Tailored for small businesses, freelancers, and entrepreneurs, Zoho Invoice aims to simplify the invoicing process and streamline financial operations. This article will delve into how small businesses can leverage Zoho Invoices and explore the benefits it offers.