WorldPay is a prominent payment solutions provider that enables businesses to accept and process payments securely and efficiently. With its robust payment gateway, merchant services, and comprehensive range of payment options, WorldPay serves as a one-stop solution for businesses worldwide. Whether it's credit card processing, online payments, or mobile transactions, WorldPay caters to diverse payment needs.

- Payment Gateway: Stripe and PayPal provide payment gateway services, allowing businesses to accept online payments. However, Stripe offers a more developer-friendly platform with extensive customization options, robust APIs, and flexibility in payment processing. On the other hand, PayPal is known for its widespread acceptance and user-friendly interface, making it a popular choice for small businesses and non-technical users.

- Pricing Structure: Stripe and PayPal have different pricing structures. Stripe operates on a pay-as-you-go model, with transparent pricing based on transaction volume. It offers competitive rates, but additional fees may apply for certain features. On the other hand, PayPal has a tiered pricing structure that includes transaction fees based on the payment source (credit card, PayPal balance, etc.), currency conversion fees, and additional charges for advanced features.

- Integration and Customization: Stripe is renowned for its developer-friendly approach, offering robust APIs, extensive documentation, and flexibility for customization. It gives developers more control over the payment process, allowing seamless integration into websites and applications. PayPal also offers integration options, but Stripe’s developer-focused tools make it a preferred choice for businesses with complex integration requirements.

- International Support: Stripe has expanded its global reach, supporting transactions in multiple currencies and countries. It offers localized payment methods and helps businesses with international customers. PayPal, being one of the pioneers in online payments, has a broader global presence and wider acceptance across different countries and regions.

- Additional Features: While Stripe and PayPal offer basic payment processing capabilities, Stripe provides a more extensive range of features and services. It offers subscription management, fraud prevention tools, reporting and analytics, mobile payment support, and more. In addition to its payment processing services, PayPal offers invoicing, peer-to-peer payments, and buyer/seller protection programs.

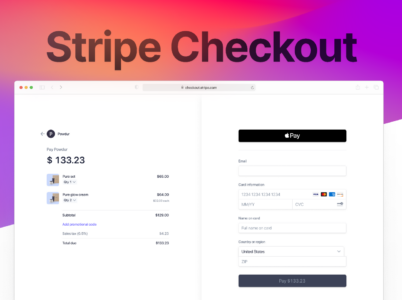

A hosted, prebuilt checkout page that is optimized for conversion is provided by Stripe. The checkout page has built-in conversion optimizations, is accessible in 20 languages, can be customized to fit a company’s logo, and can handle one-time and recurring payments. Additionally, Stripe provides simple tax reporting for each filing market and automated tax collection on all transactions for a fee of 0.5% of each transaction.

Stripe Integration Tutorial:

Stripe offers user-friendly tutorials that guide developers and businesses through integrating Stripe into their websites or applications. The tutorials provide step-by-step instructions, code samples, and best practices, making it easier for users to integrate Stripe seamlessly.

Stripe Developer Guide:

Stripe’s developer guide is a comprehensive resource for developers, offering in-depth information on using Stripe’s APIs, webhooks, authentication methods, and customization options. The developer guide empowers developers to leverage Stripe’s capabilities and build customized payment solutions.

Businesses can easily accept and handle online payments thanks to Stripe, a complete payment processing platform. It provides various services, including payment gateway integration, subscription management, fraud prevention, and reporting tools. Founded in 2010, Stripe has quickly gained popularity among merchants due to its powerful features and developer-friendly approach.

Stripe Subscription Management:

Stripe offers robust subscription management features, allowing businesses to create and manage recurring payment plans. Merchants can set up subscriptions with various billing intervals, handle upgrades, downgrades, and cancellations, and easily manage customer subscriptions. Stripe’s subscription management tools provide flexibility and convenience for businesses.

Stripe API Documentation:

Stripe’s API documentation provides developers with detailed information on how to interact with Stripe programmatically. It covers API endpoints, request and response formats, authentication methods, and error handling. The API documentation enables developers to integrate Stripe seamlessly into their applications and customize the payment process.

