WorldPay is a prominent payment solutions provider that enables businesses to accept and process payments securely and efficiently. With its robust payment gateway, merchant services, and comprehensive range of payment options, WorldPay serves as a one-stop solution for businesses worldwide. Whether it's credit card processing, online payments, or mobile transactions, WorldPay caters to diverse payment needs.

- Opayo payment solutions: Opayo offers a comprehensive suite of payment solutions, including credit card processing, recurring payments, tokenization, and virtual terminal. These features empower businesses to accept payments via multiple channels, such as online, mobile, or telephone, catering to various customer preferences.

- Opayo payment gateway: Opayo's payment gateway acts as the bridge between businesses and customers, securely transmitting payment data. It provides businesses with a seamless integration process and supports various e-commerce platforms, shopping carts, and custom integrations.

- Opayo merchant services: Opayo offers additional merchant services, including fraud prevention tools, 3D Secure, transaction reporting, and invoicing capabilities. These services enable businesses to manage their payment operations efficiently and minimize risks associated with fraudulent transactions

– Established Reputation: Opayo has been in the industry for many years and has earned a reputation for providing reliable and secure payment services. With a large customer base, Opayo has demonstrated its commitment to meeting the needs of businesses across various sectors.

– Comprehensive Payment Solutions: Opayo offers a wide range of payment solutions, catering to businesses of all sizes. Whether you are a small e-commerce store or a large enterprise, Opayo’s diverse features can accommodate your specific requirements.

– Opayo payment API: Opayo provides a comprehensive payment API (Application Programming Interface) that allows businesses to integrate their systems and applications with Opayo’s payment processing platform. The Opayo payment API enables businesses to customize and control their payment workflows, providing a seamless and secure payment experience for their customers.

– Opayo credit card processing: Opayo supports the processing of major credit card brands, including Visa, Mastercard, American Express, and Discover. This allows businesses to cater to a wide range of customers who prefer different credit card options.

– Opayo payment security: Opayo places a strong emphasis on payment security. It is PCI DSS Level 1 compliant, the highest standard of security for payment processors. This ensures that customer payment data is protected against unauthorized access and fraud.

– Integration and Customization: Opayo provides seamless integration with popular e-commerce platforms, making it easy for businesses to set up their online payment systems. Additionally, Opayo offers customization options, allowing businesses to tailor the payment process to align with their branding and user experience.

– E-commerce Businesses: Opayo’s online payment solutions make it an ideal choice for e-commerce businesses that operate through online marketplaces, websites, or mobile apps. It supports a variety of payment methods, providing a convenient checkout experience for customers.

– Retailers and Brick-and-Mortar Stores: Opayo’s virtual terminal feature enables businesses to accept payments over the phone or in person. This makes it suitable for retailers and businesses that operate physical stores, allowing them to process payments securely and efficiently.

– Subscription-based Services: Opayo’s recurring payment feature is beneficial for businesses that offer subscription-based services, such as memberships or software-as-a-service (SaaS). It automates the payment collection process, reducing administrative overhead.

- Simplicity Plus (Flex) : £32 per month + £0.12 p overage

- Simplicity Plus ( Flex Annually) : £348 per month + £0.12 p overage

- Simplicity Plus (Simplicity): £25 per month + £0.12 p overage (£5 discount from flex)

- Simplicity Plus (Plus) : £45 per month + £0.12 p overage

- Simplicity Plus ( Plus Annually) : £348 per month + £0.12 p overage

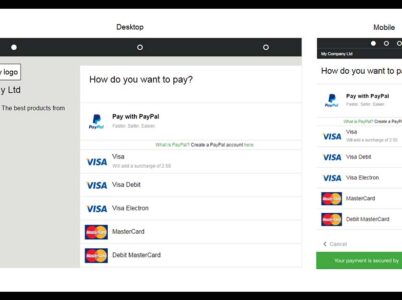

– PayPal: PayPal is a well-known payment gateway that offers a wide range of payment solutions for businesses of all sizes. It provides easy integration, global reach, and a user-friendly interface. However, compared to Opayo, PayPal’s pricing structure may be less transparent, and some businesses may find its customer support less responsive.

– Stripe: Stripe is another widely used payment processor that offers comprehensive payment solutions for online businesses. It is known for its developer-friendly platform, customizable checkout experience, and extensive API documentation. Stripe’s pricing is competitive, but businesses with complex payment requirements may find it challenging to set up and configure.

– Braintree: Braintree, a subsidiary of PayPal, provides a feature-rich payment gateway with a focus on mobile and international payments. It offers seamless integration, advanced fraud protection, and support for multiple payment methods. However, businesses with low transaction volumes may find Braintree’s pricing less cost-effective.

Opayo, formerly known as Sage Pay, is a prominent software company that specializes in providing payment solutions to businesses. With its robust infrastructure and extensive range of services, Opayo facilitates secure online payment processing, making it easier for businesses to accept payments from customers.

Opayo payment processing offers solutions that empower businesses to efficiently manage their payment transactions. With Opayo's payment processing services, businesses can securely accept and process a variety of payment methods, including credit cards, debit cards, and digital wallets.

– Pricing Plans: Opayo’s pricing plans are customizable, allowing businesses to tailor the services to their specific needs. PayPal’s pricing structure may be more suitable for smaller businesses or those with lower transaction volumes.

– Payment Solutions: Both Opayo and PayPal offer a wide range of payment solutions, including credit card processing, recurring payments, and virtual terminal. Opayo’s emphasis on security and fraud prevention may be advantageous for businesses that prioritize robust payment protection.

– Integration and User Experience: Opayo provides seamless integration with popular e-commerce platforms and customizable checkout experiences. PayPal also offers easy integration options, but some businesses may find its checkout flow less customizable compared to Opayo.

– Opayo customer support: Opayo is known for its responsive and helpful customer support, offering assistance to businesses whenever needed. PayPal’s customer support has received mixed reviews, with some users experiencing delays or difficulties in resolving issues.

– Global Reach: PayPal has a strong global presence, supporting transactions in multiple currencies and countries. Opayo also supports international transactions but may have a more focused presence in specific regions.

It’s essential to evaluate your business’s specific requirements and consider factors like pricing, features, integration, and customer support when comparing Opayo and PayPal.

While Opayo is a strong contender in the payment processing industry, it is essential to consider alternative options such as PayPal, Stripe, and Braintree to ensure you select the payment solution that best aligns with your business needs and priorities.

Before making a final decision, take into account factors such as transaction volume, international reach, customization requirements, and budget. Reach out to Opayo directly or visit their website to gather detailed information about their pricing plans and to discuss your specific business requirements with their team.

In conclusion, Opayo stands out as a reliable payment solution provider with its comprehensive range of features, secure payment processing, and responsive customer support. Whether you run an e-commerce store, operate a brick-and-mortar business, or offer subscription-based services, Opayo offers the necessary tools to streamline your payment operations and enhance the customer experience. Evaluate Opayo alongside its competitors, read user reviews, and make an informed decision based on your unique business needs. By selecting the right payment solution, you can create a seamless and secure payment process that contributes to your business’s growth and success.

Businesses can easily accept and handle online payments thanks to Stripe, a complete payment processing platform. It provides various services, including payment gateway integration, subscription management, fraud prevention, and reporting tools. Founded in 2010, Stripe has quickly gained popularity among merchants due to its powerful features and developer-friendly approach.

Braintree is a comprehensive payment processing software that offers businesses a wide range of solutions to handle online transactions effectively. It provides tools and services for payment processing, merchant account setup, payment security, and more. Braintree was founded in 2007 and has gained recognition for its user-friendly interface and extensive capabilities.