WorldPay is a prominent payment solutions provider that enables businesses to accept and process payments securely and efficiently. With its robust payment gateway, merchant services, and comprehensive range of payment options, WorldPay serves as a one-stop solution for businesses worldwide. Whether it's credit card processing, online payments, or mobile transactions, WorldPay caters to diverse payment needs.

- Square point of sale system: Square's POS system is a versatile tool that enables businesses to accept payments, track inventory, manage customer data, and generate sales reports. It supports various payment methods, including credit cards, mobile payments, and contactless payments.

- Square Online Store: With Square's online store, businesses can easily set up and customize their e-commerce website. It provides seamless integration with the Square POS system, allowing for streamlined inventory management and synchronized sales data.

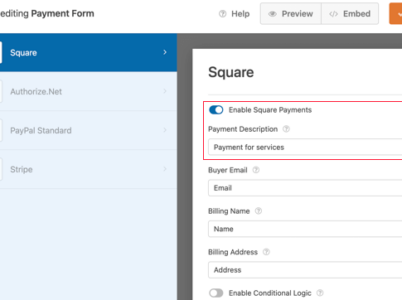

- Square payment gateway: Square's payment gateway enables businesses to accept online payments securely. It offers robust fraud protection measures and supports recurring payments and subscriptions.

- Square payment processing: Square provides national processing solutions, allowing businesses to accept payments from customers across the country. It ensures fast and secure transactions, helping businesses expand their reach and increase sales.

- Square merchant services: Merchant Services are a key component of Square's comprehensive suite of solutions, providing businesses with seamless payment processing capabilities. Designed to cater to the needs of merchants, Square Merchant Services offers a range of features and tools to streamline transactions, enhance customer experience, and optimize business operations.

- User-Friendly Interface: Square offers an intuitive and user-friendly interface, making it easy for businesses to set up and start accepting payments quickly. It’s straightforward design and accessible features require minimal training for staff members.

- Square payment processing fees: Square provides transparent pricing plans, making it easier for businesses to understand and manage their payment processing costs. It offers competitive transaction fees and does not charge any setup fees or monthly fees.

- Wide Range of Tools: Square offers a comprehensive suite of tools beyond payment processing. From inventory management to sales analytics, businesses can leverage various features to optimize their operations.

- Integration Capabilities: Square seamlessly integrates with other business software and tools, such as accounting software and customer relationship management (CRM) systems. This enables businesses to streamline their workflows and enhance productivity.

- Security: Square prioritizes the security of transactions and customer data. It utilizes advanced encryption and tokenization technologies to ensure that sensitive information is protected.

Tools to mix and match

- Team Management – Set the schedule, track time, and let your team clock in and out at your POS to streamline management. – Starting at $0/mo

- Customer Directory – Automatically create a customer profile with basic contact information each time you make a sale. – Starting at $0/mo.

- Afterpay – Let customers pay in instalments, while you get paid in full with Afterpay. More options for them. More sales for you. – 6% + 30¢ per transaction

- Checking – Get instant access to your money with a free business debit card. No minimums, and no recurring fees. – No fees.

- Savings – Automatically set aside a portion of your sales into folders for anything from taxes to rainy-day expenses. – No fees.

- Loans – Become eligible for a loan of up to $250K by processing payments on Square. Get funds as soon as the next business day. – No interest — just one flat fee

- Free Plan

Free Plan: Sell in person, online, over the phone, or out in the field. No setup fees or monthly fees — only pay when you take a payment. - $0/mo. + processing fees

- Plus Plan

Plus Plan: Get advanced features designed specifically for restaurants, retailers, or appointment-based businesses. Upgrade when you want to, and cancel anytime. - $29+/mo.+ processing fees

- PayPal: PayPal is a well-established payment processing platform known for its global reach and extensive feature set. It offers both online and in-person payment solutions and provides robust buyer and seller protection. However, PayPal’s fees may vary based on transaction volume and currency conversions.

- Stripe: Stripe is a developer-friendly payment processing platform that allows businesses to accept payments online. It offers a wide range of customization options and supports recurring payments and subscription billing. Stripe’s pricing is based on a pay-as-you-go model, with no setup fees or monthly fees.

- Shopify: Shopify is an all-in-one e-commerce platform that provides not only payment processing but also website hosting, inventory management, and marketing tools. It offers seamless integration with various payment gateways, including Square. Shopify’s pricing plans start at $29 per month, with transaction fees ranging from 2.4% to 2.9% + $0.30 per transaction.

Square is a software company founded in 2009 by Jack Dorsey and Jim McKelvey. It offers a wide range of payment processing solutions and tools to help businesses streamline their operations. Square provides a comprehensive suite of services, including its popular Square POS app, Square Online Store, and Square Payment Gateway. The company aims to empower businesses by making payment processing accessible, efficient, and secure. Square customer support makes it easy for beginners to use it.

Both Square and PayPal are reputable payment processing solutions, but they differ in certain aspects. Here’s a comparison between the two:

- User Interface: Square’s interface is known for its simplicity and ease of use, making it more accessible for businesses with limited technical expertise. PayPal, on the other hand, offers a more comprehensive feature set but may have a steeper learning curve.

- Pricing: Square’s pricing structure is transparent, with competitive transaction fees and no setup or monthly fees. PayPal’s pricing may vary based on factors such as transaction volume and currency conversions.

- Integration: Square seamlessly integrates with various business tools and software, offering a comprehensive ecosystem. PayPal also provides integration options but may not have the same level of compatibility with certain platforms.

- Customer Support: Square has received positive reviews for its customer support, offering phone, email, and chat support options. PayPal also provides customer support, but some users have reported challenges in resolving issues efficiently.

Ultimately, the choice between Square and PayPal depends on specific business needs, the desired level of customization, and the target audience.

Users also highlight Square’s reliable and secure payment processing, emphasizing the importance of its fraud protection measures and encryption technologies. The availability of real-time sales analytics and reporting is often commended, as it provides valuable insights for business decision-making.

While there are some occasional complaints about occasional software glitches or issues with customer support response times, the overall satisfaction with Square remains high. The company has made efforts to address user concerns and continually improve its services based on customer feedback.

From its versatile Point of Sale system to its seamless integration capabilities and secure online payment gateway, Square provides businesses with the tools they need to streamline operations and enhance customer experiences. The company’s commitment to security and its proactive approach to fraud protection give businesses peace of mind when processing transactions.

While there are alternative options available, Square’s unique combination of features, pricing transparency, and user-friendly interface make it a preferred choice for many businesses. However, it’s essential to evaluate specific business needs and consider alternatives like PayPal, Stripe, or Shopify to ensure the best fit for individual requirements.

In conclusion, Square has revolutionized national payment processing solutions, empowering businesses to efficiently manage their transactions, expand their reach, and optimize their operations. With its continued innovation and commitment to customer satisfaction, Square is expected to remain at the forefront of the payment processing industry for years to come.

Businesses can easily accept and handle online payments thanks to Stripe, a complete payment processing platform. It provides various services, including payment gateway integration, subscription management, fraud prevention, and reporting tools. Founded in 2010, Stripe has quickly gained popularity among merchants due to its powerful features and developer-friendly approach.

Opayo, formerly known as Sage Pay, is a prominent software company that specializes in providing payment solutions to businesses. With its robust infrastructure and extensive range of services, Opayo facilitates secure online payment processing, making it easier for businesses to accept payments from customers. Opayo payment processing offers solutions that empower businesses to efficiently manage their payment transactions. With Opayo's payment processing services, businesses can securely accept and process a variety of payment methods, including credit cards, debit cards, and digital wallets.