Wave Financial is a comprehensive software platform tailored to aid small businesses in efficiently managing their accounting and bookkeeping tasks. Offering an array of features and tools, it streamlines financial management, invoicing, payroll, and payments. With Wave Financial, business owners can direct their focus towards growing their ventures, confident in the knowledge that the software effectively handles the complexities of financial management.

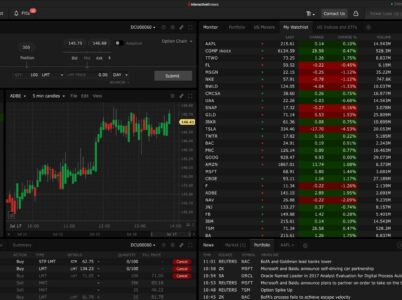

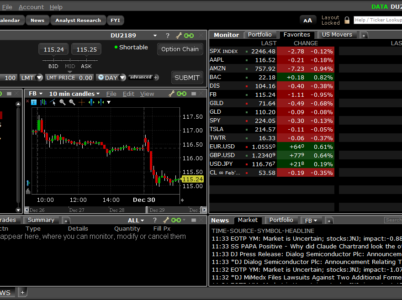

- Support Channels: Interactive Brokers offers multiple support channels to accommodate different preferences and ensure accessibility for clients worldwide. Investors can reach the customer service team via phone, email, and live chat. These channels enable clients to connect with a support representative and receive assistance with their queries, concerns, or technical issues.

- Response Times: Interactive Brokers is committed to providing efficient customer service and endeavours to address client inquiries in a timely manner. The response times may vary depending on the complexity of the inquiry and the support channel used. Phone support typically offers immediate assistance, with clients able to connect with a representative promptly. Email responses are generally provided within 24 hours, allowing clients to receive comprehensive answers to their questions. Live chat support ensures real-time engagement, enabling quick resolutions to simple inquiries or technical issues.

- Educational Resources: In addition to personalised support, Interactive Brokers provides a wealth of educational resources to empower clients with the knowledge and skills needed to navigate the financial markets effectively. The brokerage offers a comprehensive knowledge base on its website, which includes FAQs, user guides, and tutorials covering various aspects of trading, investing, and platform functionalities.

Pricing

Interactive Brokers does not impose a monthly account maintenance fee for most accounts. However, there may be minimum activity requirements for certain accounts to avoid inactivity fees.

Interactive Brokers charges a fee for incoming and outgoing wire transfers. The exact fee amount may depend on factors such as currency and location.

In today's fast-paced financial markets, access to dependable and feature-rich trading software is imperative for investors. Interactive Brokers, a renowned brokerage firm, has been a trailblazer in providing advanced software solutions to global traders and investors. With its robust trading platform, wide-ranging investment options, competitive fees, and exceptional customer service, Interactive Brokers has solidified its position as the preferred choice for both individual and institutional investors. This article offers an in-depth exploration of various aspects of Interactive Brokers' software, encompassing the login process, account management, fees, brokerage services, mobile app functionality, commission structure, trading platform, investment options, retirement planning, and customer service.

In the contemporary digital landscape, technology has revolutionized the way individuals handle their finances and investments. Wealthfront, a notable entity in the fintech industry, offers a comprehensive software platform amalgamating the benefits of robo-advisory services, intelligent automation, and personalized wealth management strategies. Wealthfront has solidified its position as a leading wealth management solution.

Zoho Invoice, developed by Zoho Corporation, an Indian software company, is an online invoicing software crafted to assist businesses in creating, sending, and managing invoices, while also tracking time and expenses and automating payment reminders. Tailored for small businesses, freelancers, and entrepreneurs, Zoho Invoice aims to simplify the invoicing process and streamline financial operations. This article will delve into how small businesses can leverage Zoho Invoices and explore the benefits it offers.