Wave Financial is a comprehensive software platform tailored to aid small businesses in efficiently managing their accounting and bookkeeping tasks. Offering an array of features and tools, it streamlines financial management, invoicing, payroll, and payments. With Wave Financial, business owners can direct their focus towards growing their ventures, confident in the knowledge that the software effectively handles the complexities of financial management.

- YNAB Login: YNAB offers a seamless login process, ensuring easy access to your financial data across multiple devices.

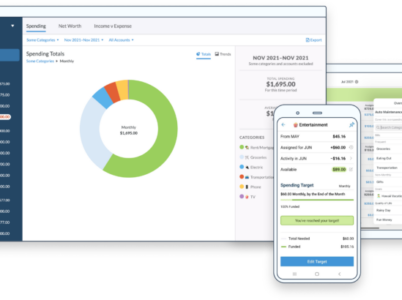

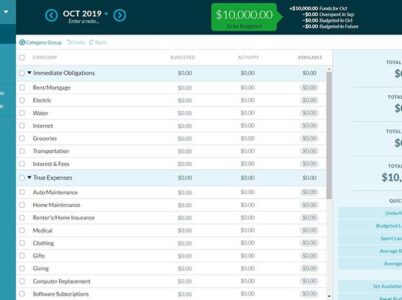

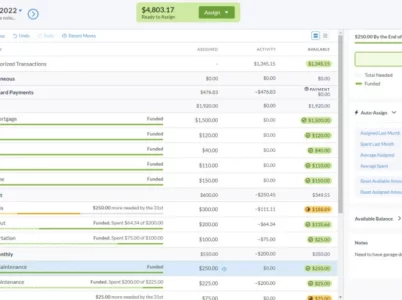

- YNAB Budgeting: YNAB's core feature is its robust budgeting system. It encourages users to assign every dollar a job, helping them prioritize spending, track expenses, and avoid overspending.

- YNAB App: The YNAB mobile app allows users to manage their finances on the go. It syncs seamlessly with the web version, ensuring real-time updates and access to your budget anytime, anywhere.

- YNAB Review: YNAB's review feature allows users to analyze spending habits and make informed decisions about their financial priorities.

- YNAB Free Trial: YNAB offers a free trial period, allowing users to experience the software's functionality and determine if it suits their needs.

- YNAB Student Discount: YNAB provides a student discount, making it more accessible to students who are keen on managing their finances effectively.

- YNAB Savings Goals: YNAB helps users set savings goals, providing a clear path towards achieving financial milestones.

- YNAB Debt Payoff: YNAB offers powerful tools to manage and pay off debts efficiently. It assists users in creating debt payoff plans and visualizing progress over time.

- YNAB Financial Planning: YNAB's robust financial planning features help users plan for the future, including long-term goals such as retirement and investments.

- YNAB Money Management: YNAB's comprehensive money management tools provide insights into spending patterns, transaction tracking, and overall financial health.

- Mint: Mint is a free budgeting app that helps you track your expenses, create budgets, and monitor your financial goals. It syncs with your bank accounts, credit cards, and other financial accounts to provide a comprehensive overview of your finances.

- Personal Capital: Personal Capital is a comprehensive financial management tool that combines budgeting, investment tracking, and retirement planning. It offers features such as expense tracking, net worth calculation, and investment portfolio analysis.

- EveryDollar: EveryDollar is a budgeting app created by Dave Ramsey’s team. It uses a zero-based budgeting approach, allowing you to allocate every dollar of your income to various expense categories. The app provides goal tracking and expense reporting features.

- PocketSmith: PocketSmith is a personal finance app that offers budgeting, forecasting, and planning features. It allows you to link your financial accounts and analyze your spending patterns over time. PocketSmith also offers cash flow forecasting, which can help you plan for the future.

- Goodbudget: Goodbudget is based on the envelope budgeting system, where you allocate money into different virtual envelopes for various spending categories. The app syncs between multiple devices and allows for expense tracking and reporting.

These are just a few examples of the many budgeting apps and tools available. Each has its own set of features and pricing structures, so it’s worth exploring them to find the one that best suits your specific needs and preferences.

