WorldPay is a prominent payment solutions provider that enables businesses to accept and process payments securely and efficiently. With its robust payment gateway, merchant services, and comprehensive range of payment options, WorldPay serves as a one-stop solution for businesses worldwide. Whether it's credit card processing, online payments, or mobile transactions, WorldPay caters to diverse payment needs.

First Data provides:

- Merchant services.

- Payment processing.

- Point-of-sale systems.

- E-commerce solutions.

- Mobile payment choices.

- Fraud detection services.

Payment processing services provided by the company enabled companies to accept various payment methods, including credit cards, debit cards, gift cards, and electronic checks. They offered safe and dependable transaction processing while protecting the privacy and security of sensitive consumer data.

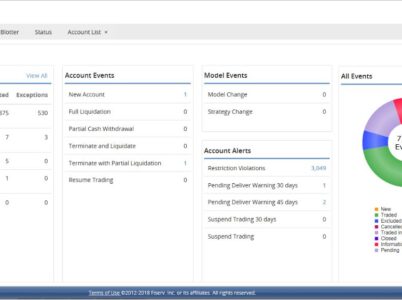

Fiserv, a multinational supplier of financial services technology, purchased First Data Corporation in 2019. The resulting firm has increased its skills in payment processing, financial technology, and merchant services.

- Payment Processing: First Data offers safe and dependable payment processing services, enabling companies to accept credit cards, debit cards, mobile payments, and electronic checks.

- First Data provided point-of-sale (POS) systems and terminals that allowed companies to process payments in physical locations. Inventory management, reporting, and interaction with other business tools were common characteristics of these systems.

- First Data provides e-commerce payment gateways and solutions, allowing businesses to accept online payments securely. These systems frequently included shopping cart integration, fraud detection measures, and recurring billing choices.

- First Data provided mobile payment systems that enabled companies to take payments on the move, whether via mobile card readers or mobile wallet interfaces. This function was designed for businesses that did not have typical brick-and-mortar locations.

- Security and Fraud Prevention: To secure sensitive client information and reduce the danger of fraudulent transactions, First Data prioritized data security and provide features such as encryption, tokenization, and fraud detection tools.

- First Data offers extensive reporting and analytics capabilities, allowing organizations to obtain insights into their payment activity, transaction trends, and other useful data to make educated decisions and optimize their operations.

- Customer help: First Data provided customer help to businesses with any concerns or inquiries about their payment solutions. This help frequently included technical support, troubleshooting, and account management.

Square is a popular payment solution that provides various services, such as point-of-sale systems, payment processing, mobile payments, and e-commerce solutions. Square is well-known for its user-friendly design, low cost, and interaction with various third-party applications.

PayPal is a well-known online payment platform that enables companies to take payments online, through mobile devices, and in person. It includes payment processing, invoicing, recurring billing, and fraud prevention. PayPal is well-known for its widespread adoption and buyer protection regulations.

Stripe is a developer-friendly payment platform that provides APIs and tools for businesses to incorporate payment processing into their applications or websites. It accepts a variety of payment ways, manages subscriptions, and has sophisticated capabilities such as bespoke checkout experiences and worldwide payments.

Authorize.Net is a payment gateway service that enables businesses to accept online payments securely. Payment processing, recurring billing, fraud detection, and a virtual terminal for manual transactions are among the capabilities available. Authorize.Net is frequently used because of its dependability and wide integration.

Adyen is a worldwide payment platform that offers businesses a single payment solution across channels and locations. It accepts various payment methods, has fraud protection capabilities, and delivers full reporting and analytics. Adyen is well-known for its scalability and global reach.

Small companies: Many payment solution providers, including merchants, restaurants, cafés, service providers, and internet stores, provide services geared to small companies. To meet the demands of small-scale companies, these solutions frequently include user-friendly interfaces, inexpensive prices, and simple setups.

Medium-Sized Firms: Payment solutions may assist mid-sized firms in various industries, including retail, hospitality, healthcare, and e-commerce. These companies often demand extensive functionality, customization possibilities, and system connections.

Payment solutions are also developed to satisfy the complicated demands of large organizations with significant transaction volumes and different locations.

Payment systems are also intended to suit the complicated needs of large companies with significant transaction volumes, many locations, and sophisticated reporting requirements. These systems may include enterprise-level capabilities such as multi-channel payment processing, international payment support, and strong security safeguards.

Online merchants and e-commerce firms rely significantly on payment systems to ensure secure and smooth website transactions. E-commerce systems frequently include shopping cart integration, mobile optimization, and payment method compatibility.

