Wave Financial is a comprehensive software platform tailored to aid small businesses in efficiently managing their accounting and bookkeeping tasks. Offering an array of features and tools, it streamlines financial management, invoicing, payroll, and payments. With Wave Financial, business owners can direct their focus towards growing their ventures, confident in the knowledge that the software effectively handles the complexities of financial management.

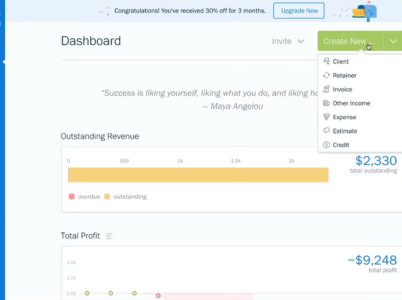

- FreshBooks invoicing and payment solutions: FreshBooks enables users to create and send professional-looking invoices and estimates to clients, receive payments online, and set up automatic payment reminders.

- FreshBooks bookkeeping for small businesses: FreshBooks is a cloud-based bookkeeping software that is designed for small businesses and self-employed professionals. It offers a range of features, including invoicing, expense tracking, time tracking, project management, and financial reporting. With its user-friendly interface and powerful tools, FreshBooks can help small businesses stay organized and manage their finances more effectively.

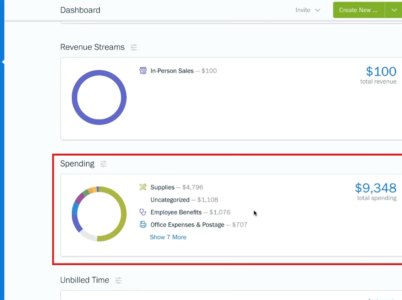

- FreshBooks accounting and financial reporting: FreshBooks is a cloud-based accounting software that provides a range of features to help small businesses and self-employed professionals manage their finances. In addition to basic accounting functions such as invoicing and expense tracking, FreshBooks offers several financial reports, including profit and loss statements, balance sheets, expense reports, invoice details reports, tax summary reports, and accounts ageing reports. These reports can be customized to meet the specific needs of your business and provide insights into your financial performance.

- FreshBooks project management: FreshBooks offers a project management feature that allows users to track their projects, collaborate with team members, and stay organized. This feature is particularly useful for freelancers and small business owners who need to manage multiple projects at once and keep track of deadlines and tasks. The project management feature in FreshBooks allows users to create and assign tasks, set due dates, and track progress. Users can also assign team members to specific tasks and collaborate on projects in real time. This feature helps to ensure that everyone is on the same page and that projects are completed on time and within budget.

- FreshBooks mobile app: FreshBooks offers a mobile app that is available for both iOS and Android devices. The app provides users with access to many of the same features and functions as the desktop version of FreshBooks, allowing them to manage their accounting and finances on the go.

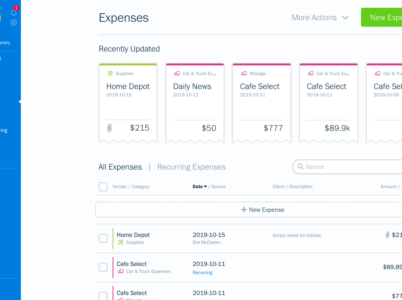

- FreshBooks expenses tracker: To use the expense tracker feature in FreshBooks, users can simply upload a photo or scan of their receipt directly into the platform. From there, they can categorize the expense, add a description, and assign it to a particular project or client. FreshBooks also offers automatic expense tracking, which allows users to connect their bank account or credit card to the platform and have their expenses automatically imported and categorized. This feature can save a lot of time and make it easier to keep track of expenses on an ongoing basis.

- FreshBooks accounting software for freelancers: FreshBooks also includes a range of features to help freelancers manage their expenses. Users can upload receipts and categorize expenses, making it easy to track their business expenses and claim deductions during tax season.

- FreshBooks time tracking software: FreshBooks also offers time tracking tools to help users keep track of how much time they spend on various projects. This feature allows for easy billing and invoicing based on the amount of time worked. Additionally, users can track expenses and generate reports to better understand their business's financial health.

- QuickBooks: QuickBooks is one of the most popular accounting software platforms, providing comprehensive bookkeeping, invoicing, and accounting features for small businesses and freelancers.

- Wave: Wave is a free accounting software platform that provides invoicing, accounting, and bookkeeping features for small businesses.

- Xero: Xero is a cloud-based accounting software platform that provides invoicing, accounting, bookkeeping, and payroll features for small businesses.

The software is particularly useful for businesses that require a streamlined approach to accounting and bookkeeping. For example, creative professionals such as graphic designers, writers, and photographers can use FreshBooks to manage their finances and invoice clients quickly. Similarly, consultants, lawyers, and healthcare practitioners can benefit from its time-tracking and project management features to stay on top of their billable hours.

FreshBooks is also well-suited for businesses that work remotely or have teams spread across different locations. Its cloud-based platform enables users to access their financial data from anywhere, on any device, and collaborate with their team members in real time.

Overall, FreshBooks is an ideal solution for businesses that need simple, intuitive accounting software that is easy to set up and use and offers robust features for managing finances and generating reports.

- Lite Plan

Lite Plan: $8.50/month for five billable clients.

- Plus Plan

Plus Plan: $15.0/month for 50 billable clients.

- Premium Plan

Premium Plan: $27.50/month for 500 billable clients.

FreshBooks is a good fit for a range of industries, including consulting, marketing, design, creative, and service-based businesses. It can be used by a wide range of professionals, such as freelance writers, graphic designers, web developers, and consultants, to manage their finances, invoicing, and time tracking.

FreshBooks is also ideal for businesses that need to collaborate with others, such as contractors or remote team members. The software allows users to share data and collaborate in real time, making it easy to work together and stay on top of finances.

Managing finances can be overwhelming for small business owners and freelancers. FreshBooks, a cloud-based accounting software platform, streamlines this process, simplifying invoicing, payment solutions, bookkeeping, and financial reporting. In this blog, we'll provide a detailed exploration of FreshBooks, covering its top features, pricing, alternatives, user reviews, and a comparative analysis with other accounting software platforms. Our goal is to help you decide if FreshBooks is the ideal solution for your business.

- FreshBooks vs QuickBooks: QuickBooks is a more comprehensive accounting software platform that provides more features and integrations than FreshBooks. However, FreshBooks is easier to use and has better customer support.

- FreshBooks vs Wave: FreshBooks offers more features than Wave, but Wave is free and may be a better choice for very small businesses.

- FreshBooks vs Xero: Xero is a more comprehensive accounting software platform than FreshBooks, providing more features and integrations. However, FreshBooks is easier to use and has better customer support.

In the contemporary digital landscape, technology has revolutionized the way individuals handle their finances and investments. Wealthfront, a notable entity in the fintech industry, offers a comprehensive software platform amalgamating the benefits of robo-advisory services, intelligent automation, and personalized wealth management strategies. Wealthfront has solidified its position as a leading wealth management solution.

Zoho Invoice, developed by Zoho Corporation, an Indian software company, is an online invoicing software crafted to assist businesses in creating, sending, and managing invoices, while also tracking time and expenses and automating payment reminders. Tailored for small businesses, freelancers, and entrepreneurs, Zoho Invoice aims to simplify the invoicing process and streamline financial operations. This article will delve into how small businesses can leverage Zoho Invoices and explore the benefits it offers.