Wave Financial is a comprehensive software platform tailored to aid small businesses in efficiently managing their accounting and bookkeeping tasks. Offering an array of features and tools, it streamlines financial management, invoicing, payroll, and payments. With Wave Financial, business owners can direct their focus towards growing their ventures, confident in the knowledge that the software effectively handles the complexities of financial management.

The software allows users to create professional invoices, track payments, and send automated payment reminders to customers. It also facilitates expense tracking by capturing and categorizing expenses, making it easier to monitor business expenditures.

OneUp Accounting generates financial reports such as profit and loss statements, balance sheets, and cash flow statements. These reports provide insights into the company’s financial performance and aid in decision-making.

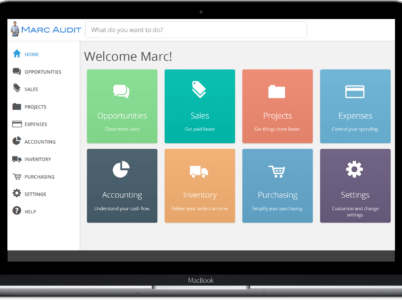

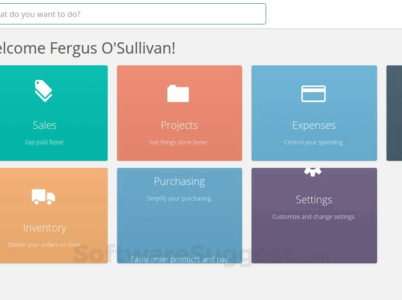

Overall, OneUp Accounting aims to simplify and streamline accounting processes for small and medium-sized businesses by offering a user-friendly interface and a range of features to manage finances efficiently. It’s worth noting that there may have been updates or changes to the software since my knowledge cutoff in September 2021, so it’s recommended to visit their official website or contact the company directly for the most up-to-date information.

- Multi-Currency Support: OneUp allows businesses to manage transactions in multiple currencies, facilitating global operations and expanding market reach.

- Invoicing and Billing: The software provides a comprehensive invoicing system, allowing businesses to create professional invoices, send payment reminders, and track outstanding payments.

- Inventory Management: OneUp includes inventory management features that enable businesses to track stock levels, manage purchase orders, and generate comprehensive reports on inventory performance.

- Bank Reconciliation: OneUp integrates with banks and financial institutions, automating the reconciliation process and ensuring accurate financial records.

- Financial Reporting: The software offers robust reporting capabilities, providing businesses with real-time insights into their financial performance. Customizable reports enable users to analyze data according to their specific requirements.

- Expense Tracking: OneUp allows businesses to record and track expenses, facilitating better control over spending and budget management.

- Integration Capabilities: OneUp integrates with various third-party applications, such as payment gateways, e-commerce platforms, and CRM systems, ensuring seamless data flow and eliminating manual data entry.

- Mobile Access: The software provides mobile applications for iOS and Android devices, enabling users to access their financial data on the go.

- QuickBooks: QuickBooks is a widely recognized accounting software that offers a range of features for businesses of all sizes. It provides robust bookkeeping, invoicing, and reporting capabilities, along with extensive integrations and third-party app support.

- Xero: Xero is another popular cloud-based accounting software known for its user-friendly interface and powerful features. It offers comprehensive invoicing, expense tracking, bank reconciliation, and financial reporting functionalities.

- OneUp vs Wave: Wave is a free accounting software designed for small businesses and freelancers. It provides basic accounting features, including invoicing, expense tracking, and financial reporting, without any subscription fees.

- OneUp vs Zoho Books: Zoho Books is a feature-rich accounting software that caters to small and medium-sized businesses. It offers advanced invoicing, expense tracking, inventory management, and robust integrations with other Zoho applications.

- OneUp vs FreshBooks: FreshBooks is a user-friendly accounting software primarily aimed at self-employed professionals and small businesses. It offers intuitive invoicing, time tracking, expense management, and reporting capabilities.

- Small and Medium-sized Enterprises (SMEs): OneUp provides SMEs with an affordable accounting solution that helps streamline their financial operations.

- Freelancers and Solopreneurs: OneUp offers a user-friendly platform for individuals managing their finances, enabling them to handle invoicing, expense tracking, and financial reporting efficiently.

- Growing Businesses: OneUp’s scalability makes it ideal for businesses experiencing growth, allowing them to expand their financial management capabilities as their operations evolve.

- Global Businesses: With its multi-currency support and integration capabilities, OneUp is a suitable choice for global businesses that engage in international transactions and require accurate currency conversion and reporting.

