Wave Financial is a comprehensive software platform tailored to aid small businesses in efficiently managing their accounting and bookkeeping tasks. Offering an array of features and tools, it streamlines financial management, invoicing, payroll, and payments. With Wave Financial, business owners can direct their focus towards growing their ventures, confident in the knowledge that the software effectively handles the complexities of financial management.

- E TRADE Investment: With EbTRADE, investors have access to a vast selection of investment options to diversify their portfolios. Whether investing in individual stocks, bonds, mutual funds, or ETFs, E TRADE offers a range of choices to suit various investment strategies. Additionally, E TRADE provides educational resources, including articles, videos, and webinars, to empower investors with knowledge and insights into the financial markets.

- E TRADE Retirement: Planning for retirement is a crucial aspect of long-term financial stability. E TRADE offers retirement accounts, including traditional and Roth IRAs, as well as SEP and SIMPLE IRAs for self-employed individuals. These accounts allow investors to benefit from tax advantages while saving for retirement.

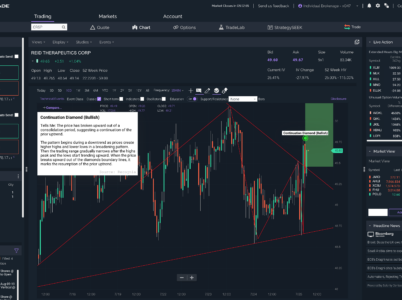

- E TRADE Trading Platform: E TRADE provides a powerful trading platform that caters to both novice and experienced investors. The platform offers an intuitive interface with a range of features designed to facilitate efficient trading. Users can access real-time market data, place trades, set up alerts, and utilise advanced charting tools for technical analysis.

When trading mutual funds, E TRADE charges transaction fees or load fees. These fees vary depending on the specific mutual fund and its class. It is advisable for investors to review the prospectus of the mutual funds they intend to trade to understand the associated fees.

Broker-Assisted Trade Fees:

E TRADE offers broker-assisted trades for users who require additional guidance or prefer assistance from a professional. These trades incur additional fees, and the specific charges can be found in E TRADE’s fee schedule.

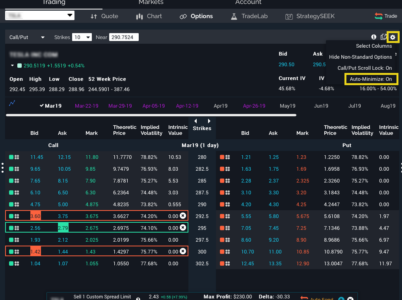

Options Contract Fees:

Trading options on ETRADE incurs fees per contract. The fee structure varies based on the number of contracts traded and whether the trade is executed online or with broker assistance. Users should review the fee schedule to understand the costs involved in options trading.

Margin Interest Rates:

E TRADE offers margin trading, allowing users to borrow funds to amplify their trading power. However, margin trading incurs interest charges on the borrowed funds. The interest rates vary based on the amount borrowed and prevailing market conditions. Users should be aware of these rates and consider them when engaging in margin trading.

One of the primary channels for customer support is the E TRADE phone service. Users can reach out to the customer service team via phone and speak directly to a representative. This allows for real-time communication, ensuring that users can receive immediate assistance with their queries or problems. The phone support is known for its prompt response and knowledgeable representatives who are well-equipped to address a wide range of issues.

In addition to phone support, E TRADE also provides email support for users who prefer written communication. Users can send an email outlining their concerns or questions, and the customer service team responds promptly with the necessary information or guidance. The email support is particularly useful for users who may need to provide detailed explanations or attachments related to their inquiries.

In the world of online trading and investing, E TRADE has risen as a prominent player, drawing millions of investors worldwide with its user-friendly interface, comprehensive features, and robust trading platform. This article offers an extensive review of E TRADE, delving into key aspects such as the login process, account management, brokerage services, fees, mobile app functionality, commissions, trading platforms, investment options, retirement accounts, and the quality of customer service.

E TRADE provides a seamless and secure login process, ensuring that users can access their accounts with ease. The account management features allow investors to efficiently manage their investments, view portfolio performance, and execute trades. The brokerage services offered by E TRADE encompass a diverse range of investment options, empowering investors to build well-rounded portfolios tailored to their investment goals.

In the contemporary digital landscape, technology has revolutionized the way individuals handle their finances and investments. Wealthfront, a notable entity in the fintech industry, offers a comprehensive software platform amalgamating the benefits of robo-advisory services, intelligent automation, and personalized wealth management strategies. Wealthfront has solidified its position as a leading wealth management solution.

Zoho Invoice, developed by Zoho Corporation, an Indian software company, is an online invoicing software crafted to assist businesses in creating, sending, and managing invoices, while also tracking time and expenses and automating payment reminders. Tailored for small businesses, freelancers, and entrepreneurs, Zoho Invoice aims to simplify the invoicing process and streamline financial operations. This article will delve into how small businesses can leverage Zoho Invoices and explore the benefits it offers.