Wave Financial is a comprehensive software platform tailored to aid small businesses in efficiently managing their accounting and bookkeeping tasks. Offering an array of features and tools, it streamlines financial management, invoicing, payroll, and payments. With Wave Financial, business owners can direct their focus towards growing their ventures, confident in the knowledge that the software effectively handles the complexities of financial management.

- Wave Financial Software for Freelancers: Wave accounting software provides freelancers with an easy-to-use platform to manage their finances. It allows freelancers to track their time, create invoices, and manage payments in one place. This feature helps freelancers save time and streamline their financial processes.

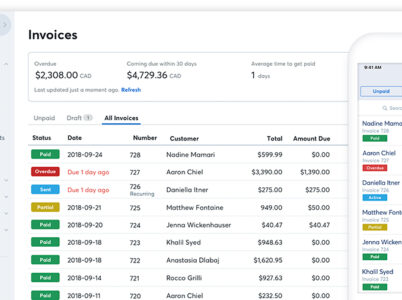

- Wave Invoicing and Billing Software: Wave invoicing and billing software allows users to create and send professional-looking invoices in minutes. Users can customize their invoices with their brand logo, colors, and payment terms. It also allows users to receive payments online, making it easier for clients to pay.

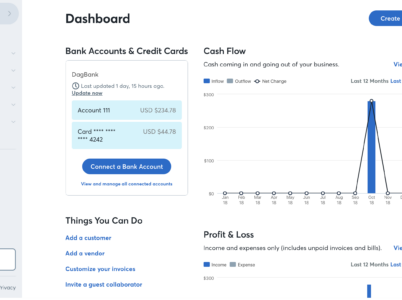

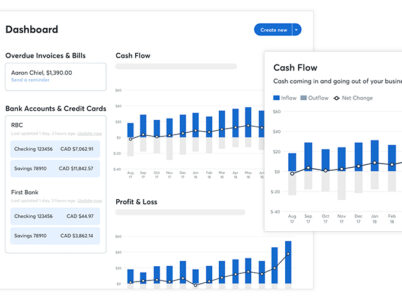

- Wave Bookkeeping Software for Entrepreneurs Wave bookkeeping software provides entrepreneurs with a simple way to track their income and expenses. The software allows users to import transactions from their bank accounts and categorize them accordingly. Users can also generate financial statements, including profit and loss statements and balance sheets.

- Wave Expense Tracking Software for Self-Employed: Wave expense tracking software enables self-employed individuals to keep track of their business expenses. Users can capture receipts on the go using their mobile phones, and the software will automatically extract the relevant data. It also allows users to categorize their expenses and generate expense reports.

- Wave Payroll Software for Small Businesses: Wave payroll software provides small businesses with an easy way to manage their payroll. It allows users to calculate employee salaries, file taxes, and generate pay stubs. The software also provides employees with an online portal to access their pay stubs and tax forms.

- Wave Online Accounting Software for Startups Wave online accounting software provides startups with a comprehensive platform to manage their finances. The software allows users to track income and expenses, generate financial statements, and manage payroll. It also provides users with real-time insights into their business performance.

The software is ideal for individuals and businesses that want to keep track of their income and expenses, create and send professional-looking invoices, and manage their cash flow. It is also useful for those who need to reconcile their bank accounts, track sales taxes, and generate financial reports.

Wave Accounting is suitable for a wide range of industries, including consulting, marketing, retail, and hospitality. It is also ideal for businesses that operate online, such as e-commerce stores and digital agencies.

- Free Plan

Wave's basic accounting software is completely free to use. It includes features like invoicing, expense tracking, and basic accounting reports. There are no setup fees, monthly fees, or hidden charges for using the free version of the software.

- Wave Plus

For users who need additional features, Wave offers a paid plan called Wave Plus. The Wave Plus plan costs $20 per month (or $200 per year if paid annually). This plan includes all the features of the free version, as well as additional tools like automatic bank connections, advanced accounting reports, and priority customer support.

