Wave Financial is a comprehensive software platform tailored to aid small businesses in efficiently managing their accounting and bookkeeping tasks. Offering an array of features and tools, it streamlines financial management, invoicing, payroll, and payments. With Wave Financial, business owners can direct their focus towards growing their ventures, confident in the knowledge that the software effectively handles the complexities of financial management.

- TurboTax Login: TurboTax provides a secure login system that allows users to access their tax information anytime, anywhere. With a registered account, users can conveniently save and access their tax returns across multiple devices.

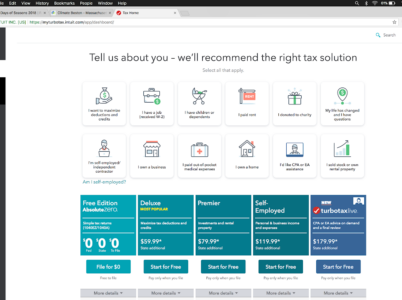

- TurboTax Free: TurboTax offers a free edition that is ideal for individuals with straightforward tax situations. This option enables users to file their federal and state taxes at no cost, making it an attractive choice for those on a budget.

- TurboTax Online: Being a cloud-based platform, TurboTax Online enables users to prepare and file their taxes entirely online. This eliminates the need for installing software on your computer and allows for seamless collaboration and access from various devices.

- TurboTax Self-Employed: Designed for freelancers, independent contractors, and small business owners, TurboTax Self-Employed offers specialized tools to simplify complex tax situations. It helps users maximize deductions and accurately calculate self-employment taxes.

- TurboTax Deluxe: TurboTax Deluxe is ideal for individuals who need to itemize deductions or have more complex tax situations. This version provides additional features such as guidance on mortgage interest, property tax deductions, and charitable donations.

- TurboTax Business: TurboTax also offers a solution for small businesses to streamline their tax filings. TurboTax Business allows businesses to prepare and file their federal business taxes, including Schedule C and other forms necessary for business tax compliance.

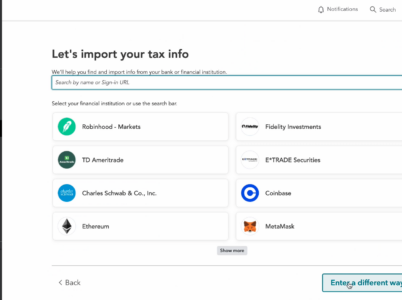

- TurboTax Tax Filing: TurboTax walks users through the entire tax filing process, asking simple questions and providing step-by-step guidance. The software automatically calculates taxes, checks for errors, and ensures accurate completion of forms. It also supports e-filing, making the submission process quick and efficient.

- TurboTax Refund Status: TurboTax provides a convenient feature to track the status of your tax refund. Users can easily check the progress of their refund and receive notifications when it is issued by the IRS.

- TurboTax Customer Service: TurboTax offers comprehensive customer support options to address any queries or concerns. Users can access live chat, phone support, community forums, and an extensive knowledge base for assistance.

- Individuals: TurboTax offers solutions for individuals with various tax situations, from those filing basic tax returns to those with more complex deductions and investments.

- Self-Employed Professionals: Freelancers, independent contractors, and small business owners can benefit from TurboTax Self-Employed. This version provides specialized tools to maximize deductions and accurately calculate self-employment taxes.

- Small Business Owners: TurboTax Business is designed specifically for small businesses, helping them streamline their tax filings and comply with federal business tax requirements.

- Investors: TurboTax Premier is tailored for individuals with investments, including stocks, bonds, and rental properties. It provides guidance on reporting investment income and deductions.

- TurboTax Free Edition

TurboTax Free Edition: This option is ideal for individuals with simple tax returns, offering free federal and state tax filing.

- TurboTax Premium

TurboTax Premium<br />

For investors, freelancers, and the self-employed to seamlessly and accurately report income, $129* Federal State additional

- TurboTax live

TurboTax live $99 - final price of $219 State additional

- User-Friendly Interface: TurboTax provides an intuitive and easy-to-navigate interface, making it accessible for individuals with varying levels of tax knowledge. The software guides users through each step, ensuring a smooth and hassle-free tax filing experience.

