Wave Financial is a comprehensive software platform tailored to aid small businesses in efficiently managing their accounting and bookkeeping tasks. Offering an array of features and tools, it streamlines financial management, invoicing, payroll, and payments. With Wave Financial, business owners can direct their focus towards growing their ventures, confident in the knowledge that the software effectively handles the complexities of financial management.

- Advanced financial management with Sage Intacct: Sage Intacct offers advanced financial management features that help businesses streamline their financial operations. These features include accounts payable and receivable management, general ledger, cash management, and project accounting. The software also includes an automated billing feature that simplifies the billing process and ensures accurate billing.

- Sage Intacct cloud financial management: Sage Intacct is a cloud-based financial management solution, which means it can be accessed from anywhere, at any time. The software is hosted on secure servers, and all data is backed up regularly, ensuring that your financial information is safe and secure.

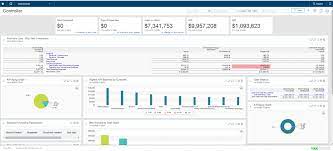

- Sage Intacct financial reporting software: Sage Intacct's financial reporting and analytics features provide businesses with the ability to track and analyze their financial data. The software offers customizable dashboards and reports that provide real-time insights into a business's financial performance. Sage Intacct also offers integration with third-party reporting tools such as Microsoft Excel, making it easy to create custom reports.

- Sage Intacct accounts payable automation: Sage Intacct's accounts payable automation features streamline the accounts payable process, reducing the time and effort required to manage invoices and payments. The software offers automatic invoice recognition, routing, and approval workflows, making it easy to manage payables and reduce errors.

- Sage Intacct accounts receivable management: Sage Intacct's accounts receivable management features help businesses manage their customer invoicing and collections. The software includes automated billing, payment reminders, and collections management features, making it easy to track and manage receivables. It's also a part of Sage Intacct cloud ERP solution.

- QuickBooks Online: QuickBooks Online is a popular accounting solution for small businesses. The software offers basic financial management features, including accounts payable and receivable, general ledger, and cash management.

- Xero: Xero is a cloud-based accounting solution that offers features similar to Sage Intacct, including accounts payable and receivable, general ledger, and financial reporting.

- NetSuite: NetSuite is a cloud-based ERP solution that offers a wide range of features, including financial management, inventory management, and CRM.

- Microsoft Dynamics 365: Microsoft Dynamics 365 is a cloud-based ERP solution that offers financial management, inventory management, and CRM features.

Here are some examples of the types of businesses that might benefit from using Sage Intacct for business accounting:

- Professional services firms, such as law firms, accounting firms, and consulting firms, that need to manage client billing, project accounting, and time tracking.

- Nonprofit organizations that need to manage grants, donations, and fund accounting.

- Software and technology companies that need to manage subscription billing, revenue recognition, and project accounting.

- Healthcare organizations that need to manage patient billing, financial reporting, and compliance with regulatory requirements.

- Financial services companies, such as banks and credit unions, need to manage complex accounting and reporting requirements.

Sage Intacct also offers add-on modules such as inventory management and multi-entity management, which can be added to any pricing tier for an additional cost. The software offers a free trial, and businesses can request a quote for pricing information tailored to their specific needs.

- Comprehensive Financial Management Suite

Sage Intacct is a comprehensive financial management suite that includes everything a business needs to manage its finances efficiently. The software’s advanced financial management features, combined with its cloud-based architecture and customizable reporting and analytics, make it a top choice for businesses looking for a complete financial management solution.

- Scalable and Flexible

Sage Intacct is scalable and flexible, making it suitable for businesses of all sizes. The software can be customized to meet the specific needs of a business and can easily grow as the business expands.

- Easy to Use

Sage Intacct is easy to use, with an intuitive user interface and straightforward navigation. The software also offers a wide range of online training and support resources, making it easy for businesses to get started and maximize their use of the software.

Sage Intacct, a cloud-based financial management solution, presents a diverse array of features tailored for businesses of all sizes. Covering aspects such as accounts payable and receivable management, as well as comprehensive financial reporting and analytics, Sage Intacct offers a holistic platform for efficient financial management. This article offers an in-depth exploration of Sage Intacct's top features, pricing structure, target market, alternative solutions, and user reviews, aiding in the decision-making process for businesses seeking an optimal financial management software solution.

In the contemporary digital landscape, technology has revolutionized the way individuals handle their finances and investments. Wealthfront, a notable entity in the fintech industry, offers a comprehensive software platform amalgamating the benefits of robo-advisory services, intelligent automation, and personalized wealth management strategies. Wealthfront has solidified its position as a leading wealth management solution.

Zoho Invoice, developed by Zoho Corporation, an Indian software company, is an online invoicing software crafted to assist businesses in creating, sending, and managing invoices, while also tracking time and expenses and automating payment reminders. Tailored for small businesses, freelancers, and entrepreneurs, Zoho Invoice aims to simplify the invoicing process and streamline financial operations. This article will delve into how small businesses can leverage Zoho Invoices and explore the benefits it offers.