WorldPay is a prominent payment solutions provider that enables businesses to accept and process payments securely and efficiently. With its robust payment gateway, merchant services, and comprehensive range of payment options, WorldPay serves as a one-stop solution for businesses worldwide. Whether it's credit card processing, online payments, or mobile transactions, WorldPay caters to diverse payment needs.

- Global purchasing: Adyallowsfor companies worldwide to take payments and permit processes locally and internationally, which may increase authorization rates and decrease transaction costs. You connect to a single platform and don't have to handle many suppliers because Adyen owns the payment flow.

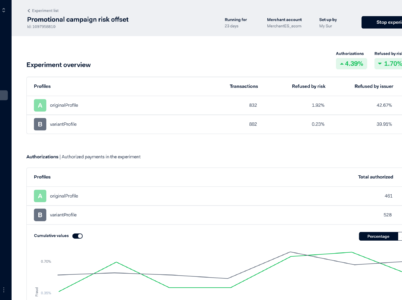

- Management of risk: A risk-management solution that may be customized, RevenueProtect can assist in stopping fraud. Each transaction can be subjected to a specific fraud setting created by risk templates and rules. The program conducts risk trials, looks for unusual client behavior, and uses 3D authentication.

- Integrated Commerce: With Adyen's Unified Commerce, retailers can combine online and offline payment methods into a single platform, allowing customers to shop as they choose.

- Integrations: Adyen provides several connectors for Oracle, Salesforce, Shopware 6, SAP Commerce Cloud, Adobe Commerce (formerly Magento), and others. There are plugins like WooCommerce, BigCommerce, and Microsoft Dynamics 365.

E-commerce Businesses: Adyen’s payment platform is well-suited for online retailers and e-commerce businesses of all sizes. It supports various online payment methods, provides fraud prevention tools, and offers features like recurring payments and subscription management.

Retail and Point-of-Sale Businesses: Adyen’s payment solutions are also suitable for brick-and-mortar and businesses with physical locations. They offer integrated point-of-sale (POS) solutions that enable businesses to accept in-store payments seamlessly.

Mobile and App-based Businesses: Adyen’s payment platform includes features and APIs that cater to businesses with mobile apps and mobile-based payment requirements. It supports mobile payment methods and offers SDKs for easy integration into mobile applications.

Marketplaces and Platform Businesses: Adyen provides payment solutions specifically designed for businesses operating as marketplaces or platforms. These solutions enable businesses to facilitate payments between buyers and sellers, handle commissions and payouts, and manage complex payment flows.

Global and Cross-border Businesses: Adyen’s payment platform supports various currencies and payment methods, making it suitable for businesses with global operations. It offers localized payment methods and can handle cross-border transactions, allowing businesses to expand their reach internationally.

Credit cards, debit cards, and electronic wallets charge a transaction fee of 2.59% + 49 cents.

For Venmo (U.S. only), non-U.S. currency transactions, and international transactions, there is a fee of 3.49% + 49 cents.

0.75% for ACH (with a $5 maximum charge). There are discounts available for large enterprises.

Why we like it: A PayPal service called Braintree Payments. It uses a less complicated pricing mechanism with no minimums or monthly fees while providing many of the same advantages as Adyen. You will have a separate merchant account, much like Adyen, and be able to take digital wallets and credit and debit cards. More than 40 nations and regions, as well as more than 130 different currencies, are supported by it. Additionally, Braintree offers marketplace firms scalability choices, data security, and fraud tools.

Square Pricing:

For in-person transactions, 2.6% + 10 cents will be added.

For online purchases, 2.9% + 30 cents will apply.

Transactions that are manually typed incur a 3.5% fee + 15 cents.

For invoicing, add 30 cents on top of 3.3%.

Why we like it: Square is a payment processor that allows for the processing of in-person, in-app, and online payments. It also has capabilities for brick-and-mortar companies. Free point-of-sale software is offered with a selection of hardware, such as card readers and registers. Additional free features include team management and inventory. With payment acceptance accessible in the United States, Canada, Australia, the United Kingdom, Japan, France, Spain, and Ireland, Square has a smaller worldwide footprint than Adyen.

Adyen payment solutions: Adyen offers a comprehensive set of payment solutions designed to meet the needs of various businesses. Their solutions include online payments, point of sale pos payments, Mobile payments recurring payments, and marketplace payments. Adyen supports various payment methods, currencies, and countries, allowing businesses to accept payments globally.

Adyen pricing plans: Adyen’s pricing structure is tailored to individual business requirements, and they offer customized pricing plans based on factors such as transaction volume payment methods and specific business needs.

Adyen typically charges a combination of fixed fees and transaction-based fees for their services. It is recommended to contact Adyen directly or visit their website for detailed information on their pricing plans.

