WorldPay is a prominent payment solutions provider that enables businesses to accept and process payments securely and efficiently. With its robust payment gateway, merchant services, and comprehensive range of payment options, WorldPay serves as a one-stop solution for businesses worldwide. Whether it's credit card processing, online payments, or mobile transactions, WorldPay caters to diverse payment needs.

By June 2011, Dwolla had 20,000 users and 15 workers and had successfully handled $1 million in a single week.

While The Members Group of the Iowa Credit Union League handled their payments, Dwolla first used Veridian Credit Union for banking services.

- Electronic wallet: You can retain money in your account received through payments, much like a digital wallet, once you set up a business account with Dwolla and get verification. You can move funds from your account to a business bank account or use them to make other payments.

- Authenticated accounts: Dwolla provides two verification options for users and merchants: micro-deposits and rapid account verification. While micro-deposits send a little amount to the customer's bank account to verify their financial details, instant verification requires users to enter their bank account via the Dwolla website. Remember that Dwolla still allows you to send and receive money without authenticating your account. Only your complete name and email address are needed to create an unverified account. You may schedule the transfer of payments from clients' bank accounts to your Dwolla account on a particular day. You may also set up these periodic payments to be repeated. Four third-party product integrations are presently available through Dwolla. Automatically notifies team members of critical account developments, such as unsuccessful transfers, successful verifications, negative balances, and more, through Slack. Users may easily link and authenticate their bank accounts using Plaid on the Dwolla platform. The firm also tokenizes and stores data, so the merchant is not accountable for PCI compliance because they are not required to maintain financial information on their platform.

A payment processor called Stripe also accepts ACH transactions. Processing ACH payments cost 0.8% of each transaction, up to a maximum of $5. For online payments, you may also handle credit card transactions at 2.9% + 30 cents.

The ability to create an embeddable checkout page, an invoicing platform, and a fraud protection system are additional capabilities. Additionally, because it is a pay-as-you-go payment processor, you can discontinue using the service whenever you choose.

PayPal: Additional payment choices

PayPal is a different payment processor that accepts ACH payments, but it does not provide a white-label service as Dwolla does.

You may access several other services through PayPal, such as a payment gateway, financing choices, and even a debit card. Credit card transaction processing costs are 2.59% + 49 cents for online transactions and 2.29% plus 9 cents for in-person purchases.

Dwolla payment solutions: Payroll, vendor payments, and marketplace payouts may all be streamlined with the help of Dwolla’s Mass Payments API, which enables companies to transmit thousands of payments at once. It cuts expenses and administrative work by streamlining the payment distribution procedure.

Dwolla provides bank account verification services that enable companies to confirm the ownership and balance of client bank accounts rapidly. This verification procedure makes sure that financial transfers are correct and reduces fraud.

Account-to-Account Transfers: Dwolla enables businesses to transfer money between their or clients’ accounts. For platforms like markets or crowdfunding websites that demand internal transfers, this capability is very helpful.

Four price choices are listed on the company’s website: Pay-As-You-Go, Launch, Scale, and Custom. The price of the latter three plans might change depending on how many transactions you do each month and what features you want. The following features are available in all plans:

Customizable features and tools that carry your company’s logo.

Customizable API.

Technology for scalable payments.

like QuickBooks and Plaid integrations.

Tokenization.

Automatized alerts.

DComponentsponents, which need little to no code and let users add fields to customer accounts.

Webhook alerts, which alert you when clients are formed, validated, or suspended, transactions are finished or fail, and more, are bespoke website code that launches apps following certain trigger events.

Dwolla vs. Stripe:

Stripe: More individualized

A payment processor called Stripe also accepts ACH transactions. Processing ACH payments cost 0.8% of each transaction, up to a maximum of $5. For online payments, you may also handle credit card transactions at 2.9% + 30 cents.

The ability to create an embeddable checkout page, an invoicing platform, and a fraud protection system are additional capabilities. Additionally, because it is a pay-as-you-go payment processor, you can discontinue using the service whenever you choose.

Dwolla customer support: Your CIP-validated Dwolla Master Account may programmatically create a Dwolla API Customer using the Create a Customer endpoint. The Customer will engage directly with your application to manage their account after the API has processed all the necessary information. The developer should create the Customer type that best fits the use case of your application. Here is a very high-level breakdown of the several customers kinds that Dwolla offers. Customer Identification Programme (CIP) Verification is something to bear when choosing what kind of customer to generate for your application. Remember that a transfer between two parties necessitates that at least one party be CIP validated, regardless of your application type. Dwolla online help center for all users; dedicated support team available only with an annual contract for Scale plan or Custom plan.

