Wave Financial is a comprehensive software platform tailored to aid small businesses in efficiently managing their accounting and bookkeeping tasks. Offering an array of features and tools, it streamlines financial management, invoicing, payroll, and payments. With Wave Financial, business owners can direct their focus towards growing their ventures, confident in the knowledge that the software effectively handles the complexities of financial management.

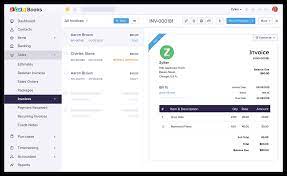

- Zoho Books invoice templates: Zoho Books allows you to create and send professional-looking invoices to your clients. You can also automate recurring invoices and set up payment reminders to ensure that you get paid on time.

- Expense Tracking: Zoho Books makes it easy to track your business expenses. You can upload receipts and categorize your expenses to get a clear picture of your business expenses.

- Zoho Books inventory : Zoho Books allows you to manage your inventory and keep track of stock levels in real-time. You can also set up alerts to notify you when stock levels are running low.

- Time Tracking: Zoho Books makes it easy to track the time spent on each project. You can also generate timesheets and invoices based on the time tracked.

- Bank Reconciliation: Zoho Books can automatically reconcile your bank transactions, saving you time and reducing the risk of errors.

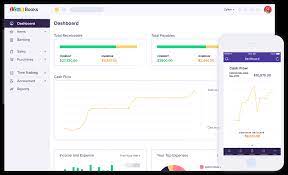

- Financial Reports: Zoho Books provides a range of financial reports, including profit and loss statements, balance sheets, and cash flow statements, to help you track your business's financial health.

- Integrations: Zoho Books integrates with a wide range of other software, including PayPal, Stripe, and Shopify, to help you manage your business finances more efficiently.

- COMPARISON: ZOHO BOOKS VS QUICKBOOKS

Zoho Books and QuickBooks are both popular accounting software options for small and medium-sized businesses. While both software offer similar features, there are some differences to consider when deciding which software to use.

- Pricing: Zoho Books is generally more affordable than QuickBooks, with plans starting at $9 per month compared to QuickBooks’ starting price of $25 per month.

- User Interface: Zoho Books has a more intuitive and user-friendly interface, making it easier for non-accountants to use the software. QuickBooks, on the other hand, can be more complex and may take some time to learn.

- Customization: Zoho Books offers more customization options than QuickBooks, allowing you to tailor the software to your specific business needs.

- Customer Support: Zoho Books offers excellent customer support, with a dedicated team available to answer any questions you may have. QuickBooks also offers customer support, but some users have reported long wait times when contacting support.

Ultimately, the choice between Zoho Books and QuickBooks will depend on your business needs and budget. If you are looking for a more affordable option with an intuitive user interface, Zoho Books may be the better choice. If you require more advanced features and are willing to pay a higher price, QuickBooks may be the better choice.

- COMPARISON: ZOHO BOOKS VS FRESHBOOKS

When comparing Zoho Books and FreshBooks, there are a few key differences to consider:

- Pricing: FreshBooks offers four pricing plans, starting at $15/month for the Lite plan and going up to $50/month for the Premium plan. Zoho Books, on the other hand, offers three pricing plans, starting at $9/month for the Basic plan and going up to $29/month for the Professional plan.

- Features: While both Zoho Books and FreshBooks offer similar features, there are some differences to note. For example, FreshBooks offers time tracking and project management tools, while Zoho Books offers inventory management and purchase order tracking features.

- User Interface: Both Zoho Books and FreshBooks have user-friendly interfaces, but FreshBooks is known for its visually appealing design and ease of use.

- Integrations: FreshBooks offers a wide range of integrations with third-party apps and services, including PayPal, Stripe, and Shopify. Zoho Books also offers integrations with popular apps, but the selection is not as extensive as FreshBooks.

- Customer Support: Both Zoho Books and FreshBooks offer excellent customer support, with dedicated teams available to answer any questions you may have.

