WorldPay is a prominent payment solutions provider that enables businesses to accept and process payments securely and efficiently. With its robust payment gateway, merchant services, and comprehensive range of payment options, WorldPay serves as a one-stop solution for businesses worldwide. Whether it's credit card processing, online payments, or mobile transactions, WorldPay caters to diverse payment needs.

- Key Advantages of Using Authorize.Net Accept all major credit cards, eCheck.Net (electronic checks from bank accounts), gift cards, and signature debit cards as payment.

- Manage transactions - A full-featured merchant interface for monitoring and controlling online payments.

- Prevent fraud by detecting suspicious transactions using value-added goods and built-in fraud detection technologies.

- Risk management - Sensitive data is never saved on the user's computer but in the Authorize.Net PCI-compliant data center.

- Receive payments promptly - Within days, funds are automatically paid into the user's merchant bank account.

- Authorize.Net offers free technical and account assistance to merchants, as well as online documentation and user manuals.

Authorize.Net has the most clients of any payment processor and has been classified as one of the more mature companies in the payment processing business, with a “decent portion” of the industry’s market share.

- PayPal

- Square Payments

- Helcim

- WeTravel

- Venmo

- Melio

- TackPay

- Chargebee

- Solar Staff

Pricing models include free and subscription.

Starting at: $25.00 per month

Net video a general comparison with some popular alternatives to give you an idea of the options available:

Paypal is a widely used payment gateway offering online and mobile payment solutions. It is known for its ease of use, strong brand recognition, and extensive global reach. Paypal supports various payment methods and provides a range of features and integrations suitable for businesses of all sizes.

Stripe: Stripe is a robust payment gateway popular among startups and tech companies. It offers a developer-friendly platform with extensive documentation and powerful customization options. Stripe supports various payment methods, has advanced fraud prevention features, and provides additional services like subscription billing and international payments.

Square: square is a versatile payment solution that caters to small and medium-sized businesses. It offers a combination of payment processing hardware options like card rea, dees pos systems, and various business management tools square is known for its straightforward pricing and easy-to-use interface.

Braintree is owned by PayPal. It is a scalable payment gateway that focuses on providing seamless payment experiences. It offers advanced features like recurring billing,multi-currency support, and robust fraud detection.

Braintree is known for its integrations when comparing payment gateways considering factors such as pricing transaction fees, ease of integration available features, supported payment methods, security measures, customer support, and scalability to determine which option best suits your business needs.

Authorize.Net pricing plans: The following price options are available from Authorize.Net:

Starting at: $25.00 per month

Pricing models include free and subscription.

Authorize.Net payment gateway:Authorize.net has been a market leader in payment gateway services since 1996. On behalf of its merchant clients, it manages the submission of billions of transactions to processing networks. Visa owns Authorize.net in its entirety as a subsidiary.

Authorize.Net merchant services: Along with the previously stated services, Authorize.net provides merchant accounts and payment gateways in a single package or individually. In other words, we can assist your business in accepting payments whether you need to open a new merchant account with us or the bank.

Authorize.Net vs. PayPal: PSPs like PayPal and Authorize.net assist small companies in accepting payments both offline and online. Small businesses may choose Authorize.net because of its lower cost. However, PayPal may be ideal for those with a worldwide clientele.

Pros and drawbacks of Authorize.net

Pros Cost. Transaction fees for merchant accounts are less expensive with Authorize.net than with PayPal. Additionally, Authorize.net rates are stable; by contrast, PayPal increases American Express fees. On its website, Authorize.net lists its costs.

Support for customers. The business provides online ticketing or chat and 24/7 phone assistance (except on holidays). A knowledge base is available online as well.

Included is recurring billing. All subscriptions contain recurring payment features, which may be useful if you operate a subscription-based business. That is a PayPal add-on that is optional.

Cons

International capacities are rather modest. Authorize.net only accepts U.S. and Canadian currencies from U.S. and Canadian companies. It supports eight currencies for U.K. and European firms and three for Australian enterprises.

NAt a free version. Regardless of your monthly sales volume, you will always be required to pay a monthly charge of $25, which may reduce or even eliminate the difference in transaction costs.

Pros and drawbacks of PayPal

Pros

Open pricing ps PayPal lists its pricing.

Relatively simple to use. PayPal was created with the express purpose of making integration easy for non-programmers. A cut-and-paste interface can be preferred by small business owners who want something easy to set up.

International. About two dozen currencies are supported by PayPal, and you may accept most of them wherever your company is located.

CustomerService. While unavailable around the clock like Authorize.net, PayPal offers phone assistance from 8 a.m. to 8 p.m. Monday through Friday at central time. Additional features include text help, an online forum, and a center for resolving transaction or account problems.

Cons

Cost relative. Per transaction, PayPal could be more expensive than Authorize.net.

Extra charges. Authorize.net offers automated recurring billing at no additional cost, even if it is an add-on.

If you wish to pay a reasonable amount, Authorize.net can be your best choice. However, if having access to foreign markets is more crucial, you could prefer to choose PayPal.

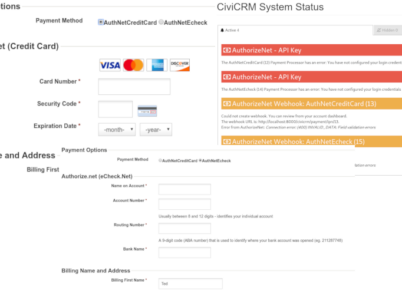

Authorize.Net integration tutorial: To integrate authorize net into your website or application, follow these steps to set up an authorize net account by registering on their website https www authorize net. This will provide you with the necessary credentials.

- Choose the integration method that suits your needs, such as simple checkout advanced integration method, aim server integration method sim, or application programming interface API.

- Obtain API credentials from your authorized net account, including the API login id and transaction key.

- Implement the integration using the documentation and guides provided by authorize net visit the authorize net developer center https developer authorize net for API documentation sd ks libraries code examples and tutorials specific to your chosen integration method.

- Test and debug the integration thoroughly using the sandbox environment provided by the authorized net to simulate transactions without actual charges.

- Once testing is successful, switch to the live production environment by updating your integration settings with the actual API can replace any test or placeholder values used during development with the appropriate production values.

Authorize.Net recurring payments:Authorize.net supports recurring payments allowing businesses to set up automated billing for subscription-based services or recurring transactions. The API documentation and resources are available in the authorized net developer center can guide on implementing recurring payment functionality.

Authorize.Net API documentation:

Processing payments over the Authorize.net gateway is made possible by the comprehensive capabilities of the Authorize.net API. The API supports the JSON and XML formats.

Authorize.Net transaction fees: To connect to the Authorize.net platform, you need to have a merchant account): No set-up costs. $25 for a monthly gateway. Ten cents for each transaction and 10 cents for each batch every day. Below are the features of the provided plan.

Authorize.Net customer support: Customer service is available from Authorize.Net to help users with questions and technical problems. You may get in touch with their customer service department via the following methods:

Phone Support: Customers of Authorize.Net can reach them via phone. On the Authorize.Net website or your account dashboard, you may locate the right phone number to call their support service.

Support Center: The Authorize.Net Support Centre (https://support.authorize.net/) is a thorough online database that contains articles, how-to manuals, FAQs, step-by-step instructions for fixing problems, and other useful data. You can study the available material or search for answers to frequent problems.

Community Forum: Authorize.Net hosts a community forum where users may post queries, discuss their experiences, and get help from other users. The Support Centre provides access to the forum.

Authorize.Net, a subsidiary of Visa, is a leading payment gateway service in the United States. Established in 1996, it empowers businesses to accept credit card and electronic check payments online through an Internet Protocol (IP) connection. Unlike certain alternatives, Authorize.Net's user-friendly service enables customers to input credit card and shipping details directly on a webpage without the need for prior sign-ups.

Businesses can easily accept and handle online payments thanks to Stripe, a complete payment processing platform. It provides various services, including payment gateway integration, subscription management, fraud prevention, and reporting tools. Founded in 2010, Stripe has quickly gained popularity among merchants due to its powerful features and developer-friendly approach.

Opayo, formerly known as Sage Pay, is a prominent software company that specializes in providing payment solutions to businesses. With its robust infrastructure and extensive range of services, Opayo facilitates secure online payment processing, making it easier for businesses to accept payments from customers. Opayo payment processing offers solutions that empower businesses to efficiently manage their payment transactions. With Opayo's payment processing services, businesses can securely accept and process a variety of payment methods, including credit cards, debit cards, and digital wallets.