WorldPay is a prominent payment solutions provider that enables businesses to accept and process payments securely and efficiently. With its robust payment gateway, merchant services, and comprehensive range of payment options, WorldPay serves as a one-stop solution for businesses worldwide. Whether it's credit card processing, online payments, or mobile transactions, WorldPay caters to diverse payment needs.

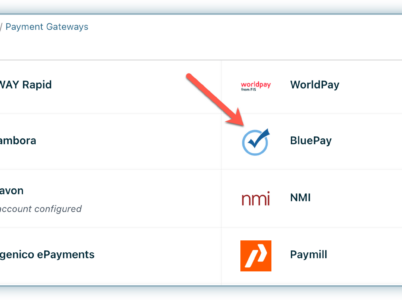

- BluePay payment gateway : BluePay's robust payment gateway enables businesses to securely accept online payments, whether through credit cards, debit cards, or ACH (Automated Clearing House) transactions.

- BluePay payment processing : BluePay offers seamless credit card processing, allowing businesses to accept payments from major credit card brands like Visa, Mastercard, American Express, and Discover.

- Merchant Services: BluePay provides businesses with a range of merchant services, including recurring billing, virtual terminals, mobile processing, and customizable payment forms.

- Payment Security: BluePay places great emphasis on security and offers advanced fraud management tools, PCI compliance solutions, and tokenization to safeguard sensitive payment information.

- Reporting and Analytics: BluePay's reporting and analytics tools provide businesses with detailed insights into their payment data, helping them make informed decisions and optimize their payment processes.

- Robust Security: BluePay prioritizes security and ensures that all payment transactions are protected with the highest level of encryption and compliance standards.

- Versatile Payment Options: BluePay supports a wide range of payment options, including credit cards, debit cards, and ACH transactions, allowing businesses to cater to a broader customer base.

- Customizable Solutions: BluePay offers customizable payment solutions to meet the unique needs of businesses across various industries.

- Integration Capabilities: BluePay integrates seamlessly with popular shopping carts, accounting software, and other business tools, enabling businesses to streamline their operations.

- Competitive Pricing: BluePay offers flexible pricing plans that cater to businesses of different sizes and transaction volumes.

The company offers various payment processing solutions, such as credit card processing, ACH processing, electronic invoicing, mobile payment processing, and virtual terminal capabilities. BluePay’s services enable businesses to accept payments from customers through multiple channels, including in-store, online, mobile devices, and mail order/telephone order (MOTO).

Whether you have a brick-and-mortar store, an e-commerce website, or operate a business that requires accepting payments from customers, BluePay provides the infrastructure and tools necessary to process payments securely and efficiently.

- Credit Cards: BluePay supports processing payments from major credit card brands, including Visa, Mastercard, American Express, Discover, and JCB. Businesses can accept credit card payments online, in-store, or through mobile devices.

- Debit Cards: BluePay allows businesses to accept payments from debit cards, including both signature-based and PIN-based transactions. This gives customers the flexibility to use their debit cards for purchases.

- ACH (Automated Clearing House): BluePay provides ACH payment processing, which allows businesses to accept payments directly from customers’ bank accounts. ACH transactions are commonly used for recurring payments, such as subscriptions or utility bill payments.

- E-checks: BluePay enables businesses to accept electronic checks (e-checks) as a form of payment. Customers can provide their bank account and routing number to make payments electronically.

- Digital Wallets: BluePay supports popular digital wallets like Apple Pay and Google Pay. These wallets allow customers to make contactless payments using their smartphones, eliminating the need to physically present a credit card.

- EMV Chip Cards: BluePay provides EMV-compliant card readers and payment solutions, allowing businesses to accept payments from chip-enabled credit and debit cards. EMV technology adds an extra layer of security to transactions, reducing the risk of counterfeit card fraud.

BluePay Payment Solutions is a reputable software company that specializes in providing secure and reliable payment processing services to businesses. It offers a comprehensive suite of payment solutions, including a payment gateway, credit card processing, and merchant services. BluePay aims to simplify and streamline payment transactions while ensuring the highest level of security for both businesses and customers.