The choice between Zoho Books and FreshBooks will depend on your specific business needs and budget. If you require time tracking and project management features, FreshBooks may be the better choice. If you need inventory management and purchase order tracking features, Zoho Books may be the better choice. Both software options offer affordable pricing plans and excellent customer support, making them both viable options for small businesses.

- COMPARISON: ZOHO BOOKS VS XERO

Here are some key differences between Zoho Books and Xero:

- Pricing: Zoho Books is generally more affordable than Xero. Zoho Books starts at $9 per month, while Xero’s plans start at $11 per month.

- Features: Xero offers more advanced features than Zoho Books, including inventory management, project management, and payroll. However, Zoho Books is more customizable and allows users to create custom fields, workflows, and reports.

- Integrations: Both Zoho Books and Xero offer a wide range of integrations with third-party apps and services. However, Xero has more integrations available than Zoho Books, particularly with payment processors and e-commerce platforms.

- User interface: Zoho Books has a simpler and more intuitive user interface than Xero, which can be overwhelming for new users.

- Customer support: Zoho Books offers 24/7 customer support via phone, email, and live chat. Xero offers similar support options, but some users have reported longer wait times for phone support.

- Free

- FREE : $ 0 For businesses with revenue

- Standard

- STANDARD : $15 per organization per month

- Professional

- PROFESSIONAL : $ 40 per organization per month

- Premium

- PREMIUM : $ 60 per organization per month

- Elite

- ELITE : $ 120 per organization per month

- Ultimate

- ULTIMATE : $ 240 per organization per month<br />

There are several reasons why you might want to consider Zoho Books as your accounting software:

- Affordability: Zoho Books offers affordable pricing plans, making it an excellent option for small businesses and startups on a budget. You can choose a plan that meets your business needs without breaking the bank.

- Comprehensive features: Zoho Books offers comprehensive features for invoicing, expense tracking, bank reconciliation, inventory management, and purchase order tracking. You can streamline your accounting processes and manage your finances more efficiently with all the tools you need in one place.

- User-friendly interface: Zoho Books login, Zoho Books tutorial make Zoho more easy to use and understand.Zoho Books has a user-friendly interface that makes it easy to navigate and use, even for non-accountants. You can manage your finances without needing extensive accounting knowledge or training.

- Zoho Books integrations: If you’re already using other Zoho apps, such as Zoho CRM or Zoho Projects, you can integrate Zoho Books with those apps to streamline your workflows and automate your processes.

- Excellent customer support: Zoho Books offers excellent customer support through various channels, including email, phone, and live chat. You can get the help you need when you need it, ensuring that you can keep your accounting processes running smoothly.

Zoho Books, created by Zoho Corporation, an Indian software company, is an online accounting software tailored to facilitate effective financial management for small and medium-sized businesses. With a diverse range of features, Zoho Books is a favored option for businesses seeking to streamline their accounting processes.

Here are some ratings and reviews of Zoho Books from various websites:

- G2: 4.2/5 (based on 437 reviews)

- Trustpilot: 4.4/5 (based on 252 reviews)

- Capterra: 4.5/5 (based on 1,142 reviews)

In the contemporary digital landscape, technology has revolutionized the way individuals handle their finances and investments. Wealthfront, a notable entity in the fintech industry, offers a comprehensive software platform amalgamating the benefits of robo-advisory services, intelligent automation, and personalized wealth management strategies. Wealthfront has solidified its position as a leading wealth management solution.

Zoho Invoice, developed by Zoho Corporation, an Indian software company, is an online invoicing software crafted to assist businesses in creating, sending, and managing invoices, while also tracking time and expenses and automating payment reminders. Tailored for small businesses, freelancers, and entrepreneurs, Zoho Invoice aims to simplify the invoicing process and streamline financial operations. This article will delve into how small businesses can leverage Zoho Invoices and explore the benefits it offers.