Wave Financial is a comprehensive software platform tailored to aid small businesses in efficiently managing their accounting and bookkeeping tasks. Offering an array of features and tools, it streamlines financial management, invoicing, payroll, and payments. With Wave Financial, business owners can direct their focus towards growing their ventures, confident in the knowledge that the software effectively handles the complexities of financial management.

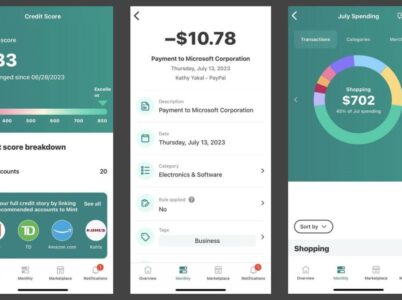

- Mint Login: Mint offers a seamless login process, allowing users to securely connect all their financial accounts, including bank accounts, credit cards, loans, and investments. This integration enables Mint to automatically categorize transactions and provide accurate insights.

- Mint Budgeting: Creating a budget is crucial for effective financial planning, and Mint simplifies this process. Users can set up personalized budgets based on their income, expenses, and financial goals. Mint categorizes transactions and provides real-time updates on spending against budgeted amounts, helping users stay on track.

- Mint App: Mint is available as a mobile app for both iOS and Android platforms. This convenient app ensures that users can access their financial information anytime, anywhere, and easily manage their budgets, expenses, and bills on the go.

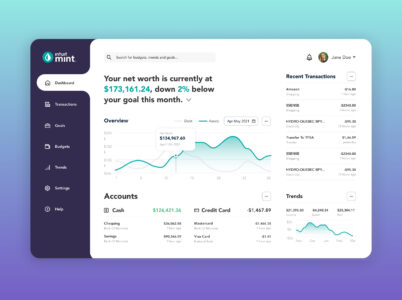

- Mint Personal Finance: Mint provides a comprehensive overview of an individual's personal finance situation. It generates reports and charts that analyze spending patterns, income, and savings, allowing users to identify areas for improvement and make informed financial decisions.

- Mint Bills: Managing bills can be time-consuming and prone to errors. Mint simplifies this process by sending reminders for upcoming bill payments and enabling users to make payments directly through the platform. This feature helps avoid late fees and ensures timely bill management.

- Mint Financial Planning: Effective financial planning requires setting goals and tracking progress. Mint allows users to set financial goals, such as saving for a down payment on a house or paying off debt. It provides visual representations of progress, motivating users to stay focused on their objectives.

- Mint Savings: Saving money is a key aspect of personal finance management. Mint helps users track their savings by setting up savings goals and monitoring progress. It offers personalized recommendations to optimize savings and maximize interest earnings.

- Mint Expenses: Mint automatically categorizes and tracks expenses across various accounts, making it easier for users to understand where their money is going. Users can set spending limits for different categories and receive alerts when they approach or exceed those limits.

- Mint Money Management: Mint's core strength lies in its ability to centralize and simplify money management. By providing a holistic view of an individual's finances, it enables better decision-making, reduces financial stress, and promotes overall financial well-being.

- Personal Capital: Personal Capital offers similar features to Mint, including expense tracking, budgeting, and investment management. However, it primarily focuses on investment tracking and financial planning for high-net-worth individuals.

- YNAB (You Need a Budget): YNAB emphasizes proactive budgeting and encourages users to allocate their income into different categories. It provides a unique approach to budgeting and offers tools to tackle debt and build savings.

- Quicken: Quicken is a comprehensive personal finance software that offers advanced features for budgeting, investment tracking, and tax planning. It is a more robust option for individuals who require in-depth financial management tools.

- PocketGuard: PocketGuard focuses on real-time expense tracking and helps users stay within their budgets. It provides insights into spending patterns and offers suggestions for optimizing finances.

- Goodbudget: Goodbudget follows the envelope budgeting method, where users allocate their income into different virtual envelopes representing various expense categories. It provides a visual representation of budget allocation and spending.

- Individuals with Multiple Financial Accounts: Mint’s ability to aggregate information from various accounts makes it ideal for individuals who have multiple bank accounts, credit cards, loans, and investments. It provides a centralized platform for managing and tracking all financial activities in one place.