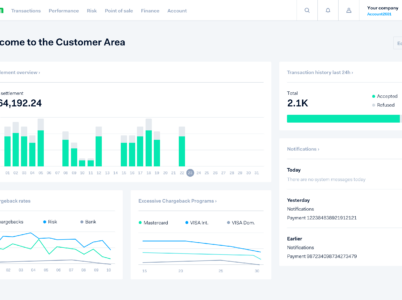

Adyen payment gateway: Adyen s payment gateway acts as the connection between a business’s website or point of sale system and the various payment methods available it securely handles payment data transmission, facilitates authorization and settlement processes, and provides reporting and analytics features. Adyen’s payment gateway is designed to be flexible, scalable, and reliable.

Adyen merchant services: Adyen provides merchant services that enable businesses to accept customer payments. These services include payment processing, fraud detection and prevention risk management, Data analytics, and reporting tools. Aydens merchant services are designed to offer a seamless and secure payment experience for both businesses and their customers.

Adyen offers customer support to assist businesses with any inquiries or issues regarding their payment solutions. Their customer support team can assist with various functions including phone, email, and online chats

Adyen strives to offer responsive and helpful support to ensure a smooth payment experience for their merchants.

Adyen payment processing: Adyen specializes in payment processing which involves the handling of payment transactions between businesses and their customers. Their payment processing platform supports various payment methods, including credit cards, debit cards, digital wallets, and alternative payment methods. Adyen’s payment processing services are designed to be secure, reliable, and scalable accommodating businesses of all sizes and industries.

Adyen Payment Integration: Adyen provides tools and resources to help businesses seamlessly integrate payment solutions into their existing systems or platforms.

Adyen offers a range of integration options, including application programming interfaces, software development kits, and pre-built plugins for popular e-commerce platforms. These integration options allow businesses to customize and tailor their payment experiences to their specific requirements.

Adyen payment platform: Adyen offers a comprehensive payment platform that is a centralized hub for businesses to manage their payment processes. The platform provides many features, including payment processing, risk management, fraud prevention, reporting, and analytics reconciliation and settlement. It supports multiple channels, such as online mobile and in-store payments providing businesses with a unified and streamlined payment solution.

Adyen payment security: Adyen strongly emphasizes payment security to protect businesses and businesses’ sensitive payment information. Their payment security measures include compliance with industry standards such as PCI DSS ( payment card industry data security standard )tokenization to secure card data encryption and fraud detection and prevention tools.

Adyen employs advanced security technologies and practices to ensure the secure transmission and storage of payment data.

Adyen payment: API Adyen offers a robust set of application programming interfaces that allow businesses to integrate Adyen’s payment capabilities into their applications, websites, or systems. The payment app enables businesses to initiate and manage payment transactions programmatically, retrieve transaction data, handle refunds and cancellations, and perform other payment-related operations.

Adyen’s payment API allows developers to create customized payment experiences and tailor the integration to their needs.

Adyen, a Dutch payment provider and acquiring bank, facilitates seamless electronic payments for businesses. Traded on Euronext Amsterdam, Adyen's platform links merchants to a variety of payment methods, including credit cards, online banking, and mobile payments, serving as both a gateway and service provider.

- Payments are accepted via apps, in-store payment methods, and Internet platforms.

- Available are international payment methods.

- There are no setup, integration, monthly, or closing fees.

- 24/7 client assistance.

- Available test account.

Cons:

- Complex pricing model.

- Minimum invoice amount required

In conclusion, Adyen is a global payment solutions provider that offers a comprehensive range of services and products to businesses. Their payment platform enables businesses to accept online mobile and in-store payments while their merchant services provide features like payment processing fraud prevention and data analytics.

Adyen prioritizes payment security by implementing industry-standard practices and technologies to safeguard sensitive payment information.

With Adyen’s payment API and integration options, businesses can seamlessly incorporate. AAdyen’spayment capabilities into their applications or systems, allowing for customizable and tailored payment experiences. Adyens customer support can assist businesses with any inquiries or issues.

Businesses can easily accept and handle online payments thanks to Stripe, a complete payment processing platform. It provides various services, including payment gateway integration, subscription management, fraud prevention, and reporting tools. Founded in 2010, Stripe has quickly gained popularity among merchants due to its powerful features and developer-friendly approach.

Opayo, formerly known as Sage Pay, is a prominent software company that specializes in providing payment solutions to businesses. With its robust infrastructure and extensive range of services, Opayo facilitates secure online payment processing, making it easier for businesses to accept payments from customers. Opayo payment processing offers solutions that empower businesses to efficiently manage their payment transactions. With Opayo's payment processing services, businesses can securely accept and process a variety of payment methods, including credit cards, debit cards, and digital wallets.