Wave Financial is a comprehensive software platform tailored to aid small businesses in efficiently managing their accounting and bookkeeping tasks. Offering an array of features and tools, it streamlines financial management, invoicing, payroll, and payments. With Wave Financial, business owners can direct their focus towards growing their ventures, confident in the knowledge that the software effectively handles the complexities of financial management.

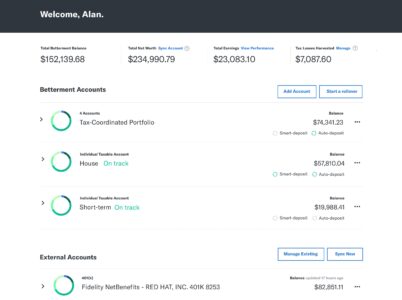

- Betterment Wealth Management: In addition to its robo-advisory services, Betterment offers wealth management features to help investors optimise their overall financial well-being. The platform provides tools and resources for goal-based investing, tax planning, college savings, and more. Betterment's goal-based investing feature allows investors to set specific financial goals, such as saving for a down payment on a house or funding a child's education.

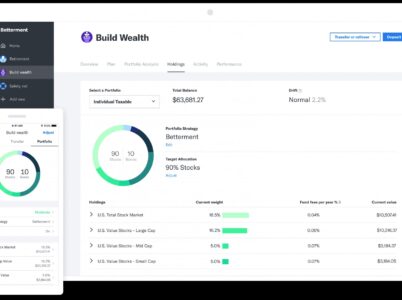

- Betterment Robo-Advisor: As a robo-advisor, Betterment leverages technology and automation to provide personalised investment advice and portfolio management. The platform's algorithm-driven approach eliminates the need for extensive manual intervention, making it an efficient and cost-effective solution for investors. Betterment's robo-advisor services utilise advanced algorithms to analyze investor profiles, risk tolerance, and financial goals.

- Betterment Customer Service: Betterment prioritises customer service and aims to provide exceptional support to its clients. The platform offers various channels for investors to seek assistance and resolve their queries. Users can contact Betterment's customer service team through phone, email, or live chat.

- Betterment Retirement: Betterment recognises the importance of retirement planning and offers specialised tools and features to help investors achieve their retirement goals. The platform provides retirement-specific accounts, including Traditional and Roth IRAs, and offers guidance on contribution limits, tax implications, and investment strategies.

- Betterment Portfolio: Betterment's portfolio management tools are designed to help investors build and manage diversified portfolios based on their unique financial circumstances and goals. The platform offers a range of portfolio strategies to cater to different risk profiles, including conservative, moderate, and aggressive portfolios.

- Betterment Digital

Betterment Digital: Betterment Digital is the standard offering and charges a competitive fee. As of the time of writing, the annual management fee for Betterment Digital is 0.25% of the assets under management. This fee is calculated as a percentage of the total value of the portfolio and is assessed on a prorated basis and deducted quarterly.

- Betterment Premium

Betterment Premium: Betterment Premium is a higher-tier service that provides additional features, including access to certified financial planners (CFPs) for personalised advice. As of the time of writing, the annual management fee for Betterment Premium is 0.40% of the assets under management. This fee is also calculated as a percentage of the total value of the portfolio and assessed on a prorated basis, deducted quarterly.

In the era of technological advancements, Betterment shines as a top robo-advisor, known for its user-friendly platform and innovative wealth management. Join us as we explore Betterment's login process, account management tools, transparent fee structure, diverse investments, portfolio management, retirement planning, and exceptional customer service, all powered by cutting-edge robo-advisory services.

In the contemporary digital landscape, technology has revolutionized the way individuals handle their finances and investments. Wealthfront, a notable entity in the fintech industry, offers a comprehensive software platform amalgamating the benefits of robo-advisory services, intelligent automation, and personalized wealth management strategies. Wealthfront has solidified its position as a leading wealth management solution.

Zoho Invoice, developed by Zoho Corporation, an Indian software company, is an online invoicing software crafted to assist businesses in creating, sending, and managing invoices, while also tracking time and expenses and automating payment reminders. Tailored for small businesses, freelancers, and entrepreneurs, Zoho Invoice aims to simplify the invoicing process and streamline financial operations. This article will delve into how small businesses can leverage Zoho Invoices and explore the benefits it offers.