WorldPay is a prominent payment solutions provider that enables businesses to accept and process payments securely and efficiently. With its robust payment gateway, merchant services, and comprehensive range of payment options, WorldPay serves as a one-stop solution for businesses worldwide. Whether it's credit card processing, online payments, or mobile transactions, WorldPay caters to diverse payment needs.

- Depending on the payment method, Braintree assesses a fixed fee. Businesses that generate over $80,000 in monthly sales may be eligible for lower rates.

- Credit cards, debit cards, and electronic wallets charge a transaction fee of 2.59% + 49 cents.

- For Venmo (U.S. only), non-U.S. currency transactions, and international transactions, there is a fee of 3.49% + 49 cents.

- Customers must pay 0.75% for ACH (with a $5 maximum charge). There are discounts available for large enterprises.

- Payment processing has no monthly fees. However, a Braintree gateway costs $49 per month plus 10 cents per transaction, and third-party merchant accounts cost $10 per month (plus any fees assessed by the merchant account supplier).

- Merchants with American Express accounts must also pay the net cost of 15 cents.

- For companies processing more than $80,000 monthly, interchange-plus pricing and custom flat rates are available.

- Each chargeback costs $15.

- The terms of your PayPal account determine the rates for transactions.

- Payment Gateway Integration: Braintree and Stripe offer comprehensive integration, allowing businesses to accept payments from various sources. However, Braintree has an advantage regarding PayPal integration, as it is a subsidiary of PayPal. Companies wishing to capitalise on PayPal’s popularity and user base should use Braintree since it simply interacts with the PayPal network.

- Developer-Focused Approach: Stripe is known for its developer-friendly platform and extensive documentation. It provides powerful APIs, libraries, and SDKs, making it easier for developers to integrate payment processing capabilities into websites and applications. Stripe’s developer-first approach appeals to businesses with complex integration requirements and needing customisation.

- Pricing Structure: When it comes to pricing, both Braintree and Stripe offer transparent fee structures. However, there are slight differences. Braintree charges a transaction fee per successful transaction without setup or monthly payments. Stripe follows a similar model but includes additional costs for features like recurring billing or international commerce. The choice between Braintree and Stripe in terms of pricing depends on a business’s specific needs and transaction volumes.

- International Support: Stripe has a broader international presence compared to Braintree. Stripe supports businesses in more countries and currencies, making it suitable for companies with a global customer base. Braintree has expanded its international reach but may have limitations regarding available countries and currencies.

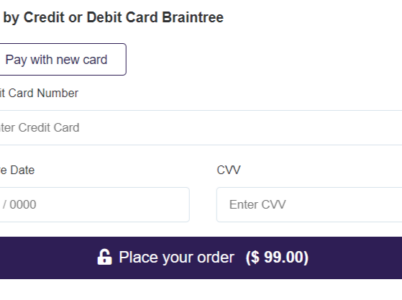

Braintree is a comprehensive payment processing software that offers businesses a wide range of solutions to handle online transactions effectively. It provides tools and services for payment processing, merchant account setup, payment security, and more. Braintree was founded in 2007 and has gained recognition for its user-friendly interface and extensive capabilities.

Braintree Payment Integration:

Braintree offers seamless integration options enabling businesses to incorporate payment processing capabilities into their websites or applications. It provides comprehensive documentation, SDKs, and client libraries to simplify integration. Braintree’s integration options cater to various platforms and programming languages, ensuring compatibility and flexibility.

Braintree Merchant Services:

Braintree offers various merchant services to facilitate businesses’ payment operations. These services include account setup, underwriting, risk management, and dispute resolution. By leveraging Braintree’s merchant services, companies can streamline their payment processes and focus on growing their core operations.

Braintree Payment Processing:

Braintree’s payment processing capabilities are designed to handle transactions efficiently and securely. It supports real-time payment authorisations, batch processing, and secure storage of customer payment information. Braintree’s robust infrastructure ensures fast and reliable payment processing, minimising disruptions and providing a positive customer experience.

