Wave Financial is a comprehensive software platform tailored to aid small businesses in efficiently managing their accounting and bookkeeping tasks. Offering an array of features and tools, it streamlines financial management, invoicing, payroll, and payments. With Wave Financial, business owners can direct their focus towards growing their ventures, confident in the knowledge that the software effectively handles the complexities of financial management.

One of the key benefits of Xero is that it is cloud-based software, meaning that users can access their financial information from anywhere with an internet connection. It also offers integrations with many other business applications, such as payment processors, CRM software, and project management tools.

Xero’s user interface is intuitive and easy to use, even for those without a background in accounting. It offers a range of pricing plans to suit different business needs, and its customer support is highly regarded. Overall, Xero is a popular choice for businesses looking to streamline their accounting processes and gain better insight into their financial performances.

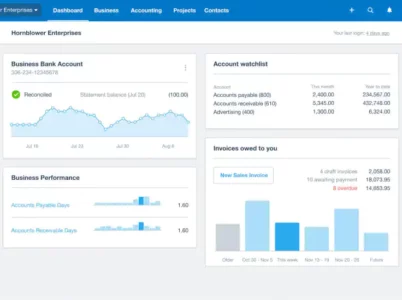

- Xero bookkeeping services for startups: Xero's bookkeeping services include features such as bank reconciliation, accounts payable and receivable management, invoicing, expense tracking, and financial reporting. With bank reconciliation, Xero automatically imports and categorizes bank transactions, making it easier to reconcile accounts.

- Customizable Invoices: Xero allows businesses to create professional-looking invoices that can be customized with their logo, color scheme, and payment terms.

- Automated Reminders: Xero can automatically send reminders to customers for unpaid invoices, reducing the need for manual follow-up.

- Payment Options: Xero allows customers to pay invoices online via credit card, PayPal, or other payment options, making it easier for businesses to get paid quickly.

- Recurring Invoices: Xero allows businesses to set up recurring invoices for regular payments, such as subscriptions or monthly services.

- Bank Reconciliation: Xero automatically imports and categorizes bank transactions, making it easier to reconcile accounts.

- Invoicing: Xero allows businesses to create and send professional-looking invoices, track payments, and set up recurring invoices.

- Expense Management: Xero allows businesses to track and manage their expenses, including bills, receipts, and payments.

- Xero payroll software for small businesses: Streamline your payroll process with Xero's payroll software, which automatically calculates taxes and deductions, and generates payslips for your employees.

- QuickBooks: QuickBooks is a popular accounting software that offers similar features to Xero accounting software. QuickBooks has been around for a long time and is well-known for its user-friendly interface and robust feature set.

- Wave: Wave is a free accounting software that offers features like invoicing, payroll, and bookkeeping. While it doesn’t have as many features as Xero accounting software, it’s an excellent choice for freelancers and small businesses with basic accounting needs.

- FreshBooks: FreshBooks is an all-in-one accounting software that offers features like invoicing, time tracking, and project management. FreshBooks is an excellent choice for small businesses and freelancers who need simple and intuitive accounting software.

Xero is also suitable for businesses that require a range of accounting features, such as invoicing, bank reconciliation, expense tracking, inventory management, and financial reporting. The software is designed to be user-friendly, making it easy for business owners and their staff to manage their accounting tasks without extensive accounting knowledge.

Additionally, Xero offers various integrations with other business software, such as payment gateways, customer relationship management (CRM) systems, and project management tools, making it an all-in-one solution for small to medium-sized businesses.

- Early

Early : The Early plan costs $13/month and is ideal for sole traders, new businesses, and the self-employed with basic accounting needs.

- Growing

Growing : The Growing plan costs $37/month and is ideal for small businesses with more complex accounting needs.

- Established

Established : The Established plan costs $70/month and is ideal for larger businesses with advanced accounting needs.

- User-Friendly: Xero accounting software is easy to use, even for those with little to no accounting experience. Its intuitive interface makes it easy to navigate, and its customer support team is always available to help.

- Cloud-Based: Xero accounting software is cloud-based, meaning you can access it from anywhere at any time. You don’t need to worry about installing software or maintaining servers.

- Affordable: Xero accounting software offers affordable pricing plans, making it accessible for small businesses, startups, and freelancers. There are no hidden fees, and you can cancel anytime.

- Comprehensive: Xero accounting software offers a wide range of features that cover everything from invoicing to payroll, making it an all-in-one solution for managing finances.

- Customizable: Xero accounting software allows you to customize reports, invoices, and other documents to fit your brand’s style and voice.

Xero is a cloud-based accounting software tailored for small and medium-sized businesses, facilitating efficient financial management, expense and invoice tracking, and financial statement preparation. With an array of features encompassing bank feeds, inventory management, payroll, and reporting, Xero provides users with a comprehensive financial management solution.

| Feature | Xero | QuickBooks | Wave |

| Invoicing | Yes | Yes | Yes |

| Payroll Yes | Yes | No | Yes |

| Bookkeeping | Yes | Yes | Yes |

| Financial Reporting | Yes | Yes | Yes |

| Mobile App | Yes | Yes | Yes |

| Integrations | Yes | Yes | Yes |

| Pricing Starts at | $20/month | $25/month | Free |

In the contemporary digital landscape, technology has revolutionized the way individuals handle their finances and investments. Wealthfront, a notable entity in the fintech industry, offers a comprehensive software platform amalgamating the benefits of robo-advisory services, intelligent automation, and personalized wealth management strategies. Wealthfront has solidified its position as a leading wealth management solution.

Zoho Invoice, developed by Zoho Corporation, an Indian software company, is an online invoicing software crafted to assist businesses in creating, sending, and managing invoices, while also tracking time and expenses and automating payment reminders. Tailored for small businesses, freelancers, and entrepreneurs, Zoho Invoice aims to simplify the invoicing process and streamline financial operations. This article will delve into how small businesses can leverage Zoho Invoices and explore the benefits it offers.