Service-based businesses, such as professional consultants, healthcare providers, and freelancers, can use payment systems to receive client payments. Invoicing, recurring billing, and appointment scheduling may be necessary for these enterprises.

Mobile and on-the-go businesses, such as food trucks, delivery services, or pop-up shops, might benefit from payment solutions that include mobile payment alternatives, wireless terminals, and portable card readers.

First Data offers tailored solutions for various industries, including retail, hotel, healthcare, e-commerce, and others. Their services often include the establishment of merchant accounts, the integration of payment processing systems, the protection of data, and the provision of continuing support and reporting.

First Data merchant services: First Data provided merchant services to businesses, allowing them to take customer payments via various channels, including in-store, online, and mobile. These services often comprised establishing a merchant account, payment processing solutions, POS systems or terminals, and integration possibilities with current company systems.

First Data customer support: First Data offers customer service to assist businesses with any questions, concerns, or technical issues with their payment solutions. This help often includes phone and email support, troubleshooting, account administration, and instruction on how to use the various features and tools.

First Data payment gateway: First Data provided payment gateway solutions, acting as a go-between for the merchant’s website or application and the payment processor. The payment gateway conveyed client payment information securely, simplified transaction authorization and settlement, and frequently incorporated features such as fraud detection, recurring billing, and reporting capabilities.

First Data payment processing: First Data offered payment processing services to businesses, enabling them to accept several payment methods securely. Credit card processing, debit card processing, electronic cheque processing, and mobile payment processing were all covered. Payment processing services provided by First Data included transaction authorization, capture, and settlement, assuring fast and quick payment acceptance.

First Data credit card processing: First Data’s payment solutions include credit card processing. They let companies take credit card payments from customers, and they support major card brands such as Visa, Mastercard, American Express, Discover, and others. Secure transaction processing, authorization verification, and settlement were common elements of First Data’s credit card processing services.

First Data payment options: To accommodate client preferences, First Data supplied companies with various payment choices. Credit card payments, debit card payments, mobile wallet payments (e.g., Apple Pay, Google Pay), electronic cheque payments (e-check), and gift card payments were frequently available. Businesses may improve ease and reach a wider consumer base by providing numerous payment alternatives.

First Data payment security: First Data (now Fiserv) prioritized payment security to secure sensitive client data and reduce the risk of fraudulent transactions. They employed a variety of security measures, including encryption, tokenization, and adherence to industry standards such as the Payment Card Industry Data Security Standard (PCI DSS). These security elements aided in ensuring the payment information’s integrity and secrecy.

First Data payment platform: First Data offers a comprehensive payment platform with various payment methods and technology. Payment processing services, payment gateways, point-of-sale (POS) systems, e-commerce solutions, and mobile payment choices were all part of its platform. The platform aimed to give businesses the best tools and infrastructure across many channels effortlessly.

First Data Corporation, now Fiserv, was a global leader in payment processing, offering merchant services, point-of-sale systems, e-commerce solutions, mobile payments, and fraud detection. Founded in 1971, it facilitated secure transactions for various payment methods. In 2019, Fiserv's acquisition of First Data strengthened their prowess in payment processing, financial technology, and merchant services, creating a formidable force in the industry.

First Data, now known as Fiserv, was a major participant in the payment processing sector, providing to companies of all kinds. Payment processing, merchant services, payment gateways, and security features were among the services they provided to ensure smooth and safe transactions. As with any payment solution provider, it is critical to assess their offers, features, price, and customer service to see whether they are a good fit for your company. Reading reviews and soliciting testimonials from other businesses can also help you make an informed selection.

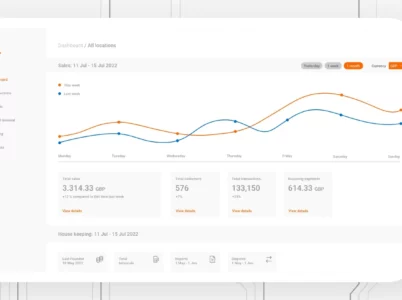

Businesses can easily accept and handle online payments thanks to Stripe, a complete payment processing platform. It provides various services, including payment gateway integration, subscription management, fraud prevention, and reporting tools. Founded in 2010, Stripe has quickly gained popularity among merchants due to its powerful features and developer-friendly approach.

Opayo, formerly known as Sage Pay, is a prominent software company that specializes in providing payment solutions to businesses. With its robust infrastructure and extensive range of services, Opayo facilitates secure online payment processing, making it easier for businesses to accept payments from customers. Opayo payment processing offers solutions that empower businesses to efficiently manage their payment transactions. With Opayo's payment processing services, businesses can securely accept and process a variety of payment methods, including credit cards, debit cards, and digital wallets.