Wave Financial is a comprehensive software platform tailored to aid small businesses in efficiently managing their accounting and bookkeeping tasks. Offering an array of features and tools, it streamlines financial management, invoicing, payroll, and payments. With Wave Financial, business owners can direct their focus towards growing their ventures, confident in the knowledge that the software effectively handles the complexities of financial management.

- Support Channels: Fidelity Investments offers multiple support channels to cater to the diverse needs and preferences of its clients. Investors can reach the customer service team through phone, email, live chat, and even in-person at Fidelity Investor Centers located across the United States. These channels provide convenient access to assistance, allowing clients to choose the most suitable method of communication based on their preferences and urgency of their inquiries.

- Response Times: Fidelity Investments is committed to providing prompt and efficient customer service. The response times may vary depending on the complexity of the inquiry and the support channel used. Phone support typically offers immediate access to a representative, minimising wait times for clients seeking urgent assistance. Email responses are generally provided within a reasonable timeframe, ensuring that clients receive thorough and well-crafted responses to their inquiries.

- Educational Resources: In addition to personalised support, Fidelity Investments offers a wealth of educational resources to empower clients with the knowledge and skills needed to make informed investment decisions. The brokerage provides a comprehensive library of articles, videos, webinars, educational courses, and interactive tools on its website.

Account Maintenance Fee: Fidelity Investments does not charge an account maintenance fee for most individual and joint accounts. However, certain account types, such as retirement accounts, may have specific fees or minimum balance requirements.

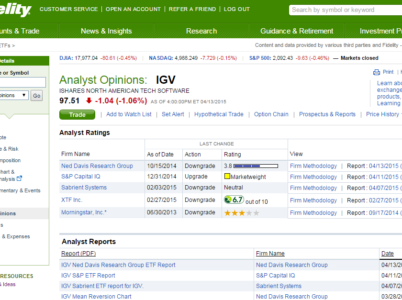

Trade Commissions:

Fidelity Investments offers competitive trade commissions for stocks, options, exchange-traded funds (ETFs), and other securities. The commission structure may vary depending on the type of account, trading frequency, and other factors. It is advisable for investors to review the commission schedule to understand the costs associated with their trades.

Mutual Fund Fees:

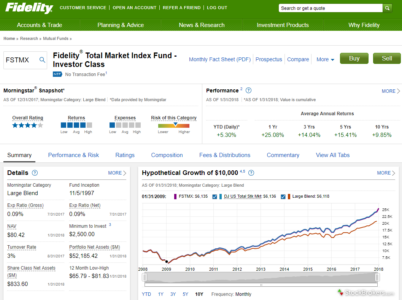

Fidelity Investments provides access to a wide range of mutual funds, and investors should be aware that certain funds may have expense ratios or transaction fees. It is important to research and understand the fees associated with specific mutual funds before making investment decisions.

In today's digital age, access to advanced software is essential for investors aiming to navigate the finance world and achieve their investment objectives. Fidelity Investments, a distinguished brokerage firm, leads the way by providing cutting-edge software solutions to investors worldwide. With its user-friendly login process, comprehensive account management tools, transparent fee structure, robust trading platforms, intuitive mobile app, competitive commission rates, diverse investment options, retirement planning features, and exceptional customer service, Fidelity Investments has solidified its reputation as a trusted partner for both novice and experienced investors.

Trade Commissions: Fidelity Investments offers competitive trade commissions for stocks, options, exchange-traded funds (ETFs), and other securities. The commission structure may vary depending on the type of account, trading frequency, and other factors. It is advisable for investors to review the commission schedule to understand the costs associated with their trades.

Mutual Fund Fees: Fidelity Investments provides access to a wide range of mutual funds, and investors should be aware that certain funds may have expense ratios or transaction fees. It is important to research and understand the fees associated with specific mutual funds before making investment decisions.

In the contemporary digital landscape, technology has revolutionized the way individuals handle their finances and investments. Wealthfront, a notable entity in the fintech industry, offers a comprehensive software platform amalgamating the benefits of robo-advisory services, intelligent automation, and personalized wealth management strategies. Wealthfront has solidified its position as a leading wealth management solution.

Zoho Invoice, developed by Zoho Corporation, an Indian software company, is an online invoicing software crafted to assist businesses in creating, sending, and managing invoices, while also tracking time and expenses and automating payment reminders. Tailored for small businesses, freelancers, and entrepreneurs, Zoho Invoice aims to simplify the invoicing process and streamline financial operations. This article will delve into how small businesses can leverage Zoho Invoices and explore the benefits it offers.