Zywave is a prominent software company that has earned a reputation for providing cutting-edge insurance technology solutions. In this article, we will explore the top features of Zywave, discuss why it is a preferred choice for insurance professionals, examine its target audience, pricing structure, and alternatives, compare it with other insurance software solutions, delve into user reviews, and conclude with an assessment of its overall impact on the industry.

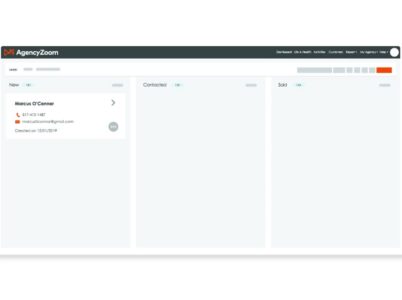

- Intuitive Dashboard: AgencyZoom boasts a user-friendly dashboard that offers a centralized view of essential data, providing quick access to important metrics and tasks.

- Policy Management: The software allows agents to efficiently manage policies throughout their lifecycle, from application to renewal, enabling seamless tracking and organization.

- Commission Tracking: AgencyZoom simplifies commission tracking, ensuring agents receive accurate compensation for their efforts promptly.

- Automated Workflows: With customizable automated workflows, repetitive tasks are automated, reducing manual intervention and increasing efficiency.

- Document Storage: The platform provides secure cloud-based storage for all essential documents, eliminating the need for physical paperwork.

- Performance Analytics: AgencyZoom offers in-depth analytics and reports to assess individual and team performance, enabling data-driven decision-making.

- Applied Epic: Applied Epic is a comprehensive insurance agency management system designed for large and complex insurance organizations. It offers a wide range of features, including policy management, accounting, customer relationship management (CRM), and reporting capabilities.

- HawkSoft: HawkSoft is a popular agency management system designed for independent insurance agencies. It provides tools for managing policies, claims, and accounting, as well as integration with various third-party services and carriers.

- EZLynx: EZLynx is an insurance agency management system that offers multi-line rating, agency website integration, and document management. It focuses on streamlining the quoting process and enhancing customer engagement.

- Vertafore AMS360: Vertafore AMS360 is a widely used agency management solution for insurance agencies. It provides robust features for policy administration, customer management, claims handling, and reporting.

- QQ Catalyst: QQ Catalyst is a cloud-based agency management system built for smaller insurance agencies. It offers streamlined workflows for policy management, billing, and client communication.

- NowCerts: NowCerts is an agency management system specializing in the management of insurance policies and clients. It features certificate tracking, document storage, and integrates with various industry platforms.

- AgencyBloc: AgencyBloc is an insurance agency management system with a strong focus on managing life and health insurance policies. It offers tools for commission tracking, lead management, and reporting.

- Newton: Newton is an agency management system designed for independent insurance agencies. It provides features such as policy management, CRM, and accounting to streamline agency operations.

- Nexsure: Nexsure is an agency management platform tailored for medium to large-sized insurance agencies. It includes policy administration, accounting, and a client portal for self-service.

- Insly: Insly is an agency management software designed specifically for insurance brokers and agents. It offers policy management, billing, and reporting functionalities.

– Insurance Agents: Individual agents can leverage AgencyZoom to manage their clients, policies, and commissions effectively.

– Insurance Brokers: Brokers benefit from the platform’s ability to streamline operations, manage teams, and monitor performance.

– Insurance Agencies: AgencyZoom serves as a one-stop solution for insurance agencies seeking to optimize their overall workflow and productivity.

For Independent

- Pro Plan : Pricing starts at $249 /month

- Growth Plan : Pricing starts at $159 /month

- Essential Plan: Pricing starts at $99 /month

For Allstate

- Multiple Location Agency Plan : Pricing starts at $109 /month

- Single Location Agency Plan : Pricing starts at $87 /month

For Farmers

- Pro Plan : Pricing starts at $249 /month

- Growth Plan : Pricing starts at $159 /month

- Essential Plan: Pricing starts at $99 /month

- AgencyZoom:

– Focuses on insurance agency management.

– Offers features like lead management, sales tracking, commission management, and policy management.

– Provides performance analytics and reporting tools.

– May have specific integrations with carriers and other insurance industry platforms.

- HawkSoft:

– Targets independent insurance agencies.

– Provides tools for policy management, claims handling, and accounting.

– Offers integration with third-party services and carriers.

– May have a strong customer support reputation.

- EZLynx:

– Offers multi-line rating and agency website integration.

– Focuses on streamlining the quoting process.

– Provides document management capabilities.

– May have tools for customer relationship management.

- Vertafore AMS360:

– Designed for insurance agencies of various sizes.

– Provides robust features for policy administration, customer management, and reporting.

– May have integrations with multiple carriers and industry platforms.

- QQ Catalyst:

– Cloud-based agency management system for smaller insurance agencies.

– Focuses on policy management, billing, and client communication.

– May have a user-friendly interface.

- NowCerts:

– Specializes in managing insurance policies and clients.

– Provides certificate tracking and document storage features.

– May offer integration with other insurance tools.

Ultimately, the best insurance agency management software choice for your agency depends on your specific needs, the size of your agency, the types of insurance you handle, and your budget. I recommend exploring each software’s official website, reading user reviews, and possibly scheduling demos or trials to see which one aligns best with your agency’s workflow and objectives.

AgencyZoom has emerged as a game-changer in the insurance industry. Providing top insurance agency technology solutions, AgencyZoom has gained popularity for its comprehensive features, ease of use, and excellent customer reviews. In this article, we will explore what AgencyZoom is, its top features, why it's worth considering, who can benefit from it, pricing details, alternative options, comparisons with other insurance software, reviews from users, and a final conclusion.

- “Simple, easy-to-use, clear, intuitive interface. My 10-person agency uses Agency Zoom every day. It has resulted in a MASSIVE increase in accountability and results tracking. For 10+ years, I’d implement a goal, ‘kinda’ track it, and be sad/ frustrated when we didn’t reach it. AGENCY ZOOM HAS SOLVED ALL THAT! Buy it! Support team will help you make it work for you. His team is super responsive and he knows Allstate and our business as well as anyone. Buy and install it!”- Mike B. Allstate Agent

- ” Agency Zoom… The on-boarding, trailing document, ALR, and payroll program to end all programs. If they charged 3 times the amount currently charged, I would still happily use this software. The product works flawlessly! It streamlines my agency when at point of sale. It tracks item count and premium sold in real time. It motivates my LSPs because it give a minute to minute update of sales in the office! It tracks ALR appointments kept and Life policies sold. It calculates payroll accurately by integrating its software with DASH reports. ” – Darwin C.

ISCS SurePower Innovation is a leading insurance software provider, ISCS has developed SurePower Innovation, a comprehensive platform that empowers insurance companies with advanced features and functionalities. In this article, we will delve into ISCS SurePower Innovation, exploring its pricing, features, demo, reviews, training options, and its position among the best insurance software solutions available.

Xuber, a leading insurance software solution, has emerged as a powerful tool that empowers insurance businesses to streamline their processes, enhance customer experiences, and gain a competitive edge. In this article, we will explore the world of Xuber, delving into its pricing, features, demo, customer reviews, and training options. With a focus on providing comprehensive and efficient insurance software solutions, Xuber has earned its reputation as the best insurance software in the market.