Businesses can easily accept and handle online payments thanks to Stripe, a complete payment processing platform. It provides various services, including payment gateway integration, subscription management, fraud prevention, and reporting tools. Founded in 2010, Stripe has quickly gained popularity among merchants due to its powerful features and developer-friendly approach.

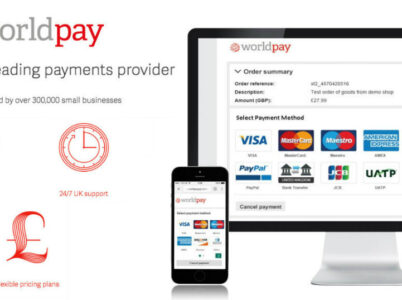

- WorldPay payment solutions: WorldPay supports multiple payment methods, including credit cards, debit cards, online banking, alternative payment options, and mobile wallets. This ensures convenience and flexibility for both businesses and customers.

- WorldPay payment processing: WorldPay prioritizes security and compliance, implementing advanced fraud prevention measures and encryption technologies to safeguard sensitive payment information.

- WorldPay payment gateway: WorldPay seamlessly integrates with various e-commerce platforms and shopping carts, making it easier for businesses to incorporate payment processing into their existing systems.

- Global Reach: WorldPay's vast network and partnerships allow businesses to expand their reach and accept payments from customers around the world, supporting multiple currencies and languages

- Reporting and Analytics: WorldPay provides comprehensive reporting and analytics tools that enable businesses to gain insights into their payment data, track sales performance, and make informed business decisions.

- Reliability: WorldPay is a trusted name in the industry, serving millions of businesses globally and handling billions of transactions each year. Its robust infrastructure ensures stability and uninterrupted payment processing.

- Versatility: WorldPay offers a wide range of payment options and services, catering to businesses of all sizes and industries. It can accommodate the needs of startups, e-commerce businesses, brick-and-mortar stores, and enterprises alike.

- WorldPay payment security: WorldPay prioritizes the security of payment transactions, implementing industry-leading security measures and compliance standards to protect sensitive data and prevent fraudulent activities.

- Integration and Scalability: WorldPay integrates seamlessly with popular e-commerce platforms and can scale alongside growing businesses, accommodating higher transaction volumes and expanding global operations.

- Gateway Standard – From £19 per month

- Gateway Advanced – From £45 per month

While WorldPay offers comprehensive payment solutions, it’s essential to explore alternatives to make an informed decision. One notable alternative is PayPal, which is widely recognized and used globally for online payments. PayPal offers its payment gateway and various payment options, making it a popular choice for many businesses.

WorldPay is a prominent payment solutions provider that enables businesses to accept and process payments securely and efficiently. With its robust payment gateway, merchant services, and comprehensive range of payment options, WorldPay serves as a one-stop solution for businesses worldwide. Whether it's credit card processing, online payments, or mobile transactions, WorldPay caters to diverse payment needs.

Payment Options: Both WorldPay and PayPal offer a range of payment options. However, WorldPay has a broader selection, including credit cards, debit cards, online banking, mobile wallets, and alternative payment methods. PayPal, on the other hand, is primarily known for its online payment platform and digital wallet.

Global Reach: WorldPay has a significant advantage when it comes to global reach. With its extensive network and partnerships, WorldPay supports transactions in multiple currencies and languages, making it ideal for businesses targeting international markets. While PayPal also operates globally, WorldPay’s reach is broader, especially for businesses with diverse international customer bases.

Integration and Ease of Use: Both WorldPay and PayPal offer integration options with popular e-commerce platforms. However, PayPal is often regarded as more user-friendly, with a straightforward setup process and intuitive interface. WorldPay, while equally capable, may require more technical expertise during the integration process.

Pricing and Fees: Pricing structures and fees can vary for WorldPay and PayPal, depending on the specific requirements and transaction volumes. Businesses must compare the pricing plans offered by both providers and assess which aligns better with their budget and projected transaction volumes.

WorldPay Credit Card Processing

When it comes to credit card processing, WorldPay offers a comprehensive range of services to businesses of all sizes. Here’s an overview of the credit card processing features provided by WorldPay:

- Payment Acceptance: WorldPay enables businesses to accept major credit cards such as Visa, Mastercard, American Express, Discover, and others. They support both card-present (face-to-face) and card-not-present (online, mail, telephone) transactions.

- Payment Gateway: WorldPay offers a secure payment gateway that allows businesses to process credit card payments online. The payment gateway integrates with websites and e-commerce platforms, providing a seamless checkout experience for customers.

- Virtual Terminal: WorldPay provides a virtual terminal that enables businesses to accept credit card payments over the phone or through mail orders. This feature allows merchants to manually enter payment information and process transactions securely.

- Card Machines and Terminals: WorldPay offers a variety of card machines and terminals for businesses to accept in-person payments. These devices are EMV-compliant and support contactless payments, chip and PIN, and magnetic stripe transactions.

- Online Shopping Carts: WorldPay integrates with popular e-commerce platforms and shopping carts, allowing businesses to integrate their online stores with WorldPay’s payment processing capabilities. This enables seamless checkout experiences for customers.

- Multi-Currency Processing: WorldPay supports processing payments in multiple currencies, making it convenient for businesses that operate internationally or cater to customers from different countries. This feature enables businesses to accept payments in the local currency of their customers.

- Fraud and Risk Management: WorldPay incorporates robust fraud prevention tools and risk management features into its credit card processing solutions. These include real-time fraud screening, 3D Secure authentication, and advanced algorithms to help detect and prevent fraudulent transactions.

WorldPay Merchant Services

WorldPay also provides a range of merchant services to businesses. These services are designed to help businesses accept and process payments from their customers efficiently and securely. Here are some of the key merchant services offered by WorldPay:

- Payment Processing: WorldPay offers payment processing services that enable businesses to accept various forms of payments, including credit and debit cards, mobile wallets, and alternative payment methods.

- Point of Sale (POS) Solutions: WorldPay provides POS solutions that allow businesses to accept payments in physical retail environments. This includes hardware such as card terminals and cash registers, as well as software that integrates with inventory management and sales reporting systems.

- E-commerce Solutions: WorldPay offers e-commerce solutions that enable businesses to accept online payments through their websites or mobile apps. This includes secure payment gateways, shopping cart integration, and fraud prevention tools.

- Recurring Billing: WorldPay supports recurring billing for businesses that offer subscription-based services or recurring payments. This allows merchants to automatically charge customers regularly, providing convenience for both the business and the customer.

WorldPay Customer Support

WorldPay places a strong emphasis on customer support to ensure businesses receive timely assistance when needed. They provide multiple support channels, including phone, email, and live chat, allowing businesses to reach out for support or technical assistance. Additionally, WorldPay offers a comprehensive knowledge base and documentation, enabling businesses to find answers to common queries and troubleshoot issues independently.

Opayo, formerly known as Sage Pay, is a prominent software company that specializes in providing payment solutions to businesses. With its robust infrastructure and extensive range of services, Opayo facilitates secure online payment processing, making it easier for businesses to accept payments from customers. Opayo payment processing offers solutions that empower businesses to efficiently manage their payment transactions. With Opayo's payment processing services, businesses can securely accept and process a variety of payment methods, including credit cards, debit cards, and digital wallets.

Braintree is a comprehensive payment processing software that offers businesses a wide range of solutions to handle online transactions effectively. It provides tools and services for payment processing, merchant account setup, payment security, and more. Braintree was founded in 2007 and has gained recognition for its user-friendly interface and extensive capabilities.