- Budget-Conscious Individuals: Mint’s budgeting feature is a valuable tool for individuals who want to take control of their spending habits and work towards specific financial goals. It offers insights into spending patterns and helps users make informed decisions to optimize their budgets.

- Those Seeking Financial Insights: Mint’s comprehensive financial insights provide individuals with a deeper understanding of their financial situation. Whether it’s analyzing spending patterns, tracking income, or monitoring savings, Mint offers valuable information to help users make smarter financial choices.

- Bill Management Seekers: Mint’s bill management feature simplifies the process of tracking and paying bills. It ensures that users never miss a payment and helps them stay organized with their financial obligations.

One of the significant advantages of Mint is that it is free to use. Users can sign up for a Mint account and start utilizing its features without any subscription fees.

- Mint Premium

Mint Premium costs $4.99 per month. For more information you can contact the team directly.

- User-Friendly Interface: Mint offers a clean and intuitive user interface that is easy to navigate, even for individuals who are new to financial management. Its visual representations and simple categorization make it accessible and user-friendly for individuals of all financial backgrounds.

- Automatic Transaction Categorization: Mint’s ability to automatically categorize transactions from various accounts saves users significant time and effort. This feature eliminates the need for manual entry and ensures accurate tracking of expenses, making it easier to understand spending habits and identify areas for improvement.

- Comprehensive Financial Insights: Mint provides users with valuable insights into their financial health. Through visual charts, reports, and personalized recommendations, users can gain a clear understanding of their income, expenses, savings, and investments. This holistic view enables better financial planning and decision-making.

- Budgeting Made Easy: Mint’s budgeting feature simplifies the process of creating and managing budgets. Users can set up customized budgets based on their financial goals and track their spending against these budgets in real-time. Mint’s alerts and notifications help users stay on track and make adjustments as needed.

Mint is an intuitive and user-friendly personal finance management platform enabling users to effortlessly track expenses, create budgets, manage bills, and monitor their overall financial well-being. Serving as a centralized hub, Mint offers individuals a comprehensive overview of their financial situation by aggregating all accounts and transactions in one place. With its valuable insights and recommendations, Mint aids users in making informed decisions and attaining their financial objectives.

- Budgeting: Mint and YNAB excel in budgeting tools, allowing users to set up customized budgets and track their spending. Personal Capital focuses more on investment tracking and financial planning.

- Investment Tracking: Personal Capital offers advanced investment tracking features, including portfolio analysis and retirement planning, which Mint and YNAB lack.

- Cost: Mint and YNAB are free to use, while Personal Capital offers a free version with limited features and a premium version with additional services for a fee.

- Focus: Mint provides a comprehensive view of overall personal finance, including expense tracking, bill management, and credit score monitoring. YNAB focuses primarily on proactive budgeting and financial planning. Personal Capital emphasizes investment tracking and wealth management.

While Mint is free to use, it generates revenue through advertisements and additional financial services. Alternatives such as Personal Capital and YNAB offer different focuses and features, catering to specific financial needs.

Considering Mint’s positive user reviews and its ability to centralize financial information and provide valuable insights, it is an excellent choice for individuals seeking efficient money management solutions. Whether you want to track expenses, create budgets, or monitor your overall financial health, Mint offers a comprehensive platform to achieve your financial goals.

In the contemporary digital landscape, technology has revolutionized the way individuals handle their finances and investments. Wealthfront, a notable entity in the fintech industry, offers a comprehensive software platform amalgamating the benefits of robo-advisory services, intelligent automation, and personalized wealth management strategies. Wealthfront has solidified its position as a leading wealth management solution.

Zoho Invoice, developed by Zoho Corporation, an Indian software company, is an online invoicing software crafted to assist businesses in creating, sending, and managing invoices, while also tracking time and expenses and automating payment reminders. Tailored for small businesses, freelancers, and entrepreneurs, Zoho Invoice aims to simplify the invoicing process and streamline financial operations. This article will delve into how small businesses can leverage Zoho Invoices and explore the benefits it offers.