Wave Financial is a comprehensive software platform tailored to aid small businesses in efficiently managing their accounting and bookkeeping tasks. Offering an array of features and tools, it streamlines financial management, invoicing, payroll, and payments. With Wave Financial, business owners can direct their focus towards growing their ventures, confident in the knowledge that the software effectively handles the complexities of financial management.

- Phone Support: TD Ameritrade provides a dedicated phone support line for customers to reach out and speak with a representative directly. This allows for real-time communication and personalised assistance. The phone support team is trained to address a wide range of queries and concerns, including account-related issues, technical difficulties, and general inquiries.

- Email Support: Customers can also contact TD Ameritrade's customer service team via email. By sending an email detailing their concerns, users can expect a response from a representative within a reasonable timeframe. Email support is particularly useful for non-urgent matters or when customers prefer written communication.

- Live Chat: TD Ameritrade offers a live chat feature on its website and mobile app, allowing users to engage in real-time conversations with support agents. Live chat provides a convenient option for quick questions or immediate assistance without the need for a phone call or waiting for an email response.

Here are some key points to consider when setting up and managing a TD Ameritrade account:

Types of Accounts: TD Ameritrade offers various types of accounts to cater to different investment needs. Some common account types include individual brokerage accounts, retirement accounts (such as Traditional IRAs, Roth IRAs, SEP IRAs, and SIMPLE IRAs), custodial accounts (for minors), and trust accounts. Each account type has its own specific rules and requirements, so it’s important to choose the one that aligns with your investment goals and circumstances.

Account Registration: To open a TD Ameritrade account, individuals are required to provide personal information, such as their name, address, date of birth, and social security number. This information is necessary for compliance with regulatory requirements, including anti-money laundering laws. Additionally, TD Ameritrade may require documentation to verify the identity and address of the account holder.

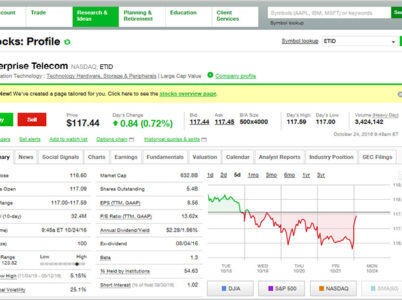

Understanding the fee structure is crucial for investors to effectively manage their investment costs. Here are some key aspects of TD Ameritrade’s fee system:

Commission Fees: In the past, TD Ameritrade was charging commission fees for online stock, ETF, and options trades. However, in October 2019, the company made a significant move by eliminating commissions for these trades, making trading more accessible and cost-effective for investors. This decision removed a significant barrier to entry and levelled the playing field for investors of all sizes.

Options Contract Fees: While the elimination of trading commissions was a significant development, it’s important to note that TD Ameritrade still charges a fee for options contracts. These fees vary and are typically applied per contract. It’s essential for options traders to review TD Ameritrade’s fee schedule to understand the specific costs associated with options trading.

Account Maintenance Fees: TD Ameritrade does not charge an annual account maintenance fee for its standard brokerage accounts. However, it’s important to note that certain types of accounts, such as retirement accounts (e.g., IRAs), may have specific fees or requirements. For example, some IRA accounts may have custodial fees or fees associated with specific services or investment options. It’s advisable for investors to review the fee schedule and terms and conditions specific to the type of account they hold.

Mutual Fund Fees: Like most brokerage firms, TD Ameritrade offers a selection of mutual funds for investors. These mutual funds may have their own expense ratios, which are the fees charged by the fund company for managing the fund. It’s important for investors to consider these expenses when evaluating the overall cost of investing in mutual funds through TD Ameritrade.

Amid the online trading and investing landscape, TD Ameritrade shines as a prominent brokerage firm, offering a robust suite of software and tools empowering investors and traders to make informed decisions and execute trades effectively. This article delves into various facets of TD Ameritrade's software, covering login procedures, account management, trading platforms, and customer service, providing a comprehensive understanding of the power behind TD Ameritrade's software ecosystem.

Recognising the importance of prompt and efficient support, the company offers various channels through which customers can seek assistance and resolve any issues they may encounter while using the software platform.

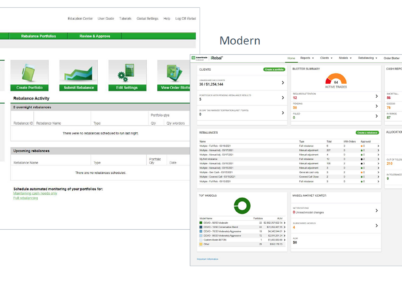

In the contemporary digital landscape, technology has revolutionized the way individuals handle their finances and investments. Wealthfront, a notable entity in the fintech industry, offers a comprehensive software platform amalgamating the benefits of robo-advisory services, intelligent automation, and personalized wealth management strategies. Wealthfront has solidified its position as a leading wealth management solution.

Zoho Invoice, developed by Zoho Corporation, an Indian software company, is an online invoicing software crafted to assist businesses in creating, sending, and managing invoices, while also tracking time and expenses and automating payment reminders. Tailored for small businesses, freelancers, and entrepreneurs, Zoho Invoice aims to simplify the invoicing process and streamline financial operations. This article will delve into how small businesses can leverage Zoho Invoices and explore the benefits it offers.