WorldPay is a prominent payment solutions provider that enables businesses to accept and process payments securely and efficiently. With its robust payment gateway, merchant services, and comprehensive range of payment options, WorldPay serves as a one-stop solution for businesses worldwide. Whether it's credit card processing, online payments, or mobile transactions, WorldPay caters to diverse payment needs.

- National Processing payment gateway: National Processing offers a highly secure payment gateway that enables businesses to accept online payments effortlessly. The gateway is equipped with advanced fraud protection measures and supports multiple payment methods, including credit cards, debit cards, and digital wallets.

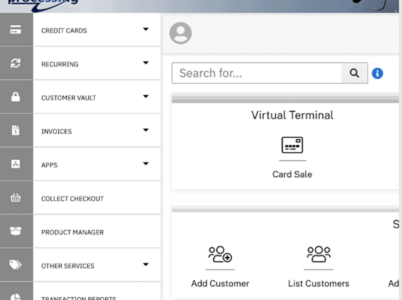

- Virtual Terminal: National Processing's virtual terminal enables businesses to accept payments from anywhere with an internet connection. The virtual terminal is a web-based solution that allows businesses to manually enter payment details and process transactions. It is particularly useful for businesses that engage in mail-order or phone-based sales, as well as those that require flexibility in processing payments.

- National Processing POS system: National Processing offers versatile POS systems that cater to businesses with physical locations. These POS systems include hardware options such as card readers, cash registers, barcode scanners, and receipt printers. The POS systems are user-friendly, feature-rich, and can be customized to meet the specific needs of different businesses.

- Seamless Integration: National Processing provides easy integration with popular e-commerce platforms, shopping carts, and business management software, ensuring smooth and hassle-free payment processing.

- National Processing payment processing fees: National Processing offers competitive pricing plans tailored to suit different business requirements. Their transparent fee structure and flexible pricing options make it easier for businesses to manage their payment processing expenses effectively.

- National Processing customer support: National Processing takes pride in offering dedicated and responsive customer support to assist businesses with any inquiries, technical issues, or payment-related concerns they may have. Their customer support team is available 24/7, ensuring that businesses receive assistance whenever they need it.

- National Processing merchant services: National Processing offers a comprehensive range of merchant services designed to simplify payment processing and enhance the overall customer experience. These services are tailored to meet the needs of businesses across various industries and can be customized to accommodate specific requirements.

- Advanced Security: National Processing prioritizes the security of customer data and transactions. Their payment solutions employ the latest encryption and tokenization technologies to ensure that sensitive information is protected from potential threats.

- Scalability: Whether you’re a small business or an enterprise-level corporation, National Processing can scale its services to accommodate your growth. They offer solutions that can handle high transaction volumes, making it easy for businesses to expand without worrying about payment processing limitations.

- Cost-Effectiveness: National Processing’s pricing plans are designed to be competitive and cost-effective. They offer transparent fee structures, with no hidden charges or surprise fees, enabling businesses to budget and forecast their payment processing expenses accurately.

- Enhanced Customer Experience: By utilizing National Processing payment solutions, businesses can provide their customers with a seamless and secure payment experience. The availability of multiple payment options and the ease of transactions contribute to higher customer satisfaction and increased sales.

- National Processing card processing: National Processing offers comprehensive card processing solutions to businesses, enabling them to accept and process various types of card payments securely and efficiently. With National Processing’s card processing services, businesses can expand their payment options, enhance customer convenience, and streamline their payment operations.

- Recurring Billing: For businesses that offer subscription-based services or recurring payments, National Processing offers recurring billing solutions. These solutions automate the process of charging customers at regular intervals, reducing administrative tasks and ensuring consistent revenue streams. Businesses can set up automated payment schedules, send invoices, and manage customer subscriptions efficiently.

- National Processing merchant account: National Processing provides businesses with merchant accounts, which are essential for accepting and processing credit and debit card payments. A merchant account acts as a holding account for funds before they are deposited into the business’s bank account. National Processing offers merchant accounts that are tailored to the specific needs of businesses, providing them with the necessary infrastructure to securely process card transactions.

- Retailers: Whether it’s an online store or a brick-and-mortar establishment, National Processing offers versatile payment solutions that streamline the checkout process and enhance the overall shopping experience.

- E-commerce Businesses: National Processing’s payment gateway seamlessly integrates with popular e-commerce platforms, allowing online businesses to accept payments securely and efficiently.

- Service Providers: From healthcare providers to professional services firms, National Processing offers payment solutions that facilitate easy and secure transactions, reducing administrative burden and ensuring prompt payment collection.

- Restaurant

Restaurant: Monthly Cost - $9.95/mo Transactions Cost - 0.14%+$0.07

- Retail

Retail: Monthly Cost - $9.95/mo Transactions Cost - 0.18%+$0.10

- eCommerce

eCommerce: Monthly Cost - $9.95/mo Transactions Cost - 0.29%+$0.15

- Non-Profit

Non-Profit: Monthly Cost - $9.95/mo Transactions Cost - 0.12%+$0.06

- ACH Processing

ACH Processing: Monthly Cost - $15/mo Transactions Cost - 0-1.5%+$0.48

- Subscription

Subscription: Monthly Cost - $59/mo Transactions Cost - 0%+$0.09

- Subscription Plus

Subscription Plus: Monthly Cost - $199/mo Transactions Cost: 0%+$0.0

- Stripe: Known for its developer-friendly platform and extensive features, Stripe offers a range of payment processing solutions tailored for businesses of all sizes.

- Square: Square is a popular choice for small businesses and startups. Their user-friendly POS system and affordable pricing plans make it a viable alternative to National Processing.

National Processing online payment solutions that enable businesses to accept payments securely and efficiently through various digital channels. These online payment services provided by National Processing streamline the checkout process, enhance customer convenience, and support businesses in expanding their online presence.

National Processing:

- Offers a comprehensive suite of payment solutions, including payment gateways, POS systems, and merchant services.

- Scalable solutions are suitable for businesses of all sizes.

- Competitive processing rates and transparent fee structures.

- Dedicated 24/7 customer support.

Stripe:

- Developer-friendly platform with robust APIs for easy integration.

- Extensive range of payment processing options and customization features.

- Advanced fraud protection and security measures.

- Flexible pricing plans based on transaction volume.

Square:

- A User-friendly POS system is suitable for small businesses and startups.

- All-in-one payment processing solution with hardware options.

- Transparent pricing structure and no long-term contracts.

- Accessible customer support and a user-friendly interface.

When comparing these options, it’s crucial to assess your business’s specific needs, transaction volume, and integration requirements to determine the most suitable payment solutions provider.

- A reputable merchant services provider with low rates, National Processing offers interchange-plus pricing and month-to-month billing. – Frank Kehl

Expert Analyst & Reviewer

- While it might not offer as many features as other top competitors, National Processing’s convenient plans and low rates make it an excellent option for cost-conscious businesses. – Alexandros Melidoniotis

Finance Specialist

- The onboarding process was clear, concise, and very courteous!! – Karen

- Evie is so helpful and friendly! She did a great job and got us up and running quickly! – Ben

However, it’s essential to conduct thorough research and read multiple reviews from different sources to gain a comprehensive understanding of user experiences and assess any potential concerns or limitations.

While National Processing is a top choice, it’s important to evaluate alternatives like Stripe and Square to ensure you find the best fit for your business. By considering your specific requirements, transaction volume, and integration needs, you can make an informed decision and select a payment solutions provider that aligns with your goals and enhances your overall payment processing experience.

Businesses can easily accept and handle online payments thanks to Stripe, a complete payment processing platform. It provides various services, including payment gateway integration, subscription management, fraud prevention, and reporting tools. Founded in 2010, Stripe has quickly gained popularity among merchants due to its powerful features and developer-friendly approach.

Opayo, formerly known as Sage Pay, is a prominent software company that specializes in providing payment solutions to businesses. With its robust infrastructure and extensive range of services, Opayo facilitates secure online payment processing, making it easier for businesses to accept payments from customers. Opayo payment processing offers solutions that empower businesses to efficiently manage their payment transactions. With Opayo's payment processing services, businesses can securely accept and process a variety of payment methods, including credit cards, debit cards, and digital wallets.