Stripe Customer Support:

Users with inquiries or problems may turn to Stripe for dependable and helpful customer service. Email, live chat, and an extensive knowledge library are just a few of the ways users may get assistance. The customer service staff at Stripe is renowned for their knowledge and commitment to speedy problem-solving.

Stripe Security Measures:

Security is a top priority for Stripe. The platform adheres to industry-leading security standards and employs advanced encryption and tokenization techniques to protect customer information. Stripe’s robust security measures ensure that transactions and sensitive data are safe and secure.

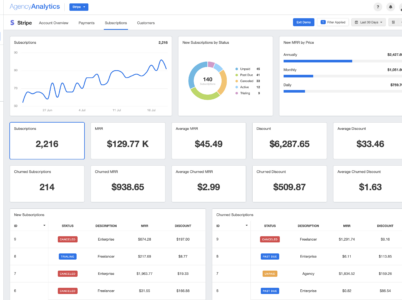

Stripe Reporting and Analytics:

Stripe provides powerful reporting and analytics tools that allow merchants to gain valuable insights into their transactions and financial performance. Users can access real-time data, generate customized reports, and track key metrics such as revenue, conversion rates, and customer behavior. These insights enable businesses to make data-driven decisions and optimize their payment processes.

Stripe Mobile Payments:

Stripe supports mobile payments, enabling businesses to accept customer payments using mobile devices. It offers mobile SDKs and libraries for iOS and Android, simplifying the integration process for developers. With Stripe’s mobile payment capabilities, businesses can provide mobile users with a seamless and convenient payment experience.

Stripe Global Expansion:

Stripe’s global reach is one of its significant advantages. It is the perfect option for companies that deal with clients from other nations and currencies since it facilitates transactions in numerous currencies. Stripe’s global expansion capabilities empower businesses to expand their operations, enter new markets, and reach a broader customer base effortlessly.

Stripe Partnerships and Integrations:

Stripe has partnered with various e-commerce platforms, financial institutions, and technology providers. These partnerships allow for seamless integration between Stripe and popular platforms such as Shopify, WooCommerce, and Magento. Stripe’s extensive network of partners enhances its compatibility and will enable businesses to leverage existing ecosystems.

Stripe Radar:

Stripe’s Radar is a robust fraud detection and prevention tool that uses machine learning algorithms and advanced data analysis to identify and block fraudulent transactions. It helps businesses minimize chargebacks and protect against fraudulent activities, ensuring secure transactions for merchants and customers.

Stripe Connect:

With the help of Stripe Connect, organizations can build and control marketplaces that let various merchants take payments on a single platform. It provides tools for onboarding sellers, handling payouts, and managing financial flows within the market, streamlining the payment process for sellers and buyers.

Stripe Sigma:

Stripe Sigma is an advanced reporting tool that allows businesses to analyze their transaction data in-depth. It provides:

- SQL-based queries and customizable dashboards.

- Enabling enterprises to extract valuable insights and create customized reports to understand revenue streams.

- Customer behavior.

- Other key metrics.

Stripe Atlas:

Stripe Atlas is a service that simplifies incorporating a business in the United States. It provides resources and guidance to entrepreneurs and startups, helping them establish a legal entity, open a business bank account, and navigate the business’s complexities. Stripe Atlas supports companies in their early stages, providing a foundation for growth and success.

Opayo, formerly known as Sage Pay, is a prominent software company that specializes in providing payment solutions to businesses. With its robust infrastructure and extensive range of services, Opayo facilitates secure online payment processing, making it easier for businesses to accept payments from customers. Opayo payment processing offers solutions that empower businesses to efficiently manage their payment transactions. With Opayo's payment processing services, businesses can securely accept and process a variety of payment methods, including credit cards, debit cards, and digital wallets.

Braintree is a comprehensive payment processing software that offers businesses a wide range of solutions to handle online transactions effectively. It provides tools and services for payment processing, merchant account setup, payment security, and more. Braintree was founded in 2007 and has gained recognition for its user-friendly interface and extensive capabilities.