- Accuracy and Compliance: TurboTax is designed to maximize accuracy in tax calculations and compliance with the latest tax laws and regulations. The software undergoes regular updates to incorporate any changes in tax codes, ensuring that users are always filing their taxes correctly.

- Time and Cost Savings: TurboTax streamlines the tax filing process, saving users valuable time and effort. With its automated calculations, error checks, and data import capabilities, users can complete their taxes more efficiently. Additionally, TurboTax offers affordable pricing plans, including a free option, reducing the financial burden associated with professional tax preparation services.

- Comprehensive Support: TurboTax provides extensive customer support options to assist users throughout the tax filing process. From live chat and phone support to community forums and a robust knowledge base, users can find answers to their queries and receive guidance when needed.

- Data Security: TurboTax prioritizes the security of user data. The platform employs advanced encryption and security measures to safeguard personal and financial information. Users can trust that their data is protected throughout the tax preparation and filing process.

Tax season can be a challenging period, given the intricacies of evolving tax laws and regulations. Fortunately, innovative software solutions have simplified the process significantly. TurboTax, a prominent tax preparation software, has become a preferred choice for millions of individuals and businesses globally. This article explores the key features, pricing, target audience, alternative options, and user reviews of TurboTax, providing you with comprehensive insights to make informed decisions when it comes to filing your taxes.

- H&R Block:

– TurboTax and H&R Block are both well-known tax software providers.

– Both offer online and desktop versions of their software.

– H&R Block provides access to tax professionals in case you need assistance.

– TurboTax is generally known for its user-friendly interface, while H&R Block offers a more comprehensive approach to tax preparation.

- TaxAct:

– TaxAct is often considered a more affordable option compared to TurboTax.

– Both offer online and desktop versions with step-by-step guidance.

– TaxAct provides a straightforward interface but may not have as many advanced features as TurboTax.

- TaxSlayer:

– TaxSlayer offers a competitive pricing structure, particularly for simple tax situations.

– Both TurboTax and TaxSlayer provide online tax preparation services.

– TurboTax is known for its extensive support and guidance, while TaxSlayer may be a more budget-friendly option.

- Credit Karma Tax:

– Credit Karma Tax offers free tax preparation and filing services.

– TurboTax has more advanced features and supports a wider range of tax situations.

– Credit Karma Tax may be suitable for individuals with straightforward tax needs, while TurboTax offers more robust features and support.

- FreeTaxUSA:

– Both FreeTaxUSA and TurboTax offer free federal tax preparation options.

– TurboTax provides a more intuitive and user-friendly interface.

– FreeTaxUSA may be a suitable alternative for individuals with simpler tax situations who prefer a no-frills approach.

In conclusion, TurboTax simplifies the tax filing process and empowers users to take control of their financial obligations. Whether you’re an individual, self-employed professional, or small business owner, TurboTax provides a comprehensive solution that saves time, ensures accuracy, and minimizes the stress associated with tax season. With its user-friendly interface, robust features, and reliable customer support, TurboTax remains a top choice for individuals and businesses seeking a seamless and efficient tax filing experience.

In the contemporary digital landscape, technology has revolutionized the way individuals handle their finances and investments. Wealthfront, a notable entity in the fintech industry, offers a comprehensive software platform amalgamating the benefits of robo-advisory services, intelligent automation, and personalized wealth management strategies. Wealthfront has solidified its position as a leading wealth management solution.

Zoho Invoice, developed by Zoho Corporation, an Indian software company, is an online invoicing software crafted to assist businesses in creating, sending, and managing invoices, while also tracking time and expenses and automating payment reminders. Tailored for small businesses, freelancers, and entrepreneurs, Zoho Invoice aims to simplify the invoicing process and streamline financial operations. This article will delve into how small businesses can leverage Zoho Invoices and explore the benefits it offers.