Braintree Payment Security:

Security is a top priority for Braintree. It adheres to industry-leading security standards, including PCI DSS compliance, to protect sensitive customer data. Braintree employs advanced encryption and tokenization techniques to ensure payment information is securely transmitted and stored. Merchants can trust Braintree to handle transactions securely and protect customer data from potential threats.

Braintree Payment API:

Braintree offers a comprehensive and flexible payment API that allows businesses to build customised payment experiences. The API enables developers to incorporate Braintree’s payment processing capabilities into their applications, providing complete control and customisation over the payment flow. Braintree’s payment API supports various programming languages and offers extensive documentation and resources for developers.

Braintree Reporting and Analytics:

Braintree provides merchants with reporting and analytics tools to gain valuable insights into payment transactions and performance. Merchants can access real-time data, generate customised reports, and analyse key metrics such as transaction volumes, revenue, and customer behavior. These insights empower businesses to make data-driven decisions and optimise their payment strategies.

Braintree Subscription Management:

For businesses that offer subscription-based services or products, Braintree offers robust subscription management features. Merchants can easily set up recurring billing, manage subscription plans, handle upgrades or downgrades, and automate invoicing and payment reminders. Braintree’s subscription management capabilities simplify the complexities of subscription-based businesses.

Braintree Recurring Billing:

Braintree enables businesses to set up recurring billing for subscriptions, memberships, or ongoing services. It allows companies to define billing cycles, trial periods, and pricing plans. Braintree’s regular billing feature ensures smooth and automated payment collection, reducing business administrative tasks.

Braintree Mobile Payments:

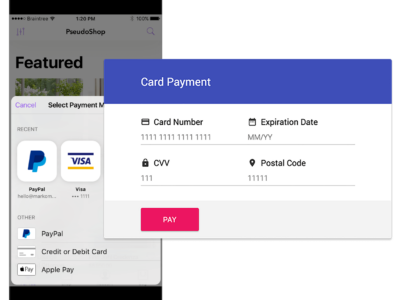

Braintree supports mobile payments, allowing businesses to accept payments from customers using mobile devices. It offers mobile SDKs and tools for iOS and Android platforms, making it easier for developers to integrate Braintree’s payment processing capabilities into mobile applications. Businesses can offer their mobile users a seamless and simple payment experience with the help of Braintree’s mobile payment solution.

Braintree Marketplace:

Braintree’s Marketplace feature enables businesses to create and manage a multi-seller platform where multiple sellers can accept payments through a single payment gateway. It provides tools for onboarding sellers, handling payouts, and managing transactions within the marketplace. Braintree’s Marketplace feature simplifies the payment process for businesses operating in a marketplace model.

Braintree Pros:

Price transparency and competition

In contrast to other merchant service providers, Braintree’s fees are refreshingly transparent. The corporation charges a set amount for most firms and posts those costs on its website. Additionally, considering that Braintree does not tack on extra monthly fees on top of its per-transaction pricing (more on that below), its rates are reasonable. However, brick-and-mortar stores seeking a gateway will probably find better prices.

No commitment, low costs

Braintree customers sign up every month so that there are no lengthy contracts or astronomical early termination fees. Beyond the flat-rate, per-transaction cost for processing payments, there aren’t many more fees to mention. Braintree does not impose additional monthly fees, PCI compliance costs, or minimum transaction fees. Customers should only anticipate a $15 chargeback cost per occurrence and a 1% conversion fee for transactions made in foreign currency.

Businesses can easily accept and handle online payments thanks to Stripe, a complete payment processing platform. It provides various services, including payment gateway integration, subscription management, fraud prevention, and reporting tools. Founded in 2010, Stripe has quickly gained popularity among merchants due to its powerful features and developer-friendly approach.

Opayo, formerly known as Sage Pay, is a prominent software company that specializes in providing payment solutions to businesses. With its robust infrastructure and extensive range of services, Opayo facilitates secure online payment processing, making it easier for businesses to accept payments from customers. Opayo payment processing offers solutions that empower businesses to efficiently manage their payment transactions. With Opayo's payment processing services, businesses can securely accept and process a variety of payment methods, including credit cards, debit cards, and digital wallets.