Wave Financial is a comprehensive software platform tailored to aid small businesses in efficiently managing their accounting and bookkeeping tasks. Offering an array of features and tools, it streamlines financial management, invoicing, payroll, and payments. With Wave Financial, business owners can direct their focus towards growing their ventures, confident in the knowledge that the software effectively handles the complexities of financial management.

- Invoicing: KashFlow offers a range of invoicing features that allow users to create and send invoices quickly and easily. Users can also set up recurring invoices and automated reminders to ensure they get paid on time.

- Bookkeeping: KashFlow's bookkeeping tools make it easy to keep track of expenses, manage bank transactions, and reconcile accounts.

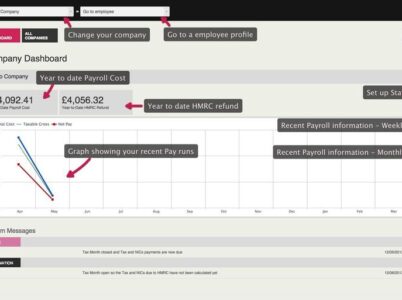

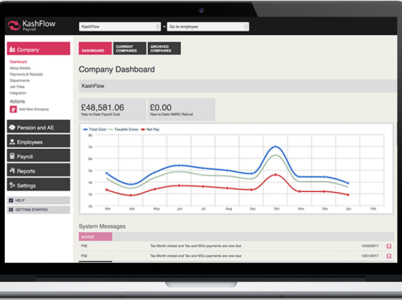

- Payroll Management: KashFlow's payroll management tools allow users to process payroll quickly and efficiently, including auto-enrolment for workplace pensions.

- Bank Integration: KashFlow can be integrated with most major UK banks, making it easy to import transactions and reconcile accounts.

- Mobile App: KashFlow has a mobile app that allows users to manage their accounts on the go, including creating invoices, recording expenses, and checking bank balances.

- Cloud-Based Accounting: KashFlow is a cloud-based accounting software, which means users can access their accounts from anywhere with an internet connection.

- Customizable Dashboard: KashFlow allows users to customize their dashboard to show the information that's most important to them.

- VAT Returns: KashFlow makes it easy to submit VAT returns to HMRC directly from the software.

- Xero: Xero is a popular cloud-based accounting software that offers a range of features, including invoicing, bookkeeping, payroll management, and bank integration.

- QuickBooks: QuickBooks is another popular accounting software that offers a range of features, including invoicing, bookkeeping, payroll management, and bank integration.

- FreeAgent: FreeAgent is a cloud-based accounting software designed specifically for small businesses and freelancers in the UK. It offers features such as invoicing, bookkeeping, and payroll management.

- Wave: Wave is a free cloud-based accounting software that offers features such as invoicing, bookkeeping, and payroll management.

The software is particularly well-suited to businesses with limited accounting experience, as it is user-friendly and easy to set up. It also offers a range of integrations with other popular business tools, such as PayPal, Stripe, and GoCardless, to streamline financial operations.

KashFlow is also a good fit for businesses that need to manage multiple users and roles, as it allows for multiple users with varying levels of access to the system. Additionally, it offers flexible pricing plans to accommodate different business needs and budgets.

Overall, KashFlow is a popular choice for small businesses and sole traders in the UK who are looking for an affordable and easy-to-use accounting software solution.

- Starter

Starter: £10.50 per month (billed annually) or £10 per month (billed monthly) - includes unlimited invoices, bank transactions, and customers, up to 10 automated bank feeds, and one user account.

- Business

Business: £22 per month (billed annually) or £20 per month (billed monthly) - includes unlimited invoices, bank transactions, and customers, up to 25 automated bank feeds, and up to 5 user accounts.

- Business + Payroll

Business + Payroll: £29 per month (billed annually) or £24 per month (billed monthly) - includes all the features of the Business plan, plus payroll management tools for up to 10 employees.

- Time-Saving: KashFlow automates many of the accounting tasks that small business owners need to do, saving them time and effort on bookkeeping, invoicing, and payroll management.

- Easy to Use: KashFlow is designed with small business owners in mind and is easy to use, even for those with little accounting experience.

- Affordable: KashFlow offers a range of pricing plans to suit different business needs and budgets, making it an affordable option for small businesses.