Dwolla payment processing: The typical clearing period from the Dwolla Network to a bank is between one and two business days. Before our cutoff time of 4 p.m., if a transfer is made, the money will be sent through the ACH Network for processing. When a transfer is made after our cutoff time of 4 p.m., the money will be taken out of the Dwolla Network the next day. Funds will be sent to the destination bank on the same day if exports from the Dwolla Network are upgraded to use same-day ACH clearing. As an illustration, money that leaves the Dwolla Network before 1 or 3 p.m. Central Time will be in the recipient’s bank account before the end of the day.

Dwolla merchant services: Dwolla is undoubtedly an intriguing choice if you’re an eCommerce shop seeking an ACH payment processing provider. A premium subscription will provide you access to a lot more features than you would with the ACH processing choices provided by the majority of conventional merchant service providers. Dwolla could be the right choice for some particular sorts of businesses.

Although the free Pay-As-You-Go plan can help you save a lot of money, you’ll have to handle all of the technical support choices and integrate Dwolla into your website.

Dwolla payment options: Businesses may accept ACH payments using Dwolla as an alternative to cash, credit, debit, or cheque payments. Customers can electronically deposit money from their bank accounts straight into your business’s bank account, and you can return ACH payments to them in the form of credits and refunds.

In the United States, an electronic money transfer method called ACH is used. Using your bank account to pay pals using Venmo or PayPal, paying your utility bill online using your bank account, or getting a direct transfer from your job are all examples of ACH payments.

Dwolla payment security: To further lower the risks of ACH returns and fraud, Dwolla checks client bank accounts and makes sure critical information can’t transit via your systems. Additionally, the business encrypts all data transferred over its network to safeguard the privacy of both you and your clients.

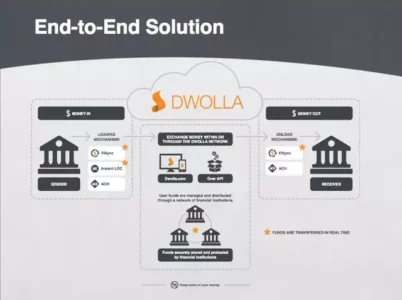

Dwolla payment API: Dwolla API reference material. You can link your program to the financial infrastructure using this API to transfer money, store money, confirm client IDs, and verify bank accounts.

Dwolla, a US fintech startup founded in 2008, began with two employees in Iowa. Launched in 2010, it connected businesses to ACH and RTP Networks. By June 2011, with $1.31 million in investments, Dwolla had 20,000 users and 15 employees, handling $1 million in transactions weekly. Initially using Veridian Credit Union for banking services, Dwolla's early success paved the way for its growth in the fintech industry.

small transaction costs

Dwolla charges 0.5% per transaction, considerably less than the standard costs associated with payment processors. This is because the platform only allows for ACH transactions, which saves you from having to pay the credit card network each time you handle a payment. The total expenses are increased by monthly fees for higher-level plans. Still, over the long term, the low transaction fees might result in considerable savings when compared to other payment processors that accept ACH payments.

unbranded service

Dwolla allows you to integrate its ACH payment technology into your platform with your branding, unlike other payment processors that support ACH payments. Customers may see your brand as more trustworthy and organized as a result. Additionally, it enables you to tailor the payment process to benefit your company, enhancing the user experience that your brand provides.

Cons There is no credit activity

Dwolla does not offer credit card transactions, while other payment service providers offer credit and ACH payments. You may lose customers if you take away their preferred payment method.

You can para use payment processors like Star, ipe l; ipe, P. InclIncludingh may be a better option if you don’t want to pay for two different products.

Businesses can easily accept and handle online payments thanks to Stripe, a complete payment processing platform. It provides various services, including payment gateway integration, subscription management, fraud prevention, and reporting tools. Founded in 2010, Stripe has quickly gained popularity among merchants due to its powerful features and developer-friendly approach.

Opayo, formerly known as Sage Pay, is a prominent software company that specializes in providing payment solutions to businesses. With its robust infrastructure and extensive range of services, Opayo facilitates secure online payment processing, making it easier for businesses to accept payments from customers. Opayo payment processing offers solutions that empower businesses to efficiently manage their payment transactions. With Opayo's payment processing services, businesses can securely accept and process a variety of payment methods, including credit cards, debit cards, and digital wallets.