- User-friendly Interface

Wave accounting software has a user-friendly interface that makes it easy for users to navigate and manage their finances. It provides users with step-by-step guides to help them set up their accounts and start using the software.

- Cost-effective

Wave accounting software is free to use, which makes it an ideal choice for small businesses and self-employed individuals who are looking for a cost-effective solution. However, there are certain premium features, such as payroll, that come with a fee.

- Comprehensive Features

Wave accounting software provides users with a comprehensive range of features that cover all aspects of financial management. Whether it’s invoicing, bookkeeping, expense tracking, or payroll, Wave has got it covered.

- Cloud-based

Wave accounting software is cloud-based, which means that users can access their accounts from anywhere with an Internet connection. This feature is particularly useful for small businesses and self-employed individuals who are always on the move.

Wave is a user-friendly, cloud-based accounting software tailored for small businesses, entrepreneurs, freelancers, and self-employed individuals. Offering a comprehensive suite of features, including invoicing, bookkeeping, expense tracking, payroll management, and online accounting, Wave streamlines financial management for its users. This article provides an in-depth exploration of Wave accounting software, covering its features, pricing structure, alternative solutions, and user reviews, offering a comprehensive understanding of this efficient accounting solution.

- Wave vs. QuickBooks

QuickBooks is a popular accounting software that provides users with a comprehensive range of features. While both Wave and QuickBooks offer invoicing, bookkeeping, and payroll features, QuickBooks has more advanced features such as inventory management and project tracking. However, QuickBooks is also more expensive than Wave.

Here are some key points to consider when comparing the two:

- Cost: Wave is free to use, while QuickBooks has a range of pricing plans that start at $15 per month and go up to $150 per month for more advanced features.

- Ease of use: Wave is known for its user-friendly interface and ease of use, while QuickBooks has a steeper learning curve but offers more advanced features.

- Features: While both software programs offer basic accounting features such as invoicing, expense tracking, and financial reporting, QuickBooks has a more extensive feature set, including advanced inventory management, project management, and time tracking.

- Integrations: QuickBooks has a wider range of integrations with other software programs, while Wave has limited integration options.

- Customer support: QuickBooks offers a more extensive support network, including phone and chat support, while Wave offers email support only.

- Wave vs. Xero

Here are some key points to consider when comparing the two:

- Cost: Wave is free to use, while Xero offers a range of pricing plans that start at $11 per month and go up to $62 per month for more advanced features.

- Ease of use: Both programs have user-friendly interfaces and are easy to use, although Xero offers more advanced features that may require more experience or training.

- Features: Xero offers a more extensive feature set than Wave, including advanced inventory management, project tracking, and multi-currency support. Xero also has a wider range of integrations with other software programs than Wave.

- Customer support: Xero offers a variety of customer support options, including phone and chat support, while Wave offers email support only.

- Mobile app: Both programs have mobile apps that allow users to access their accounts on the go, but Xero’s app offers more features and functionality than Wave’s.

In summary, if you are a small business owner or freelancer who needs basic accounting features and wants to save money, Wave may be the best choice. However, if you require more advanced features, such as inventory management or project tracking, and are willing to pay for a more comprehensive accounting solution, Xero may be a better fit for your needs.

In the contemporary digital landscape, technology has revolutionized the way individuals handle their finances and investments. Wealthfront, a notable entity in the fintech industry, offers a comprehensive software platform amalgamating the benefits of robo-advisory services, intelligent automation, and personalized wealth management strategies. Wealthfront has solidified its position as a leading wealth management solution.

Zoho Invoice, developed by Zoho Corporation, an Indian software company, is an online invoicing software crafted to assist businesses in creating, sending, and managing invoices, while also tracking time and expenses and automating payment reminders. Tailored for small businesses, freelancers, and entrepreneurs, Zoho Invoice aims to simplify the invoicing process and streamline financial operations. This article will delve into how small businesses can leverage Zoho Invoices and explore the benefits it offers.