- Cloud-Based: KashFlow is a cloud-based accounting software, which means users can access their accounts from anywhere with an internet connection.

- Reliable: KashFlow has been around for over a decade and has established a reputation for being a reliable and secure accounting software solution.

KashFlow, an acclaimed cloud-based accounting software, is tailored for small businesses in the UK. With its user-friendly interface and efficient features for bookkeeping, invoicing, and payroll management, KashFlow streamlines the accounting process, saving valuable time and effort for business owners. Established over a decade ago, KashFlow has earned recognition for its reliability and user-friendly approach, solidifying its position as a go-to accounting software solution for small businesses in the UK.

- Invoicing: Both KashFlow and Xero offer a range of invoicing features, including automated invoicing, recurring invoices, and payment reminders.

- Bookkeeping: Both KashFlow and Xero offer bookkeeping tools that allow users to manage bank transactions, reconcile accounts, and track expenses.

- Payroll Management: KashFlow offers payroll management tools, while Xero offers payroll management as an add-on feature.

- Bank Integration: Both KashFlow and Xero can be integrated with most major UK banks.

- Mobile App: KashFlow has a mobile app, while Xero offers a mobile app for iOS and Android devices.

- Cloud-Based Accounting: Both KashFlow and Xero are cloud-based accounting software.

- Customizable Dashboard: Both KashFlow and Xero allow users to customize their dashboards to show the information that’s most important to them.

- VAT Returns: Both KashFlow and Xero make it easy to submit VAT returns to HMRC directly from the software.

KashFlow VSQuickBooks

- Features: QuickBooks offers a wider range of features than KashFlow, including inventory management, payroll processing, and time tracking. KashFlow, on the other hand, offers a more streamlined set of features focused on core accounting functions like invoicing, expense tracking, and bank reconciliation.

- Ease of use: Both KashFlow and QuickBooks are user-friendly and easy to navigate. However, some users may find KashFlow simpler to use due to its more limited feature set.

- Pricing: KashFlow offers more affordable pricing plans than QuickBooks, making it a good choice for small businesses on a budget. QuickBooks has more expensive pricing plans but may be a better fit for larger businesses that require more advanced features.

- Integrations: QuickBooks offers a wider range of integrations with other business tools, including popular e-commerce platforms, while KashFlow’s integration options are more limited.

- Customer support: Both KashFlow and QuickBooks offer customer support, but QuickBooks has a larger customer support team and offers more extensive support options, including live chat and phone support.

Overall, the choice between KashFlow and QuickBooks will depend on the specific needs of your business. KashFlow is a good choice for small businesses that need basic accounting functionality at an affordable price, while QuickBooks is better suited for larger businesses that require more advanced features and extensive integrations.

Furthermore, KashFlow’s integration with most major UK banks ensures that users can easily manage their financial transactions, and the software’s mobile app allows users to access their account information on the go. Additionally, KashFlow’s cloud-based accounting software ensures that users can securely access their financial information from anywhere, at any time.

Overall, KashFlow accounting software provides a comprehensive solution for small businesses looking to streamline their accounting processes. Its features such as KashFlow invoicing features, KashFlow integration with banks, KashFlow mobile app features, KashFlow cloud-based accounting, and KashFlow payroll management make it an ideal choice for businesses that want to save time and money while maintaining accurate financial records. Additionally, the software’s affordable pricing plans and positive user reviews make it a top choice for small business owners in the UK.

In the contemporary digital landscape, technology has revolutionized the way individuals handle their finances and investments. Wealthfront, a notable entity in the fintech industry, offers a comprehensive software platform amalgamating the benefits of robo-advisory services, intelligent automation, and personalized wealth management strategies. Wealthfront has solidified its position as a leading wealth management solution.

Zoho Invoice, developed by Zoho Corporation, an Indian software company, is an online invoicing software crafted to assist businesses in creating, sending, and managing invoices, while also tracking time and expenses and automating payment reminders. Tailored for small businesses, freelancers, and entrepreneurs, Zoho Invoice aims to simplify the invoicing process and streamline financial operations. This article will delve into how small businesses can leverage Zoho Invoices and explore the benefits it offers.