Wave Financial is a comprehensive software platform tailored to aid small businesses in efficiently managing their accounting and bookkeeping tasks. Offering an array of features and tools, it streamlines financial management, invoicing, payroll, and payments. With Wave Financial, business owners can direct their focus towards growing their ventures, confident in the knowledge that the software effectively handles the complexities of financial management.

- Accessible from anywhere, anytime, with internet connectivity

- Invoicing, bill payment, and expense tracking

- Bank integration and automatic transaction categorization

- Payroll management with direct deposit option

- Tax filing and preparation assistance

- Third-party integration with a variety of business tools

- Real-time financial reporting and analysis Mobile app compatibility

- Xero: Xero is a popular cloud-based accounting software that offers similar features to Quickbooks Online. It offers invoicing, bank reconciliation, inventory tracking, and more. It also has a mobile app for on-the-go accounting.

- FreshBooks: FreshBooks is another cloud-based accounting software that offers features like invoicing, time tracking, and expense tracking. It is known for its user-friendly interface and is a good option for freelancers and small businesses.

- Zoho Books: Zoho Books is a cloud-based accounting software that offers features like invoicing, expense tracking, inventory management, and more. It also integrates with other Zoho apps, making it a good option for businesses that already use other Zoho products.

- Wave: Wave is a free cloud-based accounting software that offers features like invoicing, accounting, and receipt scanning. It also has a paid payroll service for small businesses.

- Sage 50cloud: Sage 50cloud is a comprehensive accounting software that offers features like invoicing, inventory management, project tracking, and more. It is a good option for businesses that need more advanced features than what is offered in Quickbooks Online.

- Simple Start Plan

The one-user, $24 monthly cost of the QuickBooks Simple Start package. If you miss the free trial, you can take advantage of a unique offer where the first three months will only cost you $6 each month.

- Essentials Plan

Compared to the Simple Start plan, the Essentials plan is $48 per month, supports three users, and offers a variety of accounts payable capabilities to small organizations. The initial three months will only cost you $12 per month if you take advantage of the offer and forego the free plan.

- Plus Plan

In comparison to the QuickBooks Essentials plan, the QuickBooks Plus plan is more expensive ($72/month), supports five users, and has more sophisticated features. This cost is reduced to $18 per month when the three-month deal is used.

- Advanced Plan

For the most money, the QuickBooks Advanced plan delivers the most features. It costs $140 per month. For the first three months, this is reduced by 75% to $35 per month.

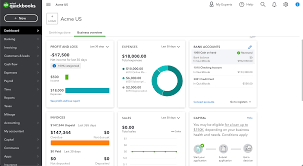

In today's fast-paced digital world, effective financial accounting management is paramount. Online financial accounting tools have empowered businesses, freelancers, and non-profit organizations to maintain organized and up-to-date finances. QuickBooks Online stands out in this arena, renowned for its advanced features, user-friendliness, and cost-effectiveness. This blog delves into the top features, pricing, benefits, and alternatives of QuickBooks Online, providing a comprehensive comparison with competitors such as Xero and Freshbooks.

QuickBooks Online, Xero, and Freshbooks are all popular cloud-based accounting software solutions for small businesses. Here’s a brief comparison of each:

QuickBooks Online:

- Offers a wide range of features, including invoicing, expense tracking, payroll, and inventory management.

- Provides excellent integration with banks, credit cards, and other financial institutions.

- Can handle multiple users and supports different access levels for them.

- Offers a variety of pricing plans, depending on the features required and the number of users.

Xero:

- Offers feature similar to QuickBooks Online, including invoicing, expense tracking, payroll, and inventory management.

- QuickBooks Online integration provides good integration with banks, credit cards, and other financial institutions.

- Offers a user-friendly interface and easy navigation.

- Has a mobile app for managing finances on the go.

- Offers a variety of pricing plans, depending on the features required and the number of users.

QUICKBOOKS ONLINE VS FRESHBOOKS

Freshbooks:

- Primarily focuses on invoicing and expense tracking, making it a good option for freelancers and small businesses with simple accounting needs.

- Offers time tracking and project management features.

- Provides good integration with payment gateways, such as PayPal and Stripe.

- Has a user-friendly interface and easy navigation.

- Offers a variety of pricing plans, depending on the features required and the number of users.

Overall, the choice between QuickBooks Online, Xero, and Freshbooks will depend on your specific accounting needs and preferences. QuickBooks Online and Xero offer more robust features and are suitable for businesses with more complex accounting needs, while Freshbooks is a simpler option suitable for freelancers and small businesses with simpler accounting needs.

In the contemporary digital landscape, technology has revolutionized the way individuals handle their finances and investments. Wealthfront, a notable entity in the fintech industry, offers a comprehensive software platform amalgamating the benefits of robo-advisory services, intelligent automation, and personalized wealth management strategies. Wealthfront has solidified its position as a leading wealth management solution.

Zoho Invoice, developed by Zoho Corporation, an Indian software company, is an online invoicing software crafted to assist businesses in creating, sending, and managing invoices, while also tracking time and expenses and automating payment reminders. Tailored for small businesses, freelancers, and entrepreneurs, Zoho Invoice aims to simplify the invoicing process and streamline financial operations. This article will delve into how small businesses can leverage Zoho Invoices and explore the benefits it offers.