- Budgeting Beginners: YNAB is suitable for individuals who are new to budgeting or have struggled with managing their money in the past. The app provides a user-friendly interface and offers educational resources to help users understand budgeting principles and establish healthy financial habits.

- Those Seeking to Break the Paycheck-to-Paycheck Cycle: YNAB’s methodology focuses on assigning every dollar a job, breaking the paycheck-to-paycheck cycle, and building up savings. It helps individuals allocate their income efficiently, prioritize expenses, and work towards long-term financial stability.

- Debt Repayment and Financial Goal-Oriented Individuals: YNAB offers tools and features that assist users in managing and paying off their debts effectively. It also enables individuals to set and track financial goals, such as saving for emergencies, paying off loans, or saving for a down payment on a home.

- Couples and Families: YNAB can be beneficial for couples and families who want to collaborate on their finances. It allows for multiple users and facilitates shared budgeting and expense tracking. It can help promote open communication and alignment regarding financial goals and priorities.

YNAB offers a subscription-based pricing model. The annual subscription cost of YNAB is $84, which breaks down to $7 per month. This fee grants users access to all the features and updates within the software. YNAB also offers a 34-day free trial, allowing potential users to explore the software's capabilities before making a commitment. The free trial period is an excellent opportunity to experience YNAB's benefits and determine if it aligns with your financial management needs.

In the realm of personal finance management, maintaining a proactive approach to budgeting is crucial. YNAB (You Need A Budget) serves as a powerful software solution, simplifying and revolutionizing the management of personal finances. With its comprehensive features, user-friendly interface, and emphasis on proactive budgeting, YNAB has garnered a dedicated user base. This article delves into the key features of YNAB, its unique value proposition compared to competitors, target user groups, pricing structures, alternative options, customer reviews, and ultimately, why YNAB is an indispensable tool for effective money management.

- Mint:

– Provides automatic transaction syncing and categorization.

– Offers budgeting tools, bill tracking, and alerts for overspending or unusual transactions.

– Provides a comprehensive overview of your financial accounts and net worth.

– Offers a free service supported by ads and personalized offers.

- Personal Capital:

– Emphasizes investment tracking and retirement planning.

– Provides a holistic view of your finances, including budgeting tools and expense tracking.

– Offers personalized investment advice and portfolio analysis.

– Has a fee analyzer to help you optimize your investments.

- EveryDollar:

– Created by Dave Ramsey’s team and follows a zero-based budgeting approach.

– Provides expense tracking and budgeting tools.

– Offers goal tracking and reporting features.

– Has a free version with limited features and a paid version with additional functionality.

- PocketSmith:

– Offers budgeting, forecasting, and planning features.

– Provides cash flow forecasting and scenario planning.

– Syncs with your financial accounts to track expenses and income.

– Offers multiple subscription tiers with varying features and pricing.

- Goodbudget:

– Based on the envelope budgeting system, where you allocate money to virtual envelopes for different spending categories.

– Syncs across multiple devices and allows for expense tracking.

– Offers budget reports and income vs. expenses analysis.

– Provides a free version with limited envelopes and a paid version for additional functionality.

- Quicken:

– Comprehensive personal finance software with budgeting, expense tracking, investment tracking, and bill payment features.

– Provides a wide range of financial management tools, including robust reporting and analysis capabilities.

– Offers both desktop and mobile versions.

– Has a one-time purchase fee or an annual subscription model.

When choosing the right budgeting tool, consider your specific needs, budgeting style, and preferences. It’s recommended to try out the free trials or free versions of these tools to see which one aligns best with your financial goals and workflow.

In the contemporary digital landscape, technology has revolutionized the way individuals handle their finances and investments. Wealthfront, a notable entity in the fintech industry, offers a comprehensive software platform amalgamating the benefits of robo-advisory services, intelligent automation, and personalized wealth management strategies. Wealthfront has solidified its position as a leading wealth management solution.

Zoho Invoice, developed by Zoho Corporation, an Indian software company, is an online invoicing software crafted to assist businesses in creating, sending, and managing invoices, while also tracking time and expenses and automating payment reminders. Tailored for small businesses, freelancers, and entrepreneurs, Zoho Invoice aims to simplify the invoicing process and streamline financial operations. This article will delve into how small businesses can leverage Zoho Invoices and explore the benefits it offers.