- Starter plan

Starter plan: $12 / month

- Intermediate plan

Intermediate plan: $48 / month

- Growth plan

Growth plan: $84 / month

- Business plan

Business plan: $240 / month

- Enterprise plan

Enterprise plan: $1600 / month

- Comprehensive Suite of Solutions: Paychex provides an all-in-one platform that covers various aspects of payroll and HR management. With integrated features and seamless data transfer between modules, businesses can streamline their processes and eliminate the need for multiple systems or manual data entry.

- Scalability: Whether you have a small startup or a large enterprise, Paychex offers solutions that can scale with your business. As your organization grows, Paychex can accommodate additional employees, locations, and complexities without disrupting your operations.

- Compliance and Security: Paychex stays up to date with ever-changing payroll and HR regulations, ensuring that your business remains compliant. Additionally, Paychex employs robust security measures to protect sensitive employee data, including encryption, data backups, and strict access controls.

- Amazing Integration Capabilities: Paychex integrates with popular accounting and timekeeping software, stream lining data flow and reducing manual entry. This integration eliminates the need for duplicate data entry, minimizes errors, and enhances overall efficiency.

- Dedicated Paychex Customer Service: Paychex is known for its excellent customer service. They provide dedicated support to their clients, offering assistance with implementation, training, and ongoing support. Whether you have questions, need troubleshooting, or require guidance, Paychex’s knowledgeable customer service team is there to help.

OneUp ERP Accounting is a cloud-based software tailored for small and medium-sized businesses, offering a range of features for efficient financial management. From invoicing and expense tracking to inventory management and bank reconciliation, OneUp simplifies various accounting operations. The platform enables professional invoicing, automated payment reminders, and streamlined expense tracking, while also providing insightful financial reports like profit and loss statements and balance sheets. With its user-friendly interface, OneUp Accounting aims to streamline accounting processes and enhance financial management for businesses.

- OneUp vs QuickBooks: OneUp offers more comprehensive inventory management features compared to QuickBooks. QuickBooks, on the other hand, has a larger user base and a vast network of third-party integrations. Both software solutions provide strong invoicing, expense tracking, and financial reporting capabilities.

- OneUp vs Xero: OneUp and Xero are similar in terms of user-friendliness and comprehensive feature sets. However, Xero has a larger selection of integrations and offers a more extensive marketplace for add-ons. OneUp, on the other hand, focuses more on multi-currency support and inventory management.

It is important to carefully evaluate the specific needs of your business and compare them with the features and pricing of each software to determine the best fit.

During our comparison, we found that OneUp Accounting offers a strong set of features, including multi-currency support, invoicing and billing, inventory management, bank reconciliation, and robust financial reporting. Its user-friendly interface and automation capabilities make it a valuable tool for businesses of all sizes.

However, it’s crucial to evaluate the alternatives as well. QuickBooks stands out with its extensive user base and wide range of third-party integrations. Xero offers a similar user-friendly experience and comprehensive features, with a larger marketplace for add-ons. Wave provides a free accounting solution, suitable for small businesses and freelancers with basic accounting needs. Zoho Books caters to small and medium-sized businesses with advanced features and integration with other Zoho applications. FreshBooks targets self-employed professionals and small businesses with its intuitive interface and core accounting functionalities.

To make the best decision, consider the specific requirements of your business, budget constraints, and the scalability needed for future growth. It’s recommended to take advantage of free trials and demos offered by these software solutions to assess their suitability firsthand.

In conclusion, OneUp Accounting offers a robust accounting solution with powerful features, a user-friendly interface, and scalability. It is suitable for various types of businesses, from SMEs to freelancers, providing the necessary tools to streamline financial operations. By carefully evaluating alternatives and considering specific business needs, you can choose the accounting software that best aligns with your requirements and helps drive financial success.

In the contemporary digital landscape, technology has revolutionized the way individuals handle their finances and investments. Wealthfront, a notable entity in the fintech industry, offers a comprehensive software platform amalgamating the benefits of robo-advisory services, intelligent automation, and personalized wealth management strategies. Wealthfront has solidified its position as a leading wealth management solution.

Zoho Invoice, developed by Zoho Corporation, an Indian software company, is an online invoicing software crafted to assist businesses in creating, sending, and managing invoices, while also tracking time and expenses and automating payment reminders. Tailored for small businesses, freelancers, and entrepreneurs, Zoho Invoice aims to simplify the invoicing process and streamline financial operations. This article will delve into how small businesses can leverage Zoho Invoices and explore the benefits it offers.