BluePay vs Stripe:

Stripe is another prominent payment gateway thatoffers a range of features and services similar to BluePay. Let’s compare BluePay and Stripe based on key factors:

- Payment Gateway: Both BluePay and Stripe provide robust payment gateways that enable businesses to securely accept online payments. They support various payment methods, including credit cards, debit cards, and ACH transactions.

- Pricing Plans: BluePay offers flexible pricing plans tailored to businesses’ specific needs. On the other hand, Stripe follows a transparent pricing structure, charging a percentage of each transaction with no setup or monthly fees.

- Payment Options: Both BluePay and Stripe support a wide range of payment options, allowing businesses to accept payments from major credit cards and alternative payment methods. BluePay also offers additional features like recurring billing and customizable payment forms.

- Integration Capabilities: Both providers offer seamless integrations with popular shopping carts, accounting software, and other business tools. Stripe has a robust API and extensive documentation, making it a preferred choice for developers.

- Payment Security: BluePay and Stripe prioritize payment security and offer advanced fraud management tools and PCI compliance solutions. Both providers use encryption and tokenization to protect sensitive payment data.

- Customer Support: BluePay is known for its responsive and knowledgeable customer support team, providing assistance via phone, email, and live chat. Stripe also offers customer support but primarily relies on its extensive documentation and developer community.

BluePay merchant services :

BluePay excels in providing efficient payment processing services and merchant services to businesses. Their payment processing capabilities enable businesses to accept a wide range of payment methods securely. BluePay’s merchant services include recurring billing options, virtual terminals for phone and mail orders, mobile processing solutions, and customizable payment forms. These services cater to the diverse needs of businesses across industries, allowing for seamless and streamlined payment transactions.

BluePay payment security:

Security is a top priority for BluePay, and they employ advanced measures to ensure the utmost protection of sensitive payment information. BluePay is PCI DSS compliant, which means it adheres to the highest standards of data security in the payment industry. They offer encryption and tokenization features to safeguard cardholder data, reducing the risk of data breaches and fraud. BluePay’s robust fraud management tools help identify and prevent fraudulent transactions, providing peace of mind to businesses and their customers.

BLUEPAY CREDIT CARD PROCESSING

BluePay offers various features and services related to credit card processing, such as:

- Virtual Terminal: BluePay’s virtual terminal allows businesses to process credit card payments manually, without the need for a physical card reader. This feature is particularly useful for businesses that accept payments over the phone or through mail order.

- Point of Sale (POS) Solutions: BluePay offers point-of-sale solutions for businesses that have physical locations. They provide EMV-compliant card readers and POS systems that allow merchants to accept chip-enabled credit cards securely.

- Mobile Payments: BluePay provides mobile payment solutions that enable businesses to accept credit card payments on the go. Merchants can use their smartphones or tablets as card readers and process payments through a mobile app.

- Recurring Billing: BluePay offers recurring billing services, which are useful for businesses that have subscription-based models or need to process regular payments from customers. This feature automates the billing process and helps to streamline operations.

- Fraud Management: BluePay incorporates robust fraud management tools and security measures to help protect businesses and their customers from fraudulent transactions. They offer features like address verification, card verification value (CVV) checks, and tokenization to enhance security.

Businesses can easily accept and handle online payments thanks to Stripe, a complete payment processing platform. It provides various services, including payment gateway integration, subscription management, fraud prevention, and reporting tools. Founded in 2010, Stripe has quickly gained popularity among merchants due to its powerful features and developer-friendly approach.

Opayo, formerly known as Sage Pay, is a prominent software company that specializes in providing payment solutions to businesses. With its robust infrastructure and extensive range of services, Opayo facilitates secure online payment processing, making it easier for businesses to accept payments from customers. Opayo payment processing offers solutions that empower businesses to efficiently manage their payment transactions. With Opayo's payment processing services, businesses can securely accept and process a variety of payment methods, including credit cards, debit cards, and digital wallets.