WorldPay is a prominent payment solutions provider that enables businesses to accept and process payments securely and efficiently. With its robust payment gateway, merchant services, and comprehensive range of payment options, WorldPay serves as a one-stop solution for businesses worldwide. Whether it's credit card processing, online payments, or mobile transactions, WorldPay caters to diverse payment needs.

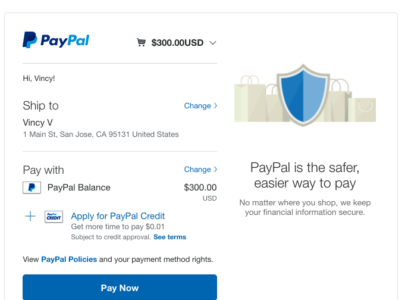

Users must provide their email address, pick a strong password, and link a legitimate bank account or credit/debit card to their PayPal account to finance transactions. Users may access their PayPal accounts by logging in using their email address and password after creating an account.

A PayPal account offers numerous benefits to users. It provides a secure online purchase without sharing sensitive financial information with merchants. Users can link their PayPal account to various online platforms and websites, enabling them to make payments with just a few clicks.

PayPal Signup: Getting Started with PayPal

The procedure of opening a PayPal account is simple. Users may start the registration process by going to the PayPal website or installing the PayPal app. Users must provide their full name, email address, and password, among other essential information. Users can begin investigating PayPal’s features and capabilities after creating an account.

PayPal Fees: Understanding the Costs

Certain transactions, including accepting money for products and services or selling items through PayPal, are subject to fees. The charge structure may change depending on the nation, the kind of transaction, and the currency used. To effectively assess the expenses involved with their transactions, users must get familiar with PayPal’s fee structure.

PayPal Merchant Services: Empowering Businesses

PayPal provides various merchant services to meet all the desired requirements of companies of all sizes. By integrating PayPal’s payment solutions into their websites or mobile apps, merchants can accept online payments seamlessly. PayPal’s merchant services provide a secure checkout experience, fraud protection, and the ability to reach a global customer base.

PayPal Customer Service: Assistance at Your Fingertips

If there are any issues or queries, PayPal provides customer support to assist its users. PayPal’s customer care is available to users via several methods, including phone number, email, live chat etc. PayPal’s dedicated support team is available to address concerns related to account management, transaction disputes, refunds, and other payment-related matters.

PayPal Business: Streamlining Business Operations

PayPal offers specific features and services tailored for businesses, making it a perfect choice for entrepreneurs and small business owners. With PayPal Business, users can create and send professional invoices to clients, manage inventory, track sales, and generate reports. These tools help businesses streamline operations, manage cash flow effectively, and maintain accurate financial records.

PayPal Payment Option: Offering Flexibility to Customers

One of the significant advantages of PayPal is its widespread acceptance as a payment option across various online platforms. Users can choose PayPal as their preferred payment method while purchasing on e-commerce websites, booking travel tickets, or subscribing to online services. This flexibility allows customers to transact securely and conveniently without sharing sensitive financial information.

PayPal Invoice: Simplifying Billing Processes

PayPal offers a powerful invoicing feature that simplifies creating and sending professional invoices to clients or customers. This feature mainly benefits freelancers, small businesses, and service providers who must bill clients for products or services rendered.

With PayPal’s invoicing option, users can create customised and itemised invoices directly within their accounts. They can include essential details such as the payment amount, due date, description of products or services, and any applicable taxes or discounts. The invoices can also be personalised with the user’s logo or branding, giving a professional touch to the transaction.

Creating an invoice through PayPal is straightforward. Users can navigate to their account’s invoicing section and click the “Create an Invoice” button. They can then fill in the required fields, including the recipient’s email address, invoice amount, and description of the goods or services provided. PayPal also allows users to save default invoice templates, making it even more convenient to generate invoices in the future.

Once the invoice is created, users can preview it to ensure accuracy and make any necessary edits. They can send the invoice directly to the recipient’s email address through PayPal. The recipient will receive a professional-looking email with a secure payment link, allowing them to make the payment conveniently using their PayPal account or credit/debit card.

A buyer can obtain the transaction data by connecting to their PayPal account when they want to start a refund. From there, customers can have the option to ask for a refund while citing the return or dispute reason. PayPal encourages buyers to communicate with the seller directly to resolve any issues before requesting a refund, as many concerns can be resolved through mutual agreement.

PayPal Security: Protecting Your Financial Information

One of the critical priorities of PayPal is its users’ financial information security. PayPal employs advanced encryption and fraud detection systems to safeguard transactions and prevent unauthorised access. Users can also enable additional security measures, such as two-factor authentication and notifications for account activity, to enhance the security of their PayPal accounts.

PayPal Mobile App: Payments on the Go

To cater to the increasing trend of mobile transactions, PayPal offers a mobile app for iOS and Android devices. The PayPal mobile app allows users to conveniently manage their accounts, send or request money, and pay using smartphones or tablets. The app provides a user-friendly interface and ensures a seamless experience, even when users are on the move.

Online transactions are integral in the digital age, demanding a secure payment processor. Stripe, a global payment gateway, has revolutionized this space with its user-friendly interface, robust security, and diverse services. This article explores Stripe's features, from account setup and fees to merchant services, customer support, and its crucial role in facilitating online payments and invoicing.

- Tools for creating donation buttons.

- Embedding donation forms on websites.

- Managing donor information enables nonprofits to collect funds efficiently and support their missions.

PayPal Integration: Enhancing E-commerce Platforms

PayPal integrates with various e-commerce platforms, making it easy for businesses to incorporate PayPal as a payment option on their websites. Popular ecommerce platforms like Shopify, WooCommerce, and Magento offer seamless integration with PayPal, allowing companies to accept payments from customers worldwide. This integration simplifies the checkout process and expands the reach of businesses.

The Future of PayPal: Advancements and Innovations

PayPal is still dedicated to innovation and staying ahead of new trends as the environment of digital payments continues to change. The company is actively exploring technologies such as blockchain and digital wallets to enhance its services further. With a focus on user experience, security, and convenience, PayPal continues to shape the future of online transactions.

Businesses can easily accept and handle online payments thanks to Stripe, a complete payment processing platform. It provides various services, including payment gateway integration, subscription management, fraud prevention, and reporting tools. Founded in 2010, Stripe has quickly gained popularity among merchants due to its powerful features and developer-friendly approach.

Opayo, formerly known as Sage Pay, is a prominent software company that specializes in providing payment solutions to businesses. With its robust infrastructure and extensive range of services, Opayo facilitates secure online payment processing, making it easier for businesses to accept payments from customers. Opayo payment processing offers solutions that empower businesses to efficiently manage their payment transactions. With Opayo's payment processing services, businesses can securely accept and process a variety of payment methods, including credit cards, debit